In 2023, Cosmoprof Asia finally returned to its home town of Hong Kong: Cosmopack (packaging, supply chain etc.) in AsiaWorld Expo near the airport and Cosmoprof (finished cosmetics, salon beauty, hair and nails) at HKCEC in Wan Chai. And it was such a good show, packed with visitors and busy across the four days of the fair (14th to 16th November for Cosmopack, 15th to 17th November for Cosmoprof).

As usual, I focused on the retail beauty side of things: Perfumery, Cosmetics Toiletries in Hall 1E, with only a quick visit to Professional Beauty Salon, Spa Products & Equipment in Hall 3E. While I do track the salon beauty sector there’s only so much time in the day. Therefore I mostly skipped this section as well as Salon Hair in Hall 3G and Nail Products & Accessories in Hall 5G.

In total, there were 2,400+ exhibitors from 44 countries across both Cosmoprof and Cosmopack, and 65,582 visitors from 119 countries and regions. Visitor numbers were almost back to the 2018 edition which is really encouraging.

A quick reminder: Cosmoprof Asia 2018 was the last “real” Cosmoprof Asia fair. The 2019 edition of the show took place right during one of the most volatile periods of the Chinese government’s crackdown on Hong Kong independence; with Wan Chai and Kowloon in uproar (police in riot gear, street blockades, tear gas, demonstrations). Unsurprisingly, many exhibitors and visitors pulled their attendance at the last minute and the trade fair halls of HKCEC were scarily deserted. You can check out my 2019 trade fair report here if you’re interested. And these are the 2017, 2016, 2015 and 2014 articles.

We all know how 2020 turned out and for the next couple of years, Cosmoprof Asia went digital (Cosmoprof Asia Digital Week 2020 and Cosmoprof Asia Digital Week 2021). Cosmoprof Asia 2022 took place in Singapore since Hong Kong still had Chinese government-enforced pandemic-related restrictions at that time. The Singaporean show was a bit of a stop-gap measure so it was really satisfying to see Cosmoprof Asia back in action this year!

And it was so much fun meeting up with people and brands that I hadn’t seen for over four years! I didn’t have time to attend any of the Cosmotalks sessions either. One the one hand, this was disappointing (the Cosmoprof shows always have a really good conference programme). On the other hand, this is one of my personal hallmarks of a really good (i.e. busy!) trade fair: When there are so many exciting brands and exhibitors for me to talk to on the floor that I barely have time to break for lunch : )

You might notice that most brands I’m featuring are Korean. While Korea always has a strong exhibitor presence at any international beauty trade show, it seriously dominated the Cosmoprof section of the trade fair this year. I did a rough count of exhibitors by country in the digital exhibitor database and at Cosmoprof Asia 2023, Korea had 300 exhibitors across several country pavillion. Japan was in second place with some 100+ companies.

With 50+ exhibitors, France was in the lead amongst the European exhibitors – the French country pavillions are always really large and I was delighted to see the WAFIB (We Are French Indie Brands) communal exhibition booth at the fair again. Italy was next in line with some 40 exhibitors and then came Germany with 28 exhibitors.

COSMOPROF ASIA 2023: KEY TRENDS

In line with global beauty trends, sleep beauty/home spa/aromatherapy/wellness-at-home was a massive trend at Cosmoprof Asia 2023; as far as ingredients were concerned cica (centella asiatica) and retinol played a leading role, especially amongst the Asian exhibitors. Microbiome/sensitive skin care: Still huge; the word “biome” was visible at many exhibitor booths across the show. I also noticed some interesting pet care launches. Even before C*vid19, the pet care industry (which includes pet foods, beauty accessories, services) was growing solidly, especially in some of the Asian markets. The pandemic gave the global pet care market an added boost and it’ll be really interesting to see how this sector is going to develop over the next few years.

After this lengthy introduction: Here are some of my favourite brand discoveries from Cosmoprof Asia 2023, loosely grouped by geographic region and, as always, in so particular order.

