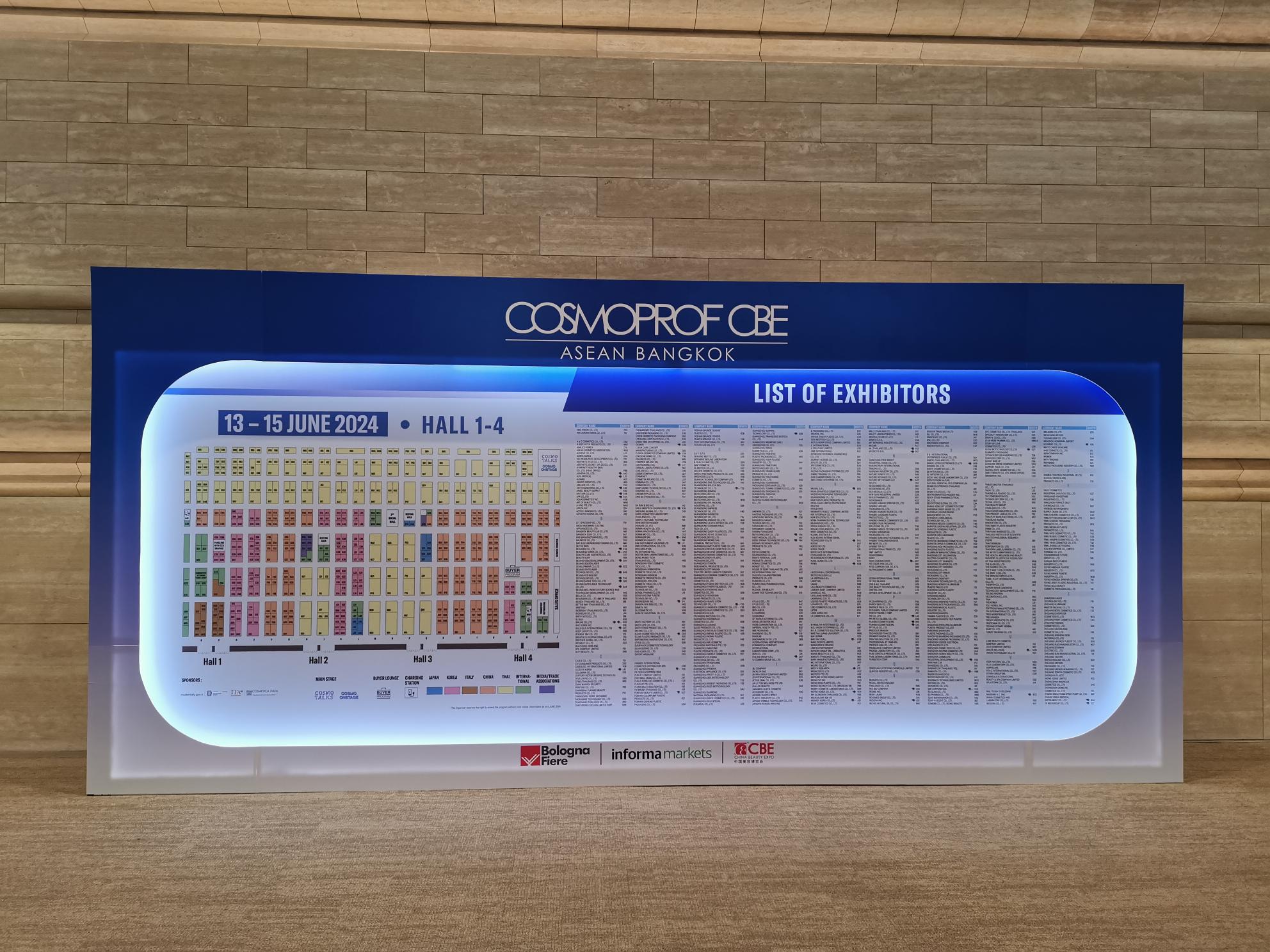

The third edition of South East Asia’s first Cosmoprof fair took place from 13th to 15th June 2024 in Bangkok, Thailand. It was my second time to visit Cosmoprof CBE Asean (here is my report of last year’s show) and I enjoyed it tremendously. Compared to Cosmoprof CBE Asean 2023, exhibitor numbers increased by 50% to around 1,500+ companies and brands from 18 countries while visitor numbers grew 26% to 16,630+ visitors from 59 countries/regions. It certainly felt busier than the previous year.

There is no official country breakdown but I did a rough count of country exhibitors by colour on the information boards posted outside the exhibition halls in Queen Sirikit National Convention Centre: Around 225 exhibitors were from Thailand making this the biggest exhibitor country (as it should be!). Some 150+ brands were Chinese (almost all of these supply chain exhibitors – OEM/ODM, ingredients, machinery and especially packaging) and around 130 brands were from Korea (almost all retail brands, KOECO, IBITA et. al. were out in force again).

Much to my delight there were more Thai retail brands than the previous year – or at least that was my impression based on what I saw on the floor. All of the big names were back: Mistine, of course, Karmart with its Baby Bright, Cathydoll, Browit by Nongchat and various other brands; spa brand Giffarine with Pattrena; Mizumi, Cosluxe and Esxence as well as a whole slew of domestic indie brands.

During the three days of the fair I focused on the Thai brands, of course, but I’ll also highlight a couple of Korean brands that caught my eye. As always, brands are listed in no particular order but I’ll be starting with the big mass market brands and then move on to the niche labels. The Karmart brands all get their individual brand profiles, of course.

COSMOPROF CBE ASEAN 2024: BIG BRANDS

CATHYDOLL (Thailand)

Let’s start with one of Karmart’s biggest brands: Cathydoll.

And there were a lot of new launches over the last 12 months, such as the new Vit C Ampoule makeup range – a compact powder, creamy concealer and liquid foundation formulated with an extra dose of vitamin C (in addition to the usual SPF50 PA+++ which is kind of standard in Thai makeup products).

The new Lip Filler Booster gloss range has a nice non-sticky texture and medium colour pay-off while the 8-sku Glow Oil Lip Tint range is a nourishing lip oil which leaves a light tint on the lips.

BABY BRIGHT (Thailand)

Baby Bright is another major brand in the Karmart portfolio; they do primarily makeup but also some skin and body care.

Amongst the newest Baby Bright makeup launches were the Cornflower Eyeliner/Remover pen, a rather clever dual-ended liquid eyeliner pen – one end contains the colour, the other the remover; both with soft pencil applicator tips. Brilliant idea! I posted a video in my Instastories of how well the eyeliner/remover works; see the Highlights on @annika_trendtraveller.

Another cool new eyebrow product: The 3-in-1 Razor Sharp Eyebrow Pen – dual-ended again: One end is a triangular eyebrow pencil, the other an eyebrow brush. If you pull at the entire brush end the cap comes off to reveal a small eyebrow razor blade so you can tidy your brows as well.

Also new: Two facial powders for oily/acne/combination skin, aimed primarily at teenagers, Glow-Up and Mattifying are packaged in the traditional small powder shaker bottles. This packaging format fascinated me the first time I visited Thailand – over here in Europe, the only products packaged in these bottles are baby powders or scented body powders. Never face care powders.

There is also a new lipgloss range: Rejulight Gloss Tint (available in ten shades) was formulated with salmon DNA for an extra dose of skin-caring ingredients.

LIPIT (Thailand)

Lip care brand Lipit was developed in collaboration with Thai transgender YouTuber/influencer Nisamanee Lertvorapong (also known as Nutt – Nisamanee). The brand was launched a couple of years ago; I think it was very new at last year’s Cosmoprof CBE Asean.

To celebrate this year’s Pride Month (which kicked off just a few days before I arrived in Bangkok and the city was simply SWATHED in rainbow visuals. So many Pride-related events and limited editions and special collabs; it was glorious), the brand launched the colour-changing lip balm Pride To Be Myself.

The lipbalm stick: pink sparkles, packaging: deep purple; very Twilight Sparkle. I loved it, bought it and am wearing it right now, actually. (I love me a good colour-changing lip balm!). The Pride Lipit balm is/was a Watsons-exclusive launch which hit the shelves on 4th June and sold out rapidly. Luckily the Karmart brands were selling their products at the trade show so I grabbed the opportunity.

Anyway, this is a nice product. In addition to the Pride lip balm, there are three lip masks packaged in squeezy tubes and four new lip gloss sticks packaged in click pens.

SKYNLAB+ (Thailand)

Another Karmart brand: This time from the oral care category. I’ve started to pay more attention to the oral care category in Asia (a lot of product innovation happening here, in Japan as well as Korea, on top of the general premiumisation trend) so I stopped at the Skynlab+ booth.

The latest launch in this brand is the White Smile Teeth Whitening CC Serum and at first I thought this was yet another classic whitening toothpaste, either with polish particles or bleaching ingredients. But no, this is an optical brightening toothpaste – and it really is more of a thick liquid than the traditional paste.

Tinted a very dark blue, the serum/paste is brushed onto the teeth like a normal toothpaste (and it has all the usual toothpaste properties, fluoride, mint flavour and all the rest); leave it on for a bit and then spit or rinse it out. The purplish-blue colour has an optical whitening effect on the teeth, neutralising any yellowish/beige tints so the teeth appear whiter. If my suitcase hadn’t been so heavy already I would have bought a bottle to try it out. Interesting product.

HAIR IT (Thailand)

Another new influencer brand from Karmart: Hair It was launched a few months ago in collaboration with Thai beauty influencer Jiraporn Buranapong (SP Saypan). The focus of the brand lies on conditioning, care and styling products interestingly enough; there is no shampoo in the range at the moment although a few hair cleansers will be launched in the future.

Right now, the Hair It line-up includes hair masks, hair oil sprays and conditioners as well as four scented hair massage brushes – super bendy and flexible; designed for scalp massage rather than hair styling and available in four scents: Jasmine, Rose, Mango and Lavender. I bought the bright green Jasmine brush for myself and must say that the fragrance smells surprisingly natural. I like it.

MISTINE (Thailand)

No need to introduce Mistine, this is probably the Thai retail beauty brand with the biggest international footprint. The company’s exhibition booth was right next to the Karmart pavillion and the crowds around these two booths was so big that it pretty much blocked the entire section of the hall! Especially once some of the influencers and celeb brand faces showed up : )

So, Mistine. Amongst its makeup products, the brand has a two very distinct product line-ups, one for the domestic market and one for its global distribution. The Mistine portfolio also includes face care and sun care as well as the premium Amorn range of home fragrance products (which launched at last year’s Cosmoprof CBE Asean, see my show report from 2023).

Last year, Mistine presented the Thai Latte lipgloss range which was packaged in a striking-looking design – the product container consisted of several metal block/elements which can be twisted and spun however you like. Kind of a fidget spinner vibe; very addictive and oh-so-playful.

Over the last year, Mistine’s global product range was extended with more fidget spinner-inspired makeup items – there is now a range of blushes with this packaging and a lipstick range as well. In the domestic line-up, new products include several oil-control pressed powders, lipglosses and lipsticks. I particularly liked the Choose Me Light Water Tint range: This is a semi-permanent lip stain in a creamy formula so it is easier to apply and more forgiving of mistakes that the super-liquidy Korean-style lip stains.

The Amorn range was extended with two new scented candles and four reed diffusers to match the most popular Amorn fragrances.

MIZUMI (Thailand)

I’ve seen the face and body care products of this Thai brand in-store before – the sun care in particular is one of the Mizumi best-sellers – but never really paid much attention to the range, so it was great to see the company at the fair and find out more about the brand.

Launched in 2016 (I think), Mizumi focuses on face, body and sun care. Amongst the brand’s most recent launches are three facial cleansers formulated for different skin types/skin issues and heavily loaded with active ingredients – Acne, Bright and Collagen for combination/problem skin, sallow/dry skin and ageing/mature skin respectively.

I also liked the new UV Cooling Body Serum SPF50 PA++++ which launched a couple of weeks ago – a wonderfully light texture, immediately disappears into the skin and has a light cooling effect (not too much menthol, thank goodness). There is also a new retinol face serum – I was told that retinol is now becoming popular in Thailand; heard the same thing in Seoul at Cosmobeauty actually.

COSLUXE (Thailand)

Colour cosmetics brand Cosluxe was launched in 2011, a classic mass market brand with a very solid retail presence in all of the big Thai drugstore and perfumery retailers. At the trade show, Cosluxe presented its latest launch, the Stardust Bunny range which is aimed at tweens and teens – I was told that the brand is currently repositioning itself to appeal to a younger demographic – GenAlpha and younger GenZs rather than it’s previous core demo of GenZ/Millennials.

The Stardust Bunny range is very cute indeed and completely on-brand for its target demographic: Heavy on the sparkle and glitter with 22 sku of powder and liquid eyeshadows, eyeliners, blushes and so on as well as the Bunny PomPom Body Glitter which is packaged in a bunny-shaped powder puff.

SCENT & SENSE (Thailand)

Thai scent design/creation company Scent & Sense was my favourite brand discovery at Cosmoprof CBE Asean 2023, hands down. Check out my 2023 article for more details about the company. I was delighted to see them back at the trade show this year and completely blown away by Scent & Sense’s new olfactory brand identity showcase.

The company’s scent design team interpreted 42 human emotions as fragrances, running from positive emotions to the most negative of feelings, such as horror, loneliness, depression, pride, insecurity, anger, arrogance and solitude – emotions that are frequently unacknowledged, or repressed and shoved aside because they are perceived as negative or damaging. Yet are still so very deeply human.

I think we’ve all smelled perfumes that were named joy, happiness, uplifting etc., or can name fragrance notes that are commonly associated with positive feelings. However, how many fragrance manufacturers do you know whose creations acknowledge that the human emotional experience also includes the bad stuff?

Obviously these are not retail/consumer fragrances (although I’d buy Lonely on the spot, the scent evokes the smell of rain on hot asphalt just before a storm, with a bit of humidity mixed in; I love it) but more of an exercise: Scent & Sense do a lot of fragrance branding, corporate fragrances and so on and they are experts in creating mind-bendingly complex and hyper-creative scent pyramids/products that reflect the most abstract concepts – musical notes, for example, the feeling of a ghost looking over your shoulder. The scent of a snowy mountaintop. Check out last year’s trade show report for some great examples of the company’s work.

To create the emotion fragrances, the scent design team incorporated scientific, medical and psychological research and clinical studies into their creations, like using scent compounds and fragrance molecules that showed specific physical and emotional effects in test subjects. Absolutely fascinating. I tested around ten fragrances – focusing on the negative emotions, obviously – and my favourite was the afore-mentioned Lonely.

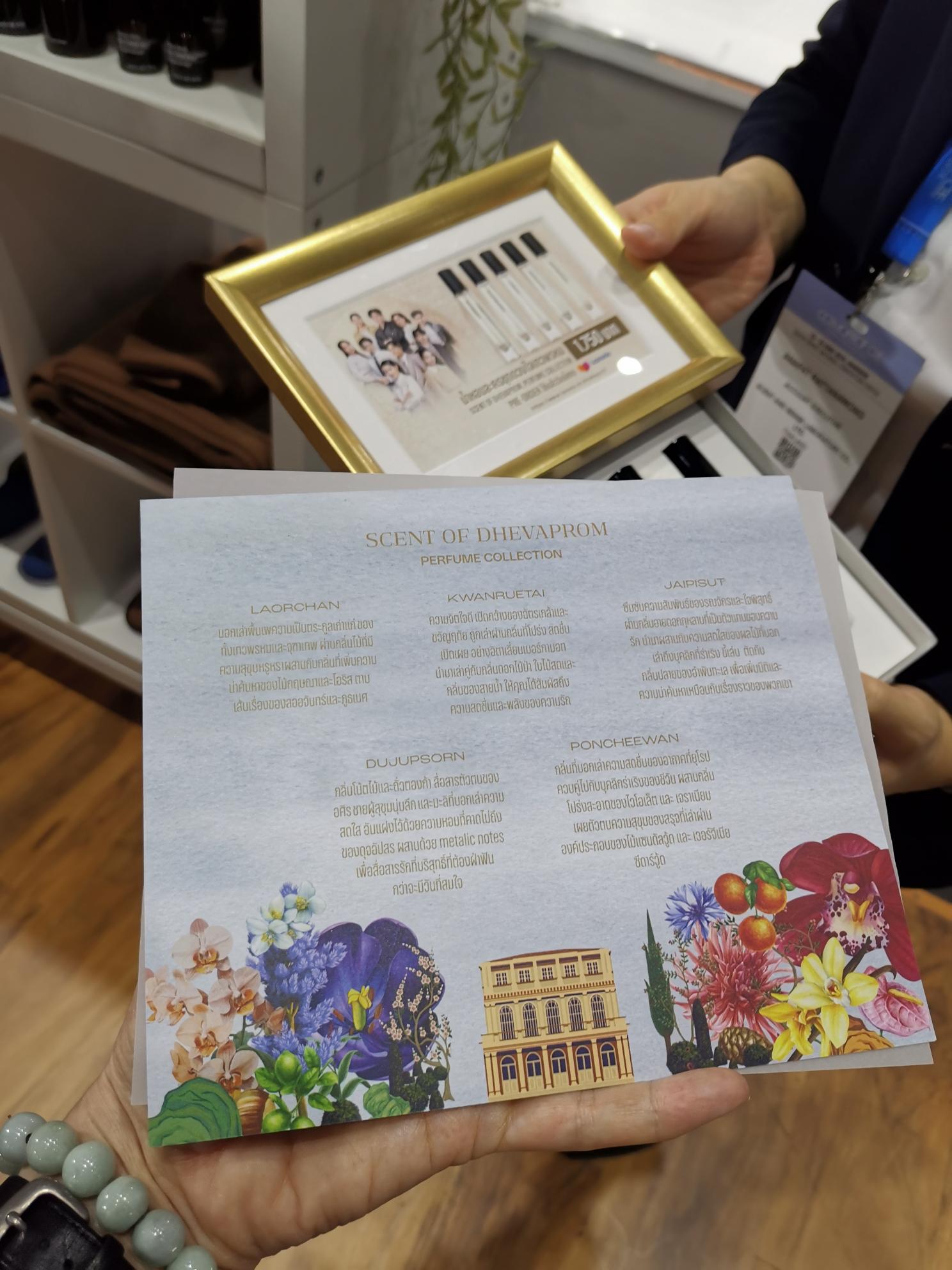

Another new fragrance creation that interested me was this set of fragrances: Olfactory interpretations of the key storylines in each of the five episodes of popular Thai soap opera, Devaphrom.

Each fragrance is named after an episode and evokes the main emotional themes or character dynamics of that particular episode. Often the scents will highlight the actions or emotions of the main characters but from what I understood, the scents also kind of give an olfactory shape to the energy of the narrative arcs as the series progresses.

I was also interested in this – I guess it’s a functional fragrance? Satisaanti’s Memories is a room/home fragrance spray to help boost cognitive abilities and thought processes. The aromatherapeutical fragrance was created in collaboration with Thai product designer/architect Honey Yanisa who develops everyday products, concepts and items for people struggling with dementia, disabilities and cognitive/degenerative neurological illnesses in general.

Barrier-free beauty is a fascinating area which, unfortunately, is still not receiving the attention from brands, manufacturers and consumers that it should.

ESXENSE (Thailand)

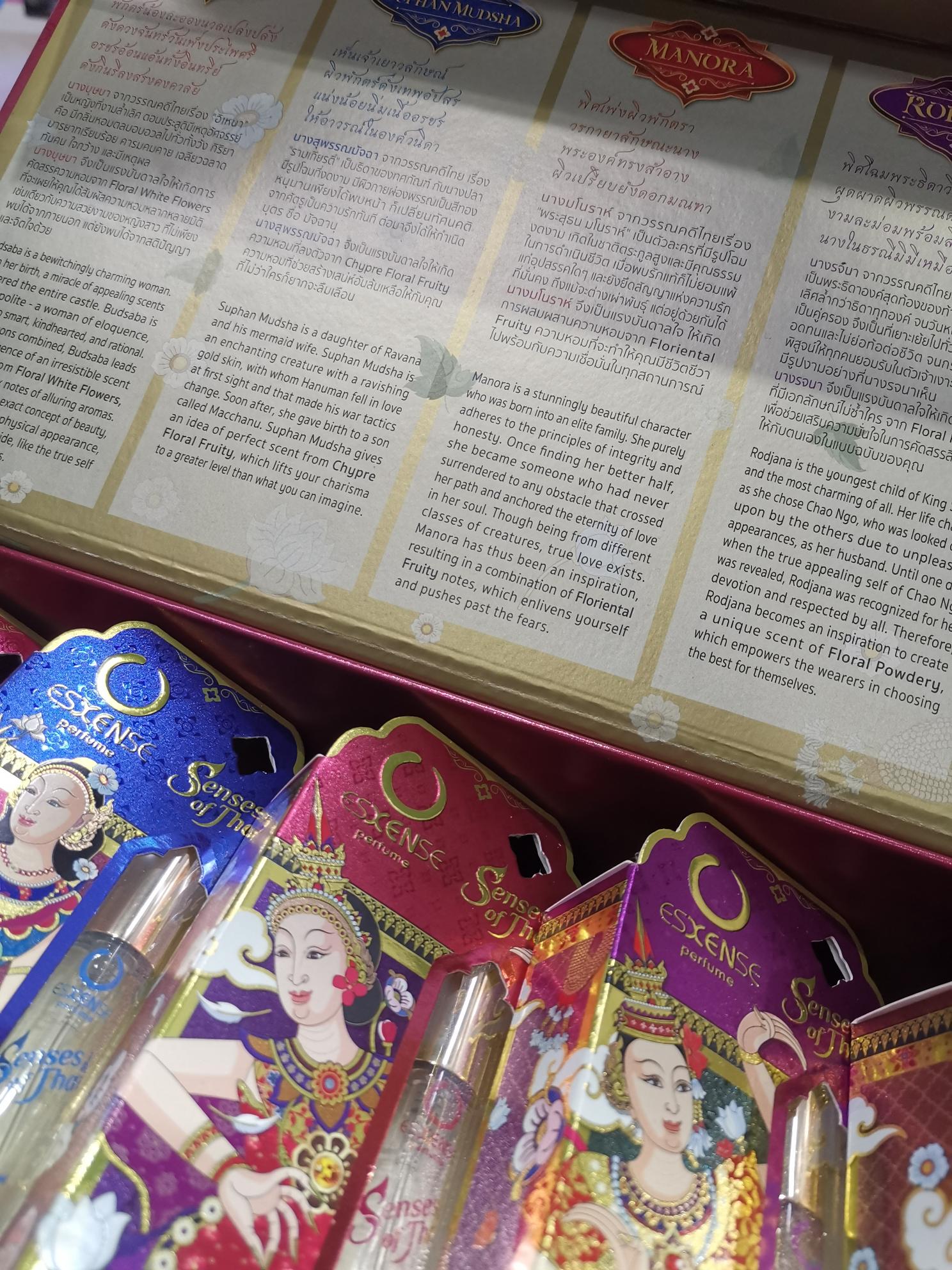

This is a Thai mass market fragrance brand; Esxence’s perfumes are very widely available through all domestic mass market channels: There are mini sprays specifically for the 7-11/convenience store channel, larger fragrance sprays are sold in perfumeries like Eve & Boy and Beautrium, in supermarkets, drugstores and other beauty retail chains.

I didn’t like any of the perfumes as scents (too one-dimensional and very pungent indeed!) but what I DID like is the Senses of Thai fragrance range which launched in 2022. Mostly because the packaging is beautiful (and indeed, the brand received the 2022 Thai Packaging Design Award for this launch) and the concept works on so many levels – it’s visually appealing and tapping into the heritage/nostalgia trend which is as strong in Thailand as it is internationally, it highlight Thai culture and traditions, and as it is so affordable it’s also is the perfect souvenir product for visitors and tourists.

These are six fragrances altogether, four female scents and two men’s perfumes; each scent is based on a famous character from traditional Thai literature and you can either purchase the perfumes individually or as a set/box. There is a smaller roll-on version that was developed specifically for the convenience store channel – it retails at 29 BHT which is less than 1 Euro – while the larger sprays are priced at around 70 BHT.

COSMOPROF CBE ASEAN 2024: NICHE BRANDS

NELETA (Thailand)

Indie brand Neleta was introduced in 2022 and offers pre-/probiotic face care – the #microbiome / #biomebeauty trend in action! There are three products in the brand’s line-up: A cleansing gel, a face serum and a moisturising cream. Clean beauty rather than natural/organic, key actives are colloidal oat extract, aloe vera and saccharide isomerate. I did like the brand’s aesthetics – modern, stylish packaging, very attractive.

Products retail for 650-1,200 BHT (15-30 Euro) which places Neleta in the upper mass market/borderline luxury category – not the easiest market environment for a newcomer brand to be in, I would imagine, since the Thai beauty market is heavily price-driven. Unsurprisingly, Neleta sells exclusively online right now (Line Shopping, Lazada, Shopee) but I was told that eventually, the company also wants to sell through offline POS.

DERMISTA (Thailand)

Pre-/pro-/postbiotics again! Dermista is a classic doctor brand – the founder is a well-known Thai dermatologist (? I think) who launched her own brand in 2023. This is #biomebeauty again; three face care products that promise to inhibit melatonin production, brighten the skin and support the skin’s microbiome.

The key ingredients are Jeju sea water, four different types/sizes of hyaluronic acid and peptides. Stylish packaging, luxury price tag; I forgot to ask about distribution channels but would imagine that it’s mostly online or through salons/clinics.

HOLISKIN (Thailand)

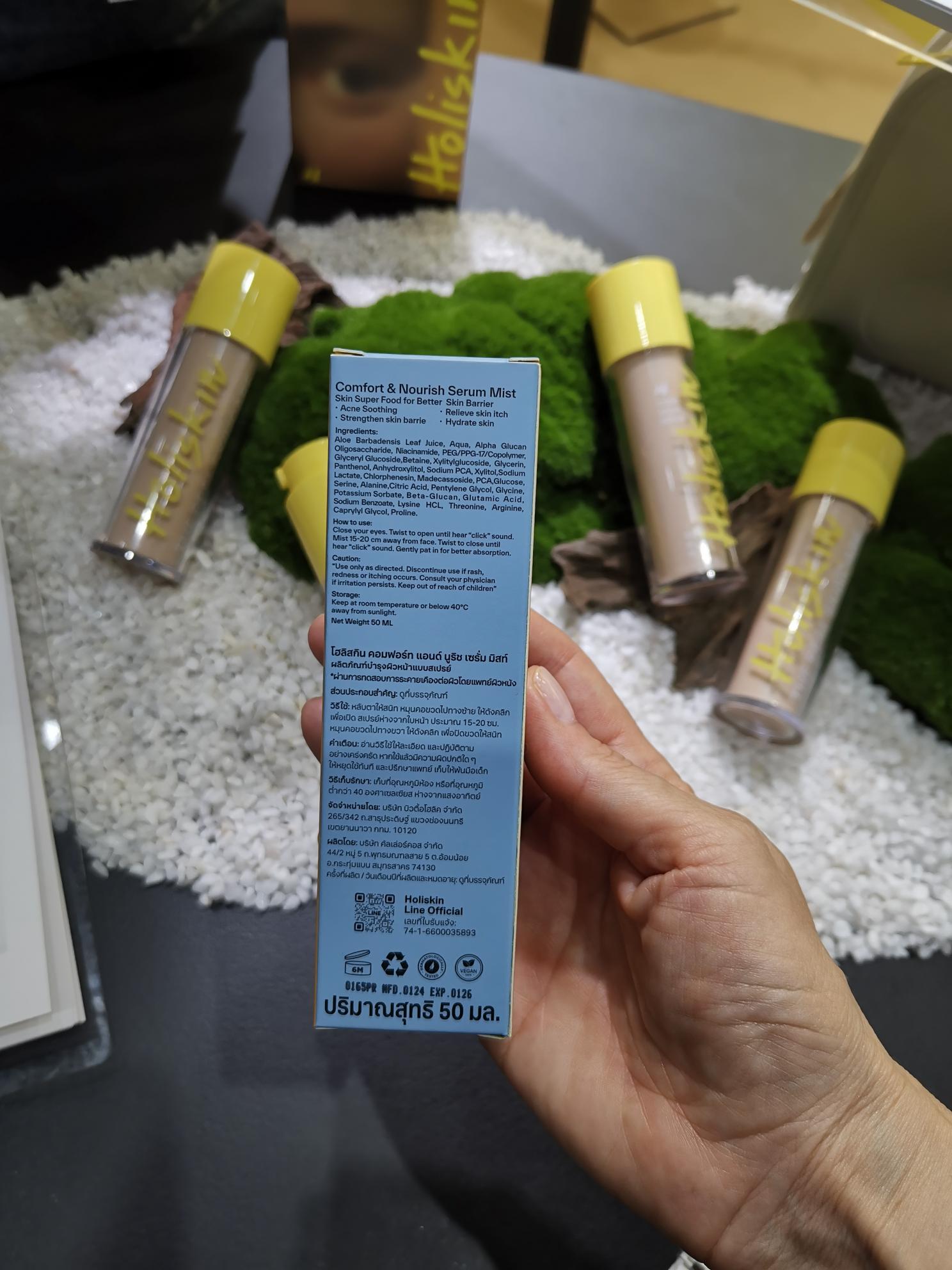

Holiskin is a typical indie label – stylish, minimalistic packaging design, natural/clean formulation. Launched just a few months ago, the newcomer brand offers one multi-purpose product at the moment: Unlike most other “natural” products that I saw at the fair so far, Holiskin’s Comfort & Nourish Serum Mist actually has a fairly natural formulation.

The formula is based on aloe vera juice and various plant oils and has a very pleasant texture. Unscented and vegan; sold exclusively online, especially through Line Shopping. The company even has a refill concept for the inner tube although the packaging is still regular plastic. However, I did like the brand’s vibe.

MC JABRIAL (Thailand)

Thailand is famous for its silk and I did notice a number of silk beauty ranges at the show – face and skin care products formulated with sericin/silk extract and other silk fibre/silk cocoon-derived ingredients. On my last day I came across this charming little silk brand.

Mc Jabrial is based in Chiang Mai and while the brand offers liquid and creamy face and body care formulated with sericin and silk proteins they also manufacture reusable sheet masks, wipes and undereye masks made from silk cocoon fibre. This fibre contains high levels of sericin so face care accessories made from this material are actually skin care products in their own right.

You simply immerse the sheet mask, undereye mask or cheek patches in warm water and then apply it to the skin. You can reuse the masks, wipes etc. several times if you dry them properly afterwards.

TREEANNSEA (Korea)

I’m finishing this trade show review with two Korean brands that I found particularly interesting. Let’s begin with Treeannsea, an organic beauty brand that I first met at my very first Korean beauty trade show more than ten years ago – I had to go through my old blog reports to find the article and here it is: It was at International K-Beauty Expo Korea 2015 (the show has since been renamed Intercharm Expo Korea or something like that).

In 2018 I bought a couple of Treeannsea products at the sadly long-defunct Cree’mare organic beauty store in Seoul (couldn’t remember the store name or location at first but again my old blog articles were helpful: I‘m mentioning Cree’Mare (Sinnonyeon station, exit 3!) in this extensive analysis of the changing Korean beauty retail sector. Reading my old article really depressed me because most of the retailers I mention here (including the then brand-new Boots chain!) are now bankrupt or gone. And the Korean beauty retail sector looks so very different now.

Anyway, Treeannsea is the cutest little brand; pretty packaging, great ingredients. The brand is currently reformulating its Eskimo range and there will be a new facial cleanser soon – you massage it into dry skin, then the formula kind of emulsifies and you can rinse it off. Hopefully Treeannsea will be at Cosmoprof Asia this November and I will post the cleanser then.

I also liked the brand’s desert rose mist which is based on desert rose extract (Adenium obesum, a succulent). So nice to see the company again. As there is practically no offline organic beauty distribution left in Korea it didn’t surprise me to hear that Treeannsea is primarily selling online through all the usual platforms although the company also has some collaborations with various luxury hotel chains in Korea. But if you want to buy the actual products you have to do it online. I miss Cree’mare.

LUNARIENCE (Korea)

Also a Korean brand but unlike Treeannsea, night-time beauty brand Lunarience is super new: The 8-sku face care range will launch in July 2024 and the products are formulated with Queen of the Night flower extract (Epiphyllum oxypetalum), the brand’s proprietary 17 Luna extract (nine kinds of hyaluronic acid, seven types of collagen and glyceryl glucoside) and a comforting signature fragrance to help relax mind and body.

While I’m not certain that the products actually align with the moon phases or whatever, the packaging and brand visuals are on-point: Muted colours, stylish design, very nicely done.

Pricing is in the upper luxury category (60-80 USD) and in Korea, the brand will be primarily sold online although I was told that the company will also retail the products offline in a Myeung-dong store in Seoul.

I’ll leave you with more images of the show. The next Cosmoprof CBE Asean will take place from 25th to 27th June 2025. Thanks for reading!

Pingback: Cosmoprof Asia 2024: [Show Report] | TRENDS. TRAVELS. AND BERLIN

Pingback: Cosmoprof CBE Asean 2025: [Show Report] | TRENDS. TRAVELS. AND BERLIN