The 27th Cosmoprof Asia trade fair was, incidentally, my 10th Cosmoprof HK show (if you count the two digital fairs during the pandemic and the Singaporean edition in 2022). Despite Typhoon Toraji passing Hong Kong on the night of the first trade show day and delaying the opening of the fair on Day 2 for a few hours, it was a good show.

And here are the annual stats for Cosmoprof Asia 2024: A total of 2,500+ exhibitors from 47 countries/territories exhibited at HKCEC (13th-15th November, Cosmoprof) and AsiaWorld Expo (12th to 14th November, Cosmopack) and 60,975 attendees from 119 countries attended the two shows. A solid performance although the comparatively low official visitor numbers surprised me a bit – the show certainly seemed as busy at Cosmoprof Asia 2023 but according to the official data, fewer visitors attended this year. Not sure why.

If you’re interested in my previous Cosmoprof Asia trade show articles here are the direct links to Cosmoprof Asia 2014, Cosmoprof Asia 2015, Cosmoprof Asia 2016, Cosmoprof Asia 2017, Cosmoprof Asia 2018, Cosmoprof Asia 2019, Cosmoprof Asia 2020 (digital), Cosmoprof Asia 2021 (digital) and Cosmoprof Asia 2022.

COSMOPROF ASIA 2024: BEAUTYTECH & FEMCARE

Let’s start with some interesting beautytech including two vaginal wellness/#femcare launches which I found particularly interesting.

TOUCHBEAUTY (China)

Smart hairbrush Touchbeauty Vita from Chinese company Touchbeauty Beauty & Health offers an unusual twist on the classic LED scalp care device. Most electronic/digital scalp brushes require the consumer to apply the serum or tonic to the scalp first and then massage the scalp/hair with a brush-shaped device.

This version of the Touchbeauty brush, however, has a removable brush head that allows you to fill the serum/tonic/liquid treatment into a small cavity. The liquid is then dispensed through four centrally located extra-thick metal bristles as you brush your hair. So much less messy. The brush has settings for red light, blue light and/or vibration.

Brush head and handle are waterproof so can be easily cleaned or wiped down. The Touchbeauty Vita was launched in last month and retails at around 249 USD.

LUMINIEL (Korea)

Before I even came across the Luminiel booth I overheard two trade show visitors talking about a device they’d seen that lights up your underwear. And yes, Luminiel kind of does that : )

Usually LED personal care devices marketed at women are focusing on treating real or imagined physical flaws and over the years I’ve seen so many whitening, firming and tightening LED devices for female consumers. No matter what geographical region or culture you’re talking about, the female body is never deemed beautiful enough for society’s male-dominated gaze.

