Cosmobeauty Seoul 2024 (29th to 31st May) was so much busier than last year’s show, with really great energy throughout the three days of the fair. There were some 370+ exhibitors including several big Korean brands that had been absent at Cosmobeauty Seoul 2023. If you’re interested, here are the links to my previous Cosmobeauty reports: Cosmobeauty Seoul 2019, Cosmobeauty Seoul 2018, Cosmobeauty Seoul 2017 and Cosmobeauty Seoul 2016.

This year’s Cosmobeauty Seoul was just chock-full of fascinating new product launches and overarching trends – like beauty tech, especially LED devices and skin/scalp diagnostics; and fragrance/home fragrance launches: I saw at least half a dozen Korean perfume/home fragrance brands that were launched within the past five years.

And of course the face care! Pimple patches everywhere (microneedle patches, patch kits with coin-sized LED devices to boost the effects, decorative/tattoo-type patches…) as were masks and serums. And a lot of aromatherapy/scented hair and body care – I posted 24 Instagram brand profiles across the three days of the show. According to my personal Instagram trade show coverage standards this is almost Cosmoprof Bologna level!

Fabric sprays were ubiquituous amongst the new home fragrance launches, and I’m so going to do more research on this: Korean fabric sprays have NOTHING to do with the boring Febreze kind of sprays you find in Europe – nope, a lot of domestic fragrance brands launch fabric sprays to match their key fragrances; it’s like a perfume flanker and an entirely new – or rather, different – way of wearing fragrance.

So let’s jump straight into some of my favourite brand discoveries at Cosmobeauty Seoul 2024. As always, brands appear in no particular order although I’ve grouped the launches according to category.

COSMOBEAUTY SEOUL 2024: BEAUTY TECH

RECLAR (Korea)

Korean beauty tech manufacturer Reclar presented a truly high-tech facial device. I mean, we’re talking full-on bells and whistles: The brand’s new Re-Merge device is packed with functions, including voice guidance, automatic UV sterilisation and wireless or wired charging for increased convenience.

The device emits four different kinds of LED waves (near infrared, green light, purple light and red light) and offers an AI-driven analysis of the skin’s moisture levels which automatically adjusts whatever LED frequency has been selected. According to the paperback-sized product brochure, the 36 gold-plated (24 karats, no less) electrodes and bi-polar 1MHz high frequency is on par with medical-grade devices, so you get an especially effective product performance.

SHENZHEN JUNYI (China)

I noticed a lot of LED beauty devices, perhaps more so than in previous years. Shenzhen Junyi, for example, recently launched red light/blue light/EMS patches specifically designed to treat the delicate undereye area.

The kit contains two smaller and two larger pads: You apply your usual serum, eye cream or whatever product, place the patches on top and switch the device on. The different light wave frequencies help the active ingredients to absorb more easily into the skin as well as firming and toning the eye area. Changing between the different modi happens via app. Looked like an interesting product, I wouldn’t have minded trying it out.

CUREWAVE (Korea)

Korean beautytech brand Curewave latest launch is Elflora, a facial massage device whose unusual shape caught my eye as I was walking past the booth.

The hand-held set features five petal-shaped applicators to allow the user to precisely move it along specific facial areas (and it really does make it easier to massage specific muscle strands) – the Elflora doubles as a manual gua sha face massager when it’s switched off, so it’s kind of a 2-in-1 device. Once the Elflora is turned on it offers red light, blue light and other modi to help skin care products to absorb more quickly into the skin.

CGBIO (Korea)

Korean beauty tech manufacturer CGBIO introduced a range of innovative beauty tech devices. One of these is the the Beluna Breast Massager which was launched last year. The Beluna is described as a total solution for convenient and healthy breast care. Apparently this is a thing? Who knew. Anyway, the massager works with negative pressure/suction to stimulate the breast tissue, enhancing circulation to promote better collagen production and increase elasticity. Said to adhere to any breast shape in just 3 seconds, the suction device is operated via smartphone app and can be used for aesthetic treatments but also for pre-/and post-op care.

Another CGBIO range is Easy L – LED care for scalp and face. The Easy L Hair is a light-weight (76 gr) scalp care device which will be launched in September 2024. The device can be fitted into any cap or hat, making it ideal for use outdoors says the company. The device features 84 LED components delivering 630nm wave-length to stimulate circulation and promote hair growth.

And Easy L Mask (not pictured but it looks like an eye mask) is an ultra-light LED mask which weights just 115 gr. Yellow LED (promotes blood circulation, prevents hyperpigmentation), red LED (stimulate skin elasticity and improve wrinkles) and NIR LED to help skin recover from fatigue. The sleep mask-shaped device features 419 high-output LED and has a heating function to promote sleep quality. I really should have asked if they sold the eye masks at the trade show…

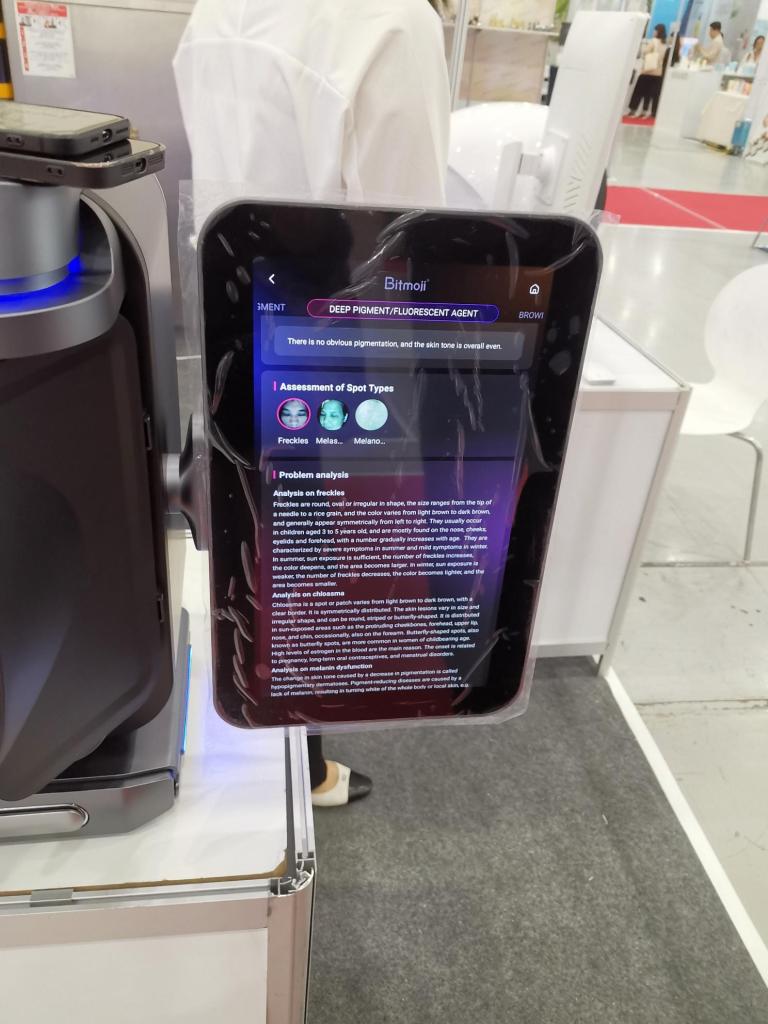

BITMOJI (China)

AI skin/scalp diagnostic tech is another fascinating product category that is becoming more sophisticated every year – from smartphone lenses over hand-held diagnostic tools to half-open diagnostic chambers; it’s amazing how precisely this kind of tech can now measure skin density, hydration, pore size, discolouration and what have you. And not just on the surface layer but going quite deeply into the dermis.

The Bitmoji diagnostics device by Chinese manufacturer Shenzhen Zhimei Lihe really impressed me because the results of the analysis were so clearly and comprehensibly explained – frequently, skin diagnostic results are a bunch of graphs, data points and overlapping circles and you have to depend on the technician to explain what the results actually mean.

The Bitmoji results are explained in great detail and even more importantly, they are described in layman’s terms with a lot background info on each point. The layout is visually attractive and very easy to read. In fact, it looks more like an interactive webpage – if you enlarge the image you can see how Bitmoji explains freckles and different skin discolourations.

There is also a hand-set that can be uses to scan areas of the face that are difficult to measure – for example, around the nose – and you can see what’s happening live on the screen. Obviously you can also export, scan or print the results in different formats and salon owners have the option of entering their own beauty products/brands into the Bitmoji database to generate specific product recommendations.

LILLYCOVER (Korea)

Korean manufacturer Lillycover is offering a customised cosmetics concept under its Balanx tech brand. I’ve seen Lillycover at various trade shows over the years – pretty much ever since the company launched it’s first robot cosmetics manufacturing machine! – and it’s great to see the Balanx concept expand internationally: The company recently signed a contract with a Hong Kong-based salon beauty chain and there are now three Balanx Enima Light machines installed in various shopping malls including up-market art museum K11 in Kowloon. The brand will also soon expand into the US, I was told.

A brief recap of what Balanx does: The brand manufactures customised beauty products right there on the spot. The Enima machines are equipped with robot arms (and a viewing window so you can see how the robot arm is mixing your lotion!) and are installed in a store, salon or mall, usually as a pop-up location. A customer comes in and gets a face or scalp diagnosis via a hand-held device and the AI-powered database the recommends specific beauty products for your skin or scalp issue. The Enima machine then begins mixing the cosmetics from stock components right there – it takes around an hour, if I remember correctly – and you (the customer) can pick it up directly afterwards.

There are many customised beauty brands on the market already but usually, you fill in an online questionnaire or get an analysis in-store, the products are manufactured in a facility somewhere and then get shipped to your home address. The Enima machines allow you to pick it up within a couple of hours of having the analysis done.

The machine you can see in the picture is the Enima Light, the second-biggest Balanx machine (the largest Enima is for the Balanx factory itself). The Light version is portable enough that it can be installed in public spaces such as shopping malls or department stores. And soon there will be an even smaller machine – the Enima Mini will be countertop-sized and designed specifically for beauty salon and clinics.

COSMOBEAUTY SEOUL 2024: SKIN CARE

DEARDOT (Korea)

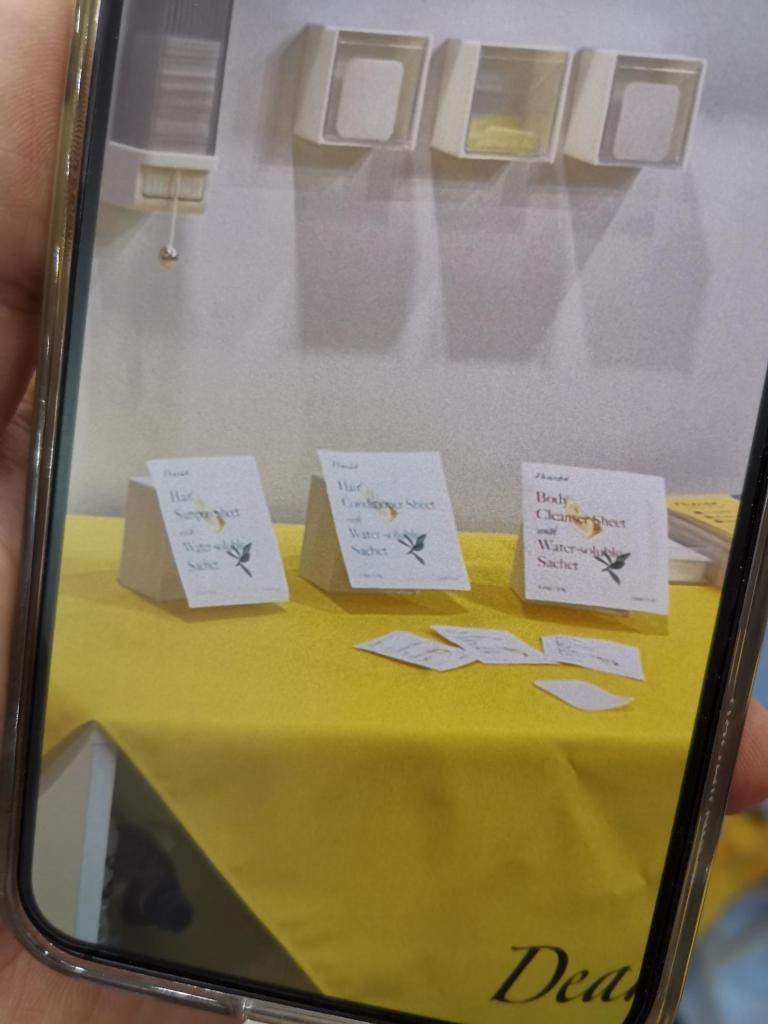

I really like Jeju-based natural beauty brand Deardot; the indie brand was launched a few years ago and its products are based on dangyua fruit extract, an endangered citrus fruit. Deardot not only turned this fruit variant into a cosmetic active (thus helping to conserve the plant) but also donated seed to one of the Korean seed vaults. Their most recent launch (which I wrote about in my Cosmoprof Bologna 2024 report) is a powdered face and body cleanser which is packaged in a fully soluble sachet so the entire product turns into rich, creamy cleansing bubbles.

And the company is leveraging this technology for several up-coming launches: Later this year there will be a shaving foam for men, a unisex shampoo and a conditioner. Because the products are still under development I only saw screenshots of the mockups but they look really interesting. Can’t wait to see the new launches! Hopefully in Hong Kong at Cosmoprof Asia this November.

MANIA HOLIC (Korea)

This is a new sister brand to skin care giant Kocostar: Mania Holic was launched in December 2023 and currently offers three problem-solving face care products.

The first is Cheek Patch, circular sheet masks saturated in cooling and hydrating ingredients that help to soothe irritated skin on the cheeks – these cooling patches are kind of a hybrid product, a mix of sheet mask and toner pad, and have become quite popular in Korea.

Product #2 is Nose Patch Sebum Control – this is an iteration of the classic pore nose strip: The Nose Patch is saturated with fruit acids and sebum-dissolving ingredients and softens the sebum plugs in the pores. After you take off the nose strip (it doesn’t harden so there is no tearing off required) you simply wipe off the clogs. So much more skin-friendly than the tear-off strips which frequently take off quite a bit of nose skin as well!

Finally, there is the Mania Holic Sunscreen Pack, a liquid sunscreen formulated with SPF50 PA+++. I tried this out on my hand and as you might expect from a Korean sun care product, the texture is beautifully light.

The international distribution of Mania Holic hasn’t yet been sorted out, I was told; in Korea the brand is widely available online of course but globally – not quite sure yet. I imagine it’ll be sold in much the same channels as Kocostar; since there is a similar price point (20-24 USD). A very nice-looking range.

UIQ (Korea)

Korean brand UIQ was launched in 2021, they do microbiome face care for different skin concerns including trouble/acne skin and hyperpigmentation.

There are several ranges: Biome Barrier offers eight face care products, Dewy/Revive Biome includes two premium hydrating serums and Biome Remedy is body care and face care for troubled skin (10 products: 8 face care, 2 body care), including four UV protecting products in different textures (mineral sunscreen, chemical sunscreen, tone-up/tinted sunscreen and powdery sun stick for oily skin). Certified Microbiome Friendly by the UK’s Labskin.

The brand’s most recent launches are the Tone-Up Sun Cream (a tinted SPF cream) and the Pore Pack Reset Cooling Patch (another cooling cheek patch!). To promote its product ranges, UIQ teamed up with K-pop superstars Riize as brand ambassadors; there was a massive cardboard cut-out of the band at the UIQ booth and plenty of visitors taking selfies in front of it. The band members have also created a lipbalm colour each, with their image on the packaging – see pic above.

FRANKLY (Korea)

Frankly launched in 2022 and offers fun and functional face care at mass market prices. In 2023, the CJ Group/Olive Young invested into the brand. Frankly launched online and offline into Olive Young in 2023; the brand is also sold online and offline in a further ten international markets, including Amazon US since January 2024.

There are 16 face care sku in the range, including seven serums, two retinol creams with different percentages of retinol, two toners and two sun care products. The latest products are the Niacinamide 15% Zinc Beads serum and a Deep Cleansing Oil.

GRANDIDIER (Korea)

Korean face care brand Grandidier was launched in 2021 and its key active is rather unusual for an Asian beauty brand: Black tea – Jay Shree’s First Flush Darjeeling, to be precise – from India. The 4-sku range offers a moisturising cleansing serum formulated with gentle sugar-based surfactants and a brightening essence based on 63.8% black tea extract plus niacinamide and PHA.

There is also a moisturising cream with ceramides, panthenol, camellia oil and shea butter and 13% Black tea extract, and a UV protection cream, UV Shield SPF50 PA++++. Sold primarily online right now as per usual for Korean indie brands. I received a few samples of the essence and cleanser and tried them out – liked the products, especially the essence.

JAMIE BRONZE (Korea)

I had no idea self-tanning was a thing in Korea (or in Asia in general) but apparently it is, at least as a very tiny niche sector – because Jamie Bronze is a Korean self-tanning brand that has been around for ten years and somehow they are surviving in what must be really tough market conditions.

The Jamie Bronze line-up includes a self-tanning cream, a self-tan bronzing booster you can mix with the cream (or any body/face lotion), a tanning oil, a sun protection stick and a (non-self tan) body lotion. I’m not sure what I feel about the brand visuals which to me evoke distinct 1980s orange-tan-lines vibes! But I guess the domestic consumers don’t mind/don’t care? Since Jamie Bronze is still around.

ALLIONE (Korea)

Amongst Korean mass market brand Allione’s most recent launches was this rather interesting product: A hair removal cream specifically formulated for men! While I do see new men’s care brands/product launches at trade shows occasionally, the vast majority of product launches in any country/regional market are, of course, for women.

Many Korean women remover their body/facial hair with IPL either at home or at a salon but men are more hesitant to visit those place, I was told. And for arm hair, for example, men prefer to use a cream.

There are two variants to chose from (two different scents/key botanical actives; the formula is essentially the same) – Jeju Carrot and Gangwha Artemisia (both Jeju and Gangwha are Korean islands famous for their beauty and nature). According to the brand, the cream can be used on dry skin, is easy to apply and removed with no fuss or mess.

BANOBAGI (Korea)

Banobagi‘s most recent launch is the new DX Mask, a dual mask sachet – remember these 2-part (or even 3-part) mask sachets which seemed to become so popular around ten years ago? These packs usually included a sheet mask, a top up serum and a cream to seal in moisture; kind of a whole skin care routine in one package.

Anyway, Banobagi has launched a 5-sku dual mask range developed specifically for night-time use. Each variant includes a sheet mask each and an extra sachet with a sleeping cream that you apply after taking off the sheet mask.

The sleeping cream contains melatonin (not certain how effective this ingredient is when applied topically though?) which kind of underscores the night-time beauty claim. There are five mask variants available in the new range and each pack contains 7 sheet masks, priced as 25,000 KRW (around 16 Euro).

The brand ambassador for this new range is artist Ten – I had to google him; I barely know the names of the big K-pop bands. Ten is a Thai-Chinese singer who debuted with Korean boy band NCT in 2016 and is currently active in a Chinese version of NCT (according to his Wikipedia page) as well as quite successful with solo projects.

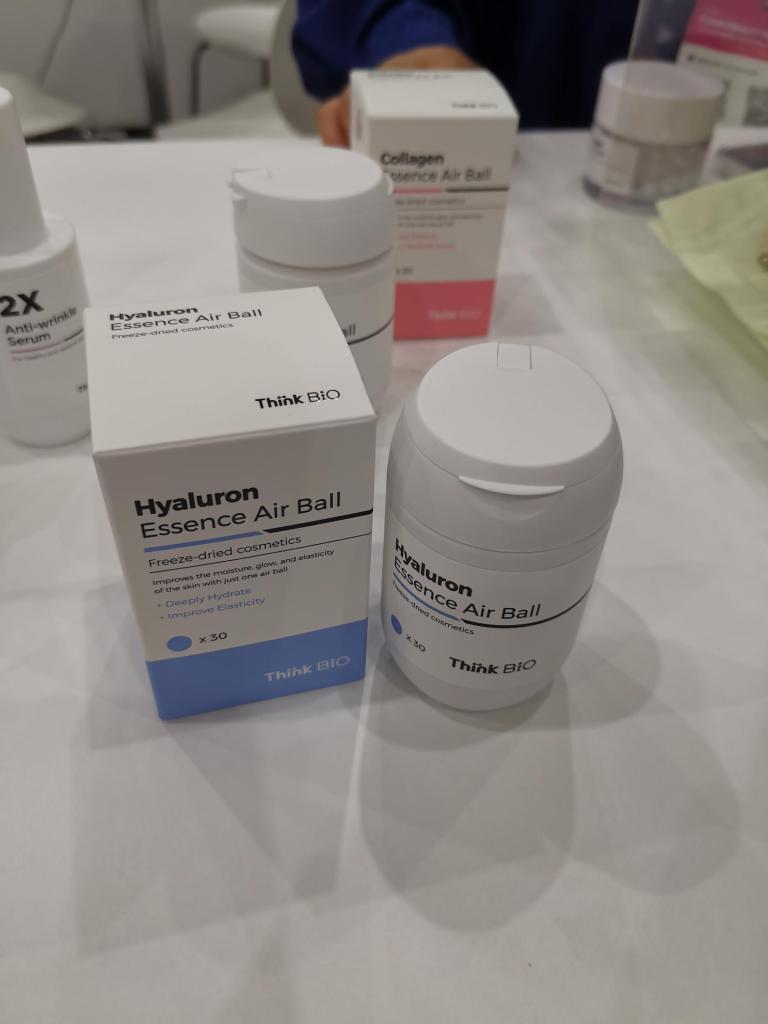

THINK BIO (Korea)

This was one of my favourite launches! Korean brand Think Bio introduced an really cool serum addition: Essence Air Balls are little spheres of highly-concentrated freeze-dried skin care ingredients that can be blended with any serum or toner to upgrade its skin care benefits. There are four variants: Hyaluron, Collagen, Premium Gold and Vita-C; each variant is available in a pack of 30 balls or a 7-balls pack.

I’ve seen freeze-dried active ingredient components before, usually in salon brand launches, but never as part of an easy-to-use consumer range. I bought a pack of 7 Essence Balls and they are really so much fun to use: Simply drip a toner, serum or other thick liquid on it and the ball starts to dissolve immediately. I blend mine with a serum and it does feel like the resulting blend is a thicker and more moisturising.

EASYFOLD (Korea)

This was another intriguing brand: Easyfold manufactures these card-board type sachets that you fold over, press together and then the sachet kind of splits in the middle. A few years ago the company launched One Flip, a whole range of travel-friendly beauty products packaged in these sachets. I really liked the look of the travel kits.

The Easyfold range includes two facial cleansers and a sun cream; the travel kits contains a shampoo, conditioner, body wash, facial cleanser and a moisturising cream. I love travel-friendly beauty!

ORJENA (Korea)

Mass market beauty brand Orjena has the prettiest packaging in its new Refine Synergy 8-sku serum/cream collection: There are four serums and four creams and my goodness, those packaging colours! I also like the square serum bottle shape. The Refine Synergy range offers four sub-ranges: Trouble Ampoule, Glowing Ampoule, Barrier Ampoule and Firming Ampoule; each ampoule is based on two highly-concentrated key actives.

Orjena was launched in 2016, in Korea the brand is sold almost exclusively online. The company also distributes its products in a few Eastern European markets (including Russia, traditionally a major market for Korean beauty) as well as Canada, the US and Australia. Product prices for the new range are around 23.000-35.000 KRW (15-20 Euro). A nice looking brand.

COSMOBEAUTY SEOUL 2024: FRAGRANCES & WELLBEING

I don’t think I’ve ever been to a Cosmobeauty Seoul that had so many new domestic fragrance brands! I mean, sure, wellness/aromatherapy is a major trend in Korea (as well as globally), but all of these brands were launched in the last five years/during the pandemic. I read that younger Koreans in particular are starting to gravitate towards indie fragrances and domestic labels rather than going for the big international mainstream options.

And this is where the fabric sprays come in: Textile sprays/linen waters are an integral part of most of these domestic brands’ ranges, usually as a flanker to the best-selling perfumes so consumers can layer their favourite scents. It’s a fascinating cross-over product between personal fragrance and home fragrance. There are even dedicated fabric spray brands on the Korean market, with highly sophisticated scent pyramids and super stylish packaging. These are total lifestyle items.

MONTHLY 121 (Korea)

Monthly 121 is a domestic indie fragrance brand which was launched in 2021. The brand’s line-up offers seven fragrances (each named after a capital city) that are available as a 50ml EDP as well as a 10ml travel size each. There are also three reed diffuser sets and as its latest launch: Six fabric sprays to match their best-selling scents.

The newest perfumes are Bali (citric-fresh rather than voluptuously floral which surprised me) and Tokyo (a light floral, very pleasant and unsurprisingly amongst the brand’s most popular fragrances). At the moment, Monthly121 is available online only but I was told that the brand founder is considering opening a brand store in Seoul.

ODID (Korea)

Korea aromatherapy/wellness body care brand Odid was launched in 2022. The brand started out with scented hair care (shampoos, conditioners, hair oils; all scented with aromatherapy-inspired fragrances) and then branched out into bath and body care.

The focus lies on the wellbeing component of the products rather than the product performance. The most recent launches in the Odid range are fabric sprays in each of the brand’s key scent ranges. I absolutely love the packaging design (and even their sample sachets are pretty) and tested out several of the body washes/lotions and shampoos. Really nice products, with pleasant scents that didn’t linger too strongly.

LIMEYOU (Korea)

Natural fragrance brand Limeyou launched in 2019 and currently offers seven fragrances available as 50ml edps and in travel size sprays. The line-up also includes three scented candles and three reed diffusers.

The latest addition to the brand’s line-up are solid perfume sticks which are elegantly packaged in slim, heavy stick containers equipped with a magnetised cap. Very pleasant to handle.

ARRAUNE (Korea)

Korean fragrance brand Arraune launched in December 2023 with seven perfumes. In January, four matching scented body lotions/washes joined the Korean indie brand’s product line-up.

Arraune says that it has a scent for every mood, including the fresh, citric Midnight Redio, the more fruity-voluptuous Amorismo Forte; earthy-green Acqua Brillo, the lavender, orange and jasmine dominated Aura Brave, Estella Amore which combines cinnamon, jasmine and rose with musk and patchouli accents, Belisa Draziya which is a feminine floral and Luna Evenouar with its notes of osmanthus, iris, bergamot and mint.

LOGIN FOREST (Korea)

Home fragrance/wellness brand Login Forest was introduced in 2023. There are five signature scents – Bourbon Vanilla Shaw, Fig Woodique, Citruble Liberty, Touffu Island 60 and Rainy Groove Garden. Each fragrance offers 4-5 bath and body care products: Bourbon Vanilla Shaw includes a hand cream, shower oil cream, body cream and creamy body wash. Fig Woodique includes a hand cream, ampoule shower gel, body ampoule moisturiser, body serum spray and oil body mist.

Citruble Liberty offers a hand sanitizer spray, body scrub, shower gel and hand cream. Rainy Groove Garden features a body lotion, body wash and moisturising body spray and Touffu Island 60 is available as body lotion, body wash and perfume stick. The positioning and marketing is focused on the fragrance notes and the wellness benefits associated with the scents rather than the skin care properties of the products. I tested several of the ranges out on the back of my hands and quite liked the scents.

AVERHEAL (Korea)

A nice-looking aromatherapy range which was launched in early 2024 by Korean beauty manufacturer Bionic Lab. There are eight products in the range, including six essential oil/carrier oil blends for specific physical and emotional symptoms – like muscle-relaxing, calming or sleep-boosting – as well as an electronic diffuser and a gua sha body massage tool.

As these are ready-to-use oil blends you can simply massage them into your pulse points or on the affected body part. Packaging is simple and stylish, the oils are decanted in heavy glass flacons.

And that was it from Cosmobeauty Seoul 2024. For more launches and product pictures (as well as videos from the fair which I collated into a Highlights, link in bio) check out my Instagram feed. Thanks for reading!

thanks for info.

Pingback: Cosmoprof Asia 2024: [Show Report] | TRENDS. TRAVELS. AND BERLIN

Pingback: Cosmobeauty Seoul 2025: [Show Report] | TRENDS. TRAVELS. AND BERLIN