COSMOPROF ASIA 2023: BRANDS FROM ASIA

DR. ORACLE (Korea)

Korean brand Dr. Oracle went for trending active ingredients in its most recent launches. The 3-sku RetinoTightening range and 4-sku CentellaBiome line were both introduced last year: The RetinoTightening collection offers a cream toner, ampoule (essence) and collagen cream formulated with hydroxypinacolone retinoate, adenosine and niacinamide to help improve wrinkles on face, neck and nasolabial folds.

CentellaBiome was formulated for sensitive skin and as the name suggests, the products have a microbiome angle. There is a cleansing foam, pore pads (pre-saturated face pads), sun cream and an ampoule, all of which are formulated with seven types of cica, including root extract, leaf extract, madecassoide, asiaticoside and madecasic acid.

ALL MY THINGS (Korea)

I really enjoyed the exhibition booth of Korean beauty brand All My Things (AMTS). This is an MZ-focused brand – the term MZ stands for Millennials/GenZ which in Korea is regarded as one demographic group – and is based on a tremendously popular Korean webtoon series, True Beauty. The first episode of True Beauty screened in 2018 and by 2019, it was the third most viewed webtoon series with around 6.6million global subscribers and over 825 million views.

The True Beauty collection includes four eyeshadow/lip colour palettes which are based on the series’ characters – I really like the pack design – as well as six liquid eyeshadows and six lip-plumping glosses. AMTS also offers several other ranges, including the new Moon & Aurora Collection (6 vegan sku of blush, duo eyeshadow and lip stick tint).

The Hi, I’m Yours! range offers six vegan Glitter Lip Tints, and four vegan lipsticks while the Kiss Your Eyes collection includes four vegan eyeliner and three vegan mascara. Except for the four True Beauty palettes, all products are certified vegan by EVE Vegan.

SELF BEAUTY (Korea)

Another highly attractive Korean makeup range, Self Beauty was first launched in 2019 and offers mostly vegan makeup and makeup/skin care hybrid products. Amongst the brand’s most popular ranges is the Uniconic collection which includes four face care products (three primers, one tinted moisturiser); two setting spray (Uniconic Glow Fixer and Uniconic Shield Fixer – these are the bestsellers in the entire Self Beauty range), four Uniconic cushion foundations and three Lip Masks (Kakadu Plum, Rosehip & Collagen and Cool Mint & Rosemary; another Self Beauty top seller).

Self Beauty’s most recent range is the Veganize Collagen Lipglass Balm collection which is formulated with mushroom-based collagen and packaged in click-type pen applicators. There are also twist-up eyeliners and eyebrow pencils which are available in nine different shades. The brand is sold mostly online with Korea, Japan, Taiwan and the US as its biggest markets

YADAH (Korea)

I think one of my first Korean beauty products was from Yadah – I seem to remember receiving a serum during one of my early Asian trade show visits. Liked both the product and the brand. That was long before Yadah launched in Europe though; they now have multiple country and language sites. And a solid international trade show presence, I see Yadah at virtually every show I attend.

Anyway, Yadah also had a booth at Cosmoprof Asia 2023 and presented three new serums: Cactus Grow (a line extension in the eponymous range), Vita C and Camellia. All products have an oil-in-serum formula and I was particularly taken with the unusual bottle design which looks really attractive.

ESFOMI (Korea)

Korean face care brand Esfomi was launched in 2011 and what particularly intrigued me about the range is the fact that around half of the products are formulated with plant stem cells. This is a really interesting category (?) of active ingredients which is trending in Europe in natural/organic beauty in particular. However, plant stem cells are not something that I see a lot in Asian beauty brands. Human stem cells; yes, absolutely; especially from Japanese prestige face care brands, but plant stem cells – not that often. At least not that I can recall.

While Esfomi has several face care products based on human stem cells (like the Age Return range consisting of Vita Cell Mist Toner, Gold Cell Ampoule and Repair Cell Cream) I found the plant stem cell products more interesting. Especially the most recent launch, the Lotus Sun Ampoule SPF50 + PA ++++ which contains Phytostem-5 complex extracted from five herbals (lotus, rice, orchid, resurrection plant and dandelion). Green Cica (Cell Boosting Mist Toner and Cell Activating Cream) contains cica stem cells.

UNSTRAUM (Korea)

Men’s care! Not something that I often see at trade fairs; the global beauty industry is still primarily geared towards female-focused products. Yes, I know, the men’s care category (including colour cosmetics) has been growing over the past decade or so; particularly in countries like Korea but also in key European markets; there are niche, indie and start-up brands in the category, plus the big mainstream labels. Still, the lion’s share of beauty and personal care – whether it’s face care, makeup, hair care, body care, whatever; obvs excluding shaving preps/razors – is still marketed at female consumers. Because as we all know, women are never beautiful enough. At the beauty trade shows that I visit I rarely see new men’s beauty launches either, so I was surprised when I came across two (!) men’s care brands at Cosmoprof Asia 2023. Both from Korea.

Korean men’s face care brand Unstraum (the brand name is based on two German words, “unser”(our) and “traum” (dream)) was launched a few months ago and offers five products: A toner mist, lotion, face wash, SPF50 moisturiser and a colour-changing lip balm (brilliant!). The products are priced at 20-30 USD and at the moment, the brand is primarily sold in Korea. However, I was told that in 2024, Unstraum will start distribution in Japan – I think the brand should do well in that market, I can absolutely see the products in Loft or Tokyu Hands.

LAZY SOCIETY (Korea)

Men’s care brand Lazy Society started out as a razor subscription brand back in 2018. From 2019 onwards, the company branched out: First into shaving products (Cica Shaving Gel, Cica Shaving Gel Frozen, Supreme Shaving Cream), then into aftershave preps (2020: Cica Aftershave Toner Spray, Cica Aftershave Lotion). 2022 and 2023 saw the introduction of further grooming and face care products, including the Trouble Solution Foam Cleanser, Al in One Face Face Lotion, Deep Scent Body Wash, Hinoki Suncream, Vitamin BB Cream, Spot-Care Cica Tea Tree Roll-on and the Grooming Tonic Hair Mist.

Lazy Society is a crowd-developed beauty brand; new products are created in collaboration with its community, the Lazy Family. First potential product ideas are gathered, then samples of new products are sent to interested testers who provide detailed feedback. After the last round of product adjustments the product is launched. Products are priced at around 20 USD and in 2024, Lazy Society will launch in Loft stores in Japan. Another Korean brand that should do really well in that market.

ARTH (Korea)

Aromatherapy/functional fragrance brand Arth was launched in 2022. The company offers a highly segmented range of bath and body care, personal fragrance, scented multibalms, candles and home fragrance products (essential oils and electric diffusers). All products are unisex and formulated with essential oil blends to boost emotional health, improving sleep quality and relaxation and reducing stress.

Packaging is super stylish and minimalistic and for customers who are uncertain which fragrance blend would be most beneficial for them, Arth offers aura/emotional health readings. Yes, really. I did one of those: You place your hands on the touch pads (see pic above) and the device (presumably) registers some sort of bio waves/markers; the laptop software (or algorithm?) then translates this data into charts and diagrams. The read-out also quantifies your emotional health state (mine was 6% higher than the average in my (I assume) age and gender demographic, so well done me). My aura colour was yellow, apparently, so I was directed towards the appropriate colour-coded fragrance blend.

AROMANG (Korea)

Another aromatherapy/functional fragrance beauty brand from Korea, Aromang was launched in 2019. The brand concept combines aromatherapy with colour therapy and the compact product line-up offers pillow sprays, body oils and washes, facial oils and a 13-sku range of pure essential oils as well as gua sha massage tools.

I was told that Aromang has three offline POS in Seoul and here, you can get a colour therapy diagnosis to help you select the most beneficial fragrance blend for your personal emotional health needs. They offered the same analysis at the trade fair booth: I was asked to select my four favourite colours from the bottle range and the brand founder, a trained colour therapy practicioner, analysed my selection. Her analysis was spot-on and the fragrance blend she recommended for me was based on almost the exact same fragrance notes as those determined by the Arth aura reading (citrus/lemongrass). I was intrigued!

LALACHUU (Korea)

Shampoo bars are still a trending product in some international markets, apparently. Although I’ve been bored by solid beauty for a while now – here in Germany it’s become so mainstream (especially solid shampoos!) – I must admit that Korean brand Lalachuu’s new and ultra-stylish herbal shampoo bar (launched in July 2023 and retailing for around 20 USD) looks very attractive indeed. Definitely the prettiest solid shampoo I’ve ever seen.

The key ingredients in the anti-hairloss shampoo formula are ginger and ginseng extracts and 24k gold powder; I liked the herbal scent too and the bar foamed up really well (not particularly difficult to achieve with the right chemical ingredients – and from what I could see on the INCI list, the Lalachu shampoo bar has a very conventional formulation). But overall this is a very nice-looking product. I also liked the other Lalachuu products – hair cushions (colour-correcting powders to temporarily cover grey and white roots), face cushions, eyebrow products.

WOOSHIN LABOTTACH (Korea)

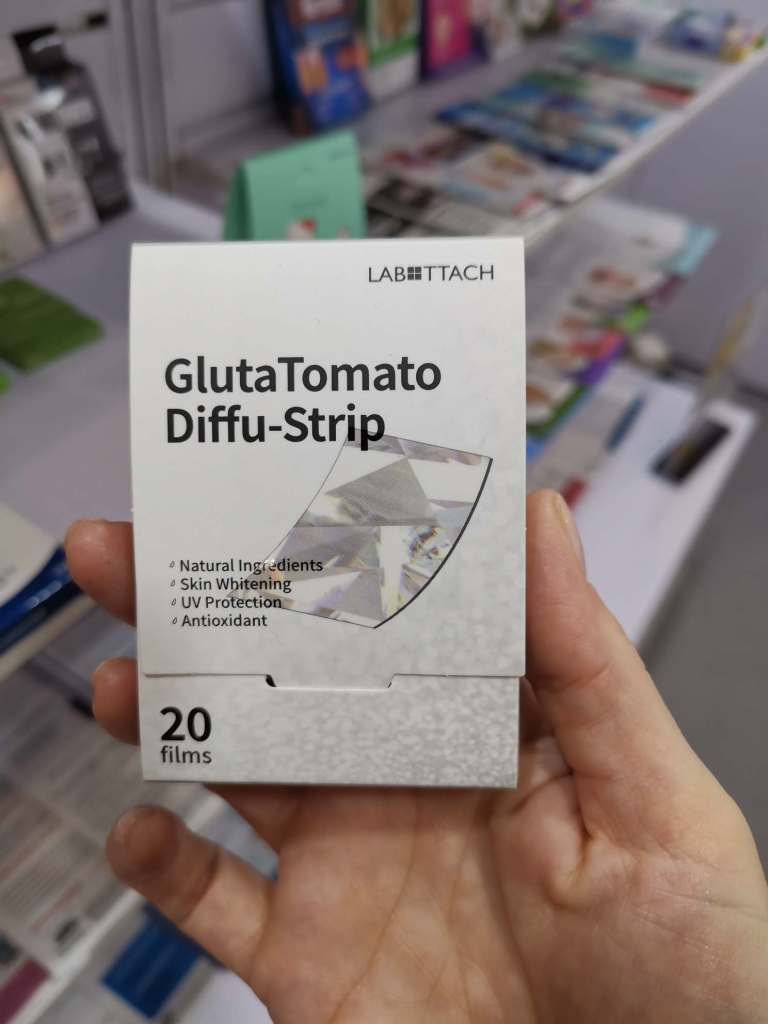

Korean healthcare manufacturer Wooshin Labottach also had a booth at Cosmoprof Asia 2023. The company is primarily known for its medicinal/dermal patches – pain medications, antibiotics etc. in the shape of patches that are applied onto the skin – and ODF products. ODF stands for “oral disintegration film”: These are super thin strips of active ingredients (pain killer, antibiotics, whatever) for oral administration; you put them onto or underneath the tongue and they dissolve immediately.

At the trade fair, Wooshin showcased some of its ODF nutritional supplements. There were around 25 variants in total, including various vitamin and mineral complexes, supplement blends to treat hangovers, help against travel sickness, insomnia or motion sickness, boost emotional health or provide skin and body care benefits. I also saw a strip supplement for dogs.

Amongst the company’s newest ODF launches were strips with saffron to improve emotional balance and the GlutaTomato Diffu-Strip which contains L-glutathione, white tomato extract and saurus chinensis (Asian lizard’s tails) extract for an extra portion of antioxidant protection.

ADWIN (Korea)

Visting the expo booth of Adwin Korea is always interesting. Best known for its skin care sheet masks (the company does a lot of own label/OEM/ODM manufacturing but also has several best-selling skin care/mask brands including Purederm), Adwin has really branched out into other beauty categories in recent years. Like the temporary hair colourant pouches for men from last year.

Their sheet mask and skin care launches are always super innovative and so much fun to check out. The company’s 2023 launches included a brightening sheet mask specifically designed for knees – with four “petals” to comfortably fit the knee joint– moisturising body pads (large cottonwool pads saturated with moisturising essence), sun protection pads and an essence packaged in a small pouch as well as the Multi Area Only Gel Masks which feature an ingredients strip specifically for the eye region – i.e. two sets of skin care ingredients in a single mask.

There was also the Sebum Melting Mask which is a hybrid between a nose strips and an exfoliating serum. These are half-moon shaped patches saturated with a liquid AHA/BHA fruit acid formula which are placed over the nose. Unlike the classic nose strip which can tear off quite a bit of nose skin if you’re unlucky, the residue of the Sebum Melting Mask can just be wiped off.

Finally, one of my favourite Adwin launches: The pet care! Cleansing gloves for cats and dogs to clean individual patches of fur or coat rather than having to wash the entire animal. There are also cleansing finger pads – you slip them on over your finger – to more easily clean ears and eyes. I also saw teeth cleansing gloves – again, these are individual pads that go over your fingers so you can thoroughly clean/polish the dog’s teeth. I don’t have pets myself but these products seemed to be really cleverly designed.

NATURELAB (Japan)

Japanese health & beauty manufacturer Nature Lab had its usual large trade show expo booth at Cosmoprof Asia 2023. The company’s most famous personal care brands include the Diane brand family of hair and body care (Diane Botanical, Diane Perfect Beauty, Diane Bonheur and one of the most recent Diane sub-brands: The vegan Diane Be True). Diane Bonheur is a natural product range with a strong aromatherapy angle and the most recent launces within this line include aromatherapy-focused sleep night-time bath essences and two dry shampoos. For Diane’s international Asian markets (i.e. anything outside of Japan), there were two new antibacterial body washes – I did notice that the pack design was different from the usual ornamental and playful Diane vibe; it looks almost plain which I guess suits the more utilitarian product formula.

The company also has a couple of salon hair care brands and its Naturelab Tokyo salon range was extended with a line of scalp care products (Perfect Clean Scalp Care) formulated with sake. Loving the pack design! There is also a new night-time hair/body care range in the Naturelab Tokyo brand: Perfect Dream offers an overnight hair mask, a bath oil and a pillow spray.

Men’s care brand Maro is another Nature Lab best-seller: The range which is regularly extended with on-trend products. Amongst the most recent Maro launches are two dry shampoos, a body soap and a liquid shampoo.

In addition to its wide range of personal care brands (besides the brands listed above Nature Lab owns around half a dozen further beauty brands, including face care, oral care, beauty accessories etc.), the group’s portfolio also includes three nutritional supplements / beauty foods and and two home care/household products brands, Lavons and Laundrin.

Lavons and Laundrin were both extended with new wellness-positioned product ranges that reflects the on-going influence of the #sleepbeauty/ #sleeptech mega trend in Japan. The new Lavons to the Moon range, for example, is a classic night-time range formulated to help improve sleep quality and promote relaxation. The line-up includes room diffusers, fabric softener, fabric spray and scented wardrobe sachets which are available in two relaxing fragrances.

And the Laundrin range now offers the Laundrin Tea collection of tea-scented laundry detergents and fabric softeners. There are four tea-scented variants (oolong, earl grey, white tea and darjeeling lemon) for a soothing and relaxing at-home fragrance experience.

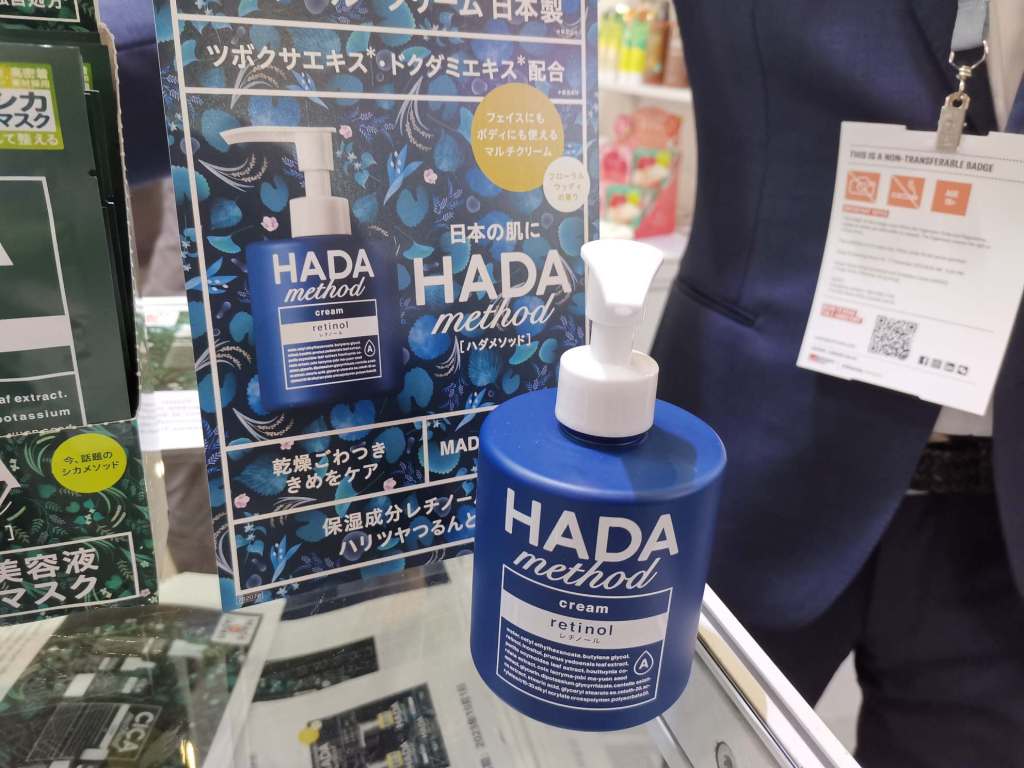

HADA METHOD (Japan)

And here we’re circling back to cica and retinol: Japanese personal care brand Hada Method brought out the Cica Retinol body lotion earlier this year. The formula is based on the company’s Cica Method skin and body care range (mist, booster serum, SPF, sheet mask, toner pad, hand cream, lip balm) which was launched a few years ago and has turned into a best-seller.

I was told that Cica Method is sold in over 12,000 stores in Japan, especially in variety stores and drug stores; with a price point of around 2,000 JPY and over 1 million units sold per year. The Cica Retinol body lotion has, well, added retinol in a light and moisturising skin care formula and there will soon be several matching face care products in the range.

ORAL CREATE (Japan)

For me, Co-brush from Japanese oral care manufacturer Oral Create turned out to be one of the most interesting launches in the Japanese pavillion. This is a manual toothbrush available in three colour – as you can see in the picture below, there is a plastic nub thingy on the side of the brush head: I originally thought this was for gum massage.

Turns out I was wrong about this (thank goodness I returned to the Oral Create booth later that day to find out more) because Cobrush is actually an anti-wrinkle/anti-ageing beauty toothbrush! The plastic nubbin is to massage the inside of your mouth (the cheeks, roof of the mouth, inside the lip area and yes, you can also massage the gums, of course) which will improve and tone the muscles and thus plump up sagging chins or cheeks from the inside.

The brush was launched a few years ago in collaboration with Japanese women’s magazine Biteki and the most recent launch is an electric version of the brush.

COCONUT MATTER (Hong Kong)

This was another really interesting beauty brand: Coconut Matter is not just organic and plastic-free but the products are produced in Hong Kong (note: Hong Kong is a very small city state and there are not that many beauty brands that are actually manufactured here).

Coconut Matter was launched in 2015; the company started out with lipbalms and then branched out into body care and deodorants. The range retails for around 150-200 HKD (17-23 Euro) and almost all products contain fair trade cold-pressed coconut oil from the Solomon islands. The brand’s latest launch are two powder shampoos and one powder body wash, with refill options to come later. I really liked the pack design of the powder products.

Around 70% of Coconut Matter’s distribution in its home market is online, the rest is sold in offline retail; primarily through local circular beauty/zero waste/organic stores. The Philippines is the company’s biggest international market followed by Singapore – in fact, South East Asia is one of their most important geographic regions for Coconut Matter, as is the Middle East.

NBC / NOX BELLCOW (China)

NBC is a major Chinese beauty and personal care manufacturer and regularly attends the big international trade shows. Still, for whatever reason the company hadn’t brought any English language marketing materials to Cosmoprof Asia 2023 (or maybe they were kept out of sight, I don’t know) and no-one was available to speak to me either so I used my intuition and Google Translate to make sense of their new launches. It’s a pity since NBC’s product innovations in the prestige face care category are usually really interesting.

First, the black sheet mask transmits electric impulses through electrodes inserted into the mask material, the little metal transmitter (?) box is attached to the mask. I think the mask works on the principle of EMS (electric muscle stimulation) to tone facial muscles. I saw a number of these EMS masks at the show.

The 5-sku Electro Active products packaged in purple is for acne-prone skin (my Google Translate app gave me “Phone Sex Special Series” as the range name 🤣) and I think that the key ingredients in this formula carry an electric charge (i.e. they are high in piezoelectric energy) which interrupts the liposomes in the skin cells of the stratum corneum. This helps the active ingredients to more easily penetrate this skin layer and boosts collagen and elastine production.

Finally there was an interesting-looking facial mask: Nano Instant Firming Essence Mask is a hydration/anti-wrinkle mask which leaves a creamy/foamy layer on the skin after you’ve applied the sheet mask (there was a small video that showed the process but unfortunately, the subtitles were in Chinese only). The foam/cream layer then penetrates extra quickly into the skin courtesy of (I assume), the nano-sized ingredients.

COSMOPROF ASIA 2023: BRANDS FROM EUROPE

WAFIB (France)

I always enjoy visiting the WAFIB (We Are French Indie Brands) booth: A communal exhibition pavillion showcasing French indie brands. The first time I saw WAFIB at a trade show was during Cosmoprof Asia Singapore 2022, then again at Cosmoprof Bologna 2023 and now in Hong Kong.

It’s such a brilliant marketing idea: Newcomer and niche brands get the opportunity to present their products at an international trade show without having to sell their soul to afford an individual expo stand, and busy trade show visitors like me can discover dozens of beauty brands at one single booth. WAFIB also has a communal exhibitor database so you can look up each brand and frequently, the brand founders are also at the booth. At Cosmoprof Asia 2023, WAFIB presented around 20 beauty brands (I think), some of which I’d seen before but there were also some new faces.

NIDECO (France)

Face and body care brand Nideco was launched in 2019. It’s a co-creation brand and products are developed in close cooperation with the Nideo community of beauty enthusiasts. Anyone can suggest a product idea (there’s a cash reward if your idea is viable), the community then votes on this product idea and if enough people vote for the creation of the product, Nideco develops it. Members of the community then test the product and based on this feedback, the brand tweaks the formula (if necessary) and launches the final version.

Amongst the newest Nideco creations are several period care products which I found particularly interesting, such as a relaxing face cream when you’re suffering from PMS, a soothing body oil for tummy cramps, a breast moisturiser and a moisturiser for the butt! There are currently around 25 sku in the Nideco line-up.

SINE AQUA (France)

Sine Aqua (if your Latin’s not so good: The brand name means “without water”) is a definite newcomer brand; I think they were launched just this year? The company manufactures powder shampoos – there are six different shampoo and conditioner variants, with powdered face care products to follow soon.

With powder products, and especially those that are designed to be used in the direct vicinity of running water (like shower gels or shampoos), the packaging plays an enourmously important role. We all know what happens when powder get wet or is exposed to too much humidity – it gets clumpy or dissolves completely, i.e. the product is ruined.

If you’re going plastic-free with your powder product – and the majority of powder shampoo/body care brands that I’ve met over the past 10 years tried to be as zero-waste as possible – the only packaging options are paper bags with some sort of moisture-resistant coating for the refills and glass or aluminum/metal jars or tins for daily use. Keep in mind that shampoos and shower gels are almost always applied when the hands are already wet/under the shower; and the products are also usually stored in the bathroom (humidity/moisture again).

Sine Aqua offers glass bottles with humidity-proof glass caps; refills are available in compostable paper bags. As the brand is still very new, products are mostly sold online at the moment but the company is looking to move into offline retail as well; most likely in natural/organic supermarkets and health food stores as well as bulk food/zero waste stores.

POÉCILE (France)

Fragrance brand Poécile was an exhibitor in the regular French brand pavillion. Launched in 2021 during the seemingly endless pandemic lockdowns in Europe, founder Léa Chonier’s fragrances were inspired by the different regions in France. As physical travelling was impossible at that time, she wanted to give customers the opportunity to travel via their perfume – a sort of olfactory travelling experience.

The Poécile range includes five fragrances at the moment, highlighting the Cote d’Azur, Provence, Paris and its environs, Bretagne and Auvergne. Each composition references the the most famous fragrance notes, flavours and ingredients from these regions.

My favourite was the Auvergne (which I’ve never visited but really want to discover now – I liked the perfume very much), a green, slightly dry herbal scent. 50ml EDP retail for 69 Euro and products are sold online and offline in selected perfumeries and concept stores in France. The brand also has a retail presence in around 20 further countries.

ALTEYA ORGANICS (Bulgaria)

It’s been a while since I last saw Alteya Organics at a trade fair – I don’t think they were at Cosmoprof Bologna 2023 and they were also absent from Vivaness 2023. I’m a big, BIG fan of Alteya Organics’ floral hydrosols and face care so I immediately coveted the brand’s new Rose Hydrobiome face care range.

There are five sku in the new line – an overnight mask, cream, serum, toner and cleanser – and all products are based on a complex based on three types of rose (centifolia, alba and damascena) as well as green and brown algae extract, sea water and pre-/pro-biotics to strengthen the skin’s barrier.

I was told that the new range will most likely be launched in early 2024, with a masstige price point located in between Alteya Organics’ basic face care and the premium anti-ageing lines.

NATURA SIBERICA (Russia)

Natura Siberica’s most recent skin care launches also focused on microbiome beauty – the brand’s Biome face care range was extended with over 20 (!) new sku which all focus on skin barrier-enhancing ingredients. The collection is divided into two sub-ranges – Hydration (packaged in blue) and Glow (yellow). The INCI are classic Natura Siberica formulations: Natural and near-natural rather than organic but solidly formulated with pleasant textures.

I mostly associate Natura Siberica with retail beauty, especially face/body care and skin care and always forget that they also offer several salon and professional ranges. The brand’s professional hair care range will be extended with six new scalp care products in 2024: Shampoo, scalp lotion and self-heating scalp mask in the Stimulate line, Exfoliate anti-dandruff shampoo and a scalp scrub and the scalp-soothing Calm shampoo.

And that’s it for me from Cosmoprof Asia 2023. Thanks for reading. Cosmoprof Asia 2024 will take place from 12th to 15th November 2024 (12th to 14th November for Cosmopack, 13th to 15th for Cosmoprof). I have just booked my hotel for next year and judging by how bloody expensive and scarce hotel rooms in Hong Kong island and Kowloon already are (on all major booking platforms!), I’d says that next year’s Cosmoprof Asia will surely reach (if not overtake) the trade fair’s 2028 visitor and exhibitor numbers.

Pingback: Cosmoprof Asia 2024: [Show Report] | TRENDS. TRAVELS. AND BERLIN