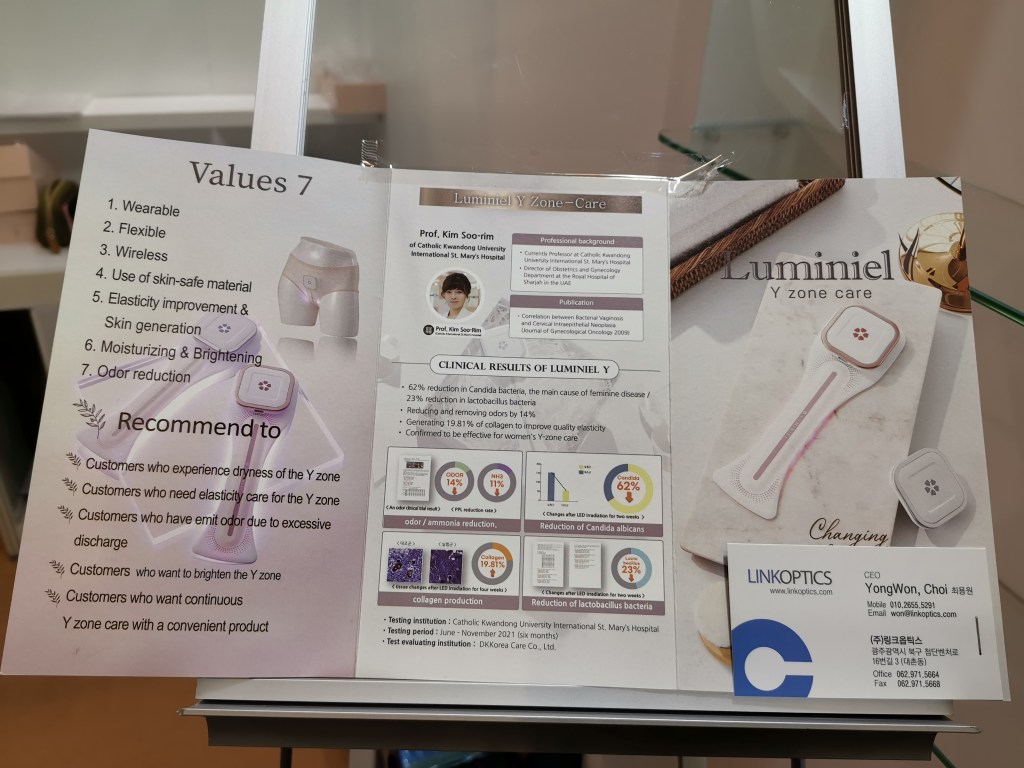

It took me a few seconds to realise what Korean manufacturer Vivilux meant by “Y-care” – this is an LED device to treat the female vaginal area with a mixture of anti-inflammatory and soothing red, blue and amber lights. The Luminiel is shaped like a pantyliner and comes with a USB-rechargable battery pack. Stick it into your underwear, turn it on and, yes, you get a fun personal light show as well.

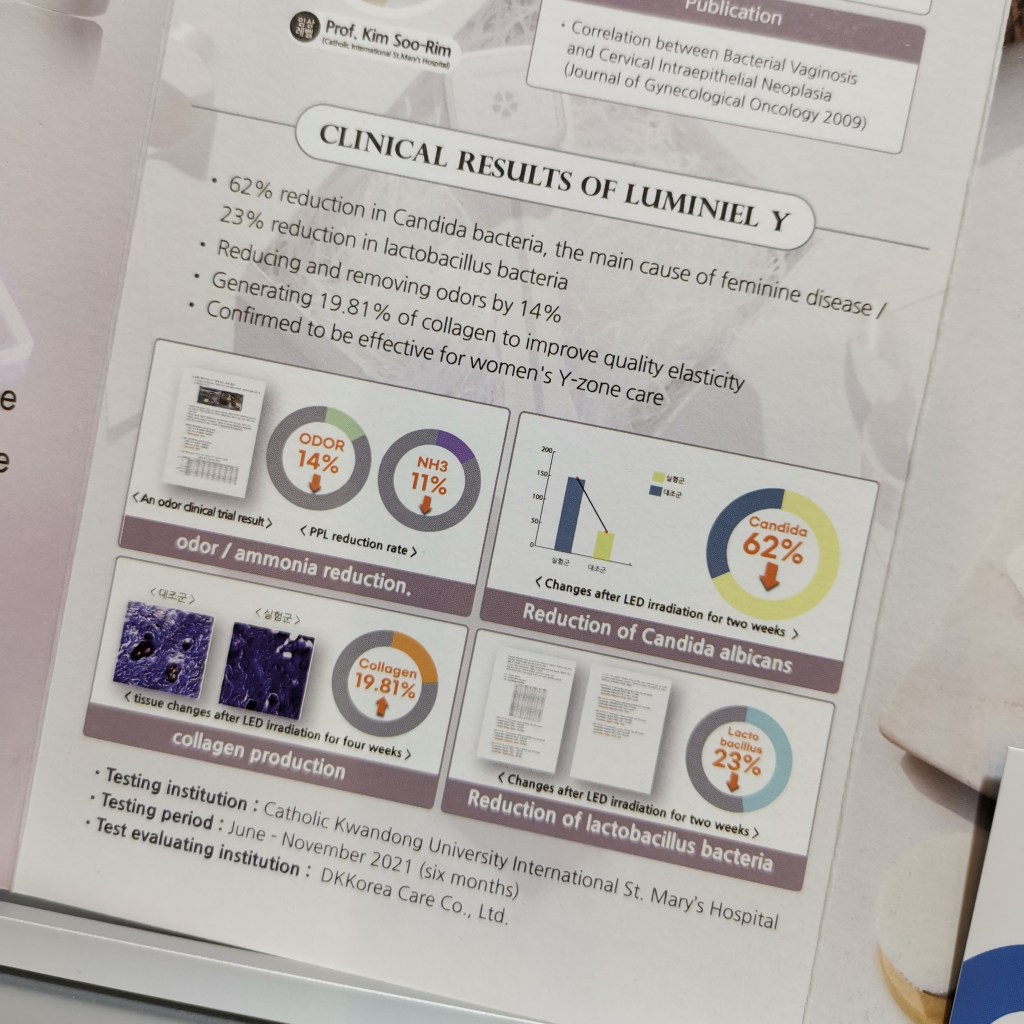

I really liked that the Luminiel is marketed as a healthcare product rather than a beautifying tool. According to the company, the device helps to reduce bacterial infections, improves the vaginal microbiome and decreases vaginal dryness. See pics above for some of the clinical research info.

THE GRAPHENE LADIM (Korea)

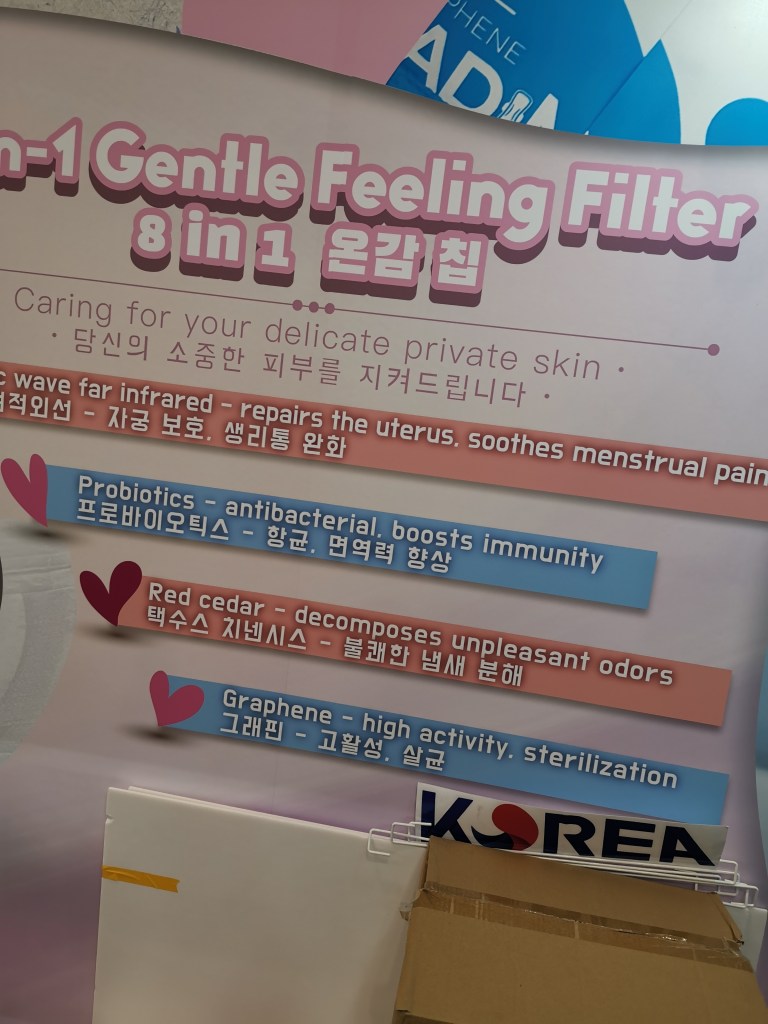

Another vaginal wellness-oriented launch from Korea came from menstrual care brand The Graphene LadiM whose booth was around the corner from Luminiel. Manufacturer Konxept Limited has developed menstrual pads and pantyliners featuring a small rectangular strip which is based on graphene and said to be particularly absorbent. And the product demonstration at the booth – two vials of liquid, on placed on a Ladim pad, the other on a regular pad from a different brand – certainly looked convincing enough.

The graphene strip also contains a host of other ingredients including red cedarwood extract and chitosan to help reduce odour, probiotic ingredients to improve the vaginal microbiome, antibacterial nano silver particles to reduce inflammation. In addition, the graphene strips emits far infra-red waves which are said to help relieve menstrual pain/cramps, as well as negative ions (something I always associate with Japanese hair styling tools!) which also have a beneficial and soothing effect on the uterus (I’m quoting the English-language booth info material here).

A pack of ten pads retails for around 6 USD and there are three variants in the range: Daily pads, larger night-time pads and pantyliners. I was intrigued by this launch (and since Cosmoprof Asia 2024, I have seen similar products from a Taiwanese brand in Taipei) – in Europe, menstrual care has become all about sustainability, washable pads, menstrual cups, reusable, recyclable and so on. In some of the Asian countries, on the other hand, the trend appears to go more towards high-tech products.

LadiM also received the Cosmoprof Asia 2024 award in the Personal Care & Body Care category for its launch and deservedly so, this is a true product innovation.

COSMOPROF ASIA 2024: MAKEUP & PERFUME

CATHYDOLL (Thailand)

Karmart’s Cathydoll skin and makeup brand presented such a pretty little limited makeup edition at the trade show. The packaging design was created by Thai artist Give.Me.Museums, the vibe is floral, bright and colourful. At the same time, the flower design looks surprisingly grown-up.

The last time I saw Cathydoll was at Cosmoprof Bangkok this June and the rapid launch pace of this brand is impressive; I’m very certain that they brought only a partial line-up of new Cathydoll launches (the Karmart booth at Cosmoprof Hong Kong was kind of small). Besides the makeup collection there is also the Jelly Tint For Bouncy Lips, a twist-up blusher/lipstick with a firm jelly texture that feels really good on the skin.

The line-up of new Cathydoll launches also includes four new functional face care products: Reju-C Glass Skin Cream, Tox & Fill Melatonin Serum, Melalight Anti-Dark Spots Cream and White Bomb Serum in Cream.

SUNNY RECIPE (Korea)

I really liked this brand, and I don’t even use nail foils/wraps/stickers! Sunny Recipe is from Korea, the brand was launched in 2022 and they specialise in colour-changing (i.e. UV sensitive) nail foils. Nail foils/stickers are nothing new but this is the first time that I’ve seen foils that change colour in response to sunlight.

It’s very cool, you go outside and your nails change colour/pattern in a few seconds, go back inside and the nails return to the original colour. Sunny Recipe offers 10 different designs with different base colours, colour gradations and patterns.

I was told that the nail foils are pretty popular in Japan as in many office, Japanese office ladies tend to (read: have to) still dress quite conservatively. Bright and eye-catching nail designs are a no-go, so having nails that change colour during your lunch hour outside, but still go back to a conservative nude or uni-coloured shade once your back at your desk is a pretty good compromise.

In Korea, Sunny Recipe is sold in Shinsegae Duty Free and City Duty Free malls; in the US the brand is in Urban Outfitters and Costco and in Japan, they’re in Donki (Don Quijote) and Loft stores. Sunny Recipe is also sold in mainland China where they generate the majority of their sales on TikTok.

IM:SOLE (China)

One of my personal highlight at Cosmoprof Hong Kong this year: I finally got to sample the perfumes of Im:Sole, one of the new generation of uber-hip Chinese fragrance brands! Over the last five years or so, mainland China has seen the rise of exciting new domestic fragrance brands, like Melt Season, To Summer, Assassina or Documents.

The indie fragrance boom in China began with Western niche labels but Chinese GenZ consumers are growing increasingly nationalistic and patriotic, preferring to buy domestic beauty brands that reflect Chinese aesthetics, values and visuals rather than Western imports. And the new crop of Chinese indie fragrance houses is developing truly local perfumes that reflect regional tastes, culture and traditions, using fragrance accords and notes you will rarely find in mainstream Western perfumery.

Anyway, I’ve read so much about these new Chinese fragrance brands but as none of these are even available outside of China (or at least, not easily available) and perfumes really need to be tried out on the skin I was very excited when I saw the trade show booth of Im:Sole.

Im:Sole was launched in 2020 and their product range comprises around 14 mostly gender-neutral fragrances. The names are wonderfully quirky, like The Naif, The Code or Social Trash – these are fragrances designed to be worn to express emotions and inner dialogues, highlighting the roles that we play; at least this is what Google Translated and I really like this approach to wearing fragrance.

Each year, Im:Sole introduces four seasonal fragrances; this year’s offerings are Soft Hedgehog, The Witch, The Lost and Grateful Sinner. Amongst the Im:Sole standard range I liked The Code which is an aquatic, fresh fragrance with aldehydic undertones and Social Trash was also nice but my absolute favourite was The Hunter (see pic below) which is built around a creamy milk candy accord anchored by incense and woods.

I usually can’t stand gourmand fragrances which often tend to by sticky-sweet but The Hunter is an intriguing dichotomy with an aromatic dry-down that lingers on my skin in the most delightful way. On the last day of the show, I bought a flacon of The Hunter (yay!) and as a spontaneous purchase, the incense-forward Poet To Be. Very happy with my purchases.

The fragrances retail for around 25-30 Euro and as is common with Chinese GenZ brands, sales are primarily online and through socials although Im:Sole also has a brand store in the company‘s home city Hangzhou.

COSMOPROF ASIA 2024: CHILDREN’S BEAUTY

ILY BY JEONG FAMILY (Malaysia)

I’m always a bit conflicted as far as children’s cosmetics, especially makeup for girls, are concerned but I do realise, of course, that this is a legitimate product category. Occasionally I see children’s beauty/makeup brands at trade shows and usually check them out.

Ily by Jeong Family is from Malaysia and was launched in 2020. The brand’s product line-up comprises more than 100 sku – makeup, face care, body care, hair care, bath and shower and SPF products, including sun serums as lotions and cushion compacts, face glitter, bath bombs, face moisturisers and lip oils. I really liked the child-sized sheet masks which are shaped like cat’s faces (so cute!) and the water-based peel-off nail polishes.

I asked the booth lady whether children’s beauty/makeup was a big category in Asia and she said that it was definitely a niche sector. However, in Malaysia, the brand is sold in 200+ offline Guardian drugstores which means that Ily by Jeong must be doing something right – the European kids‘ makeup brands that I’ve met over the years never seem to have an offline distribution base and mostly sell online.

In addition, the brand is sold online, of course, and through social media (especially Facebook). Price range: 89-150 MYR (approximately 18-30 Euro) which places this brand very firmly in the upper masstige/lower luxury category – the Malaysian personal care market is very price sensitive.

And get this, Ily by Jeong runs a kid’s spa/beauty space (the brand calls it a “curated experiental play studio facility“ in Kuala Lumpur – Playlab is located at BSC (Bangsar Shopping Center) and offers princess makeover-style makeup and beauty treatments (primarily for girls) but they also have a small treatment menu that is popular with boys.

More kids’ skin care, this time from Korean brand Goongbe. This manufacturer is truly taking baby and children’s skin care to the next level: There are 30+ sku across several sub-ranges, including dedicated ranges for Baby (0+ months) and Kids (36+ months).

It’s a tightly segmented line-up which goes far beyond what you usually find in this category – the European baby care brands tend to offer shampoo, body wash, bath additive, nappy cream and baby powder and mostly, that’s it.

The Goongbe range offers a variety of textures and product types that are more commonly associated with adult K-beauty – water creams, barrier creams, biome care, SPF cushions, gel creams; it’s really impressive. Simple and stylish packaging.

According to what I read about Goongbe, the brand has based its baby/kids products on traditional Korean beauty ingredients, including their trademarked Royal Oji Complex which contains peach tree, plum, mulberry, ash and willow tree bark extracts and the antioxidant-rich Royal Terratiguard Complex (plum blossom and bamboo leaf tea).

COSMOPROF ASIA 2024: SKIN CARE

ALTEYA ORGANICS (Bulgaria)

No need to to say much about Alteya Organics – if you’re at least somewhat familiar with European organic beauty you’ll have come across this Bulgarian rose water brand. The company is at Cosmoprof Asia every year and as Alteya Organics still isn’t particularly widely available in Germany, at least not offline, I’m always glad to be able to test out their new products in person.

And this was an interesting launch! Three new functional toners on a rose water base, each formulated with 2-3 trending actives: Pore-Clarifying 2% Salicylic Acid Acacia Complex + Witch Hazel, Pore-Minimizing 7% Niacinamide + Ceramide and Glycolic Exfoliating Toner Vitamin C + 3% AHA.

Usually I tend to avoid these kind of functional toners as my skin has a damaged skin barrier and is quite reactive. However, I like that these toners are based on rose water (soothing and anti-inflammatory) instead of distilled water so I’d give the products a go. The Niacinamide one at least.

Also new in the Alteya Organics product portfolio are several rose oil-based supplements. In Bulgaria (and quite a few other Balkan/South East European countries), rose oil is a highly popular nutritional supplement – in Germany, not so much.

The Bright Rose Skin Boost Capsules contain white rose oil, Collagen Peptides + Rose Water contains hydrolyzed fish collagen, rose oil and rose water and Black Seed Oil Capsules are based on nigella seed (black cumin) extract, milk thistle extract and rose oil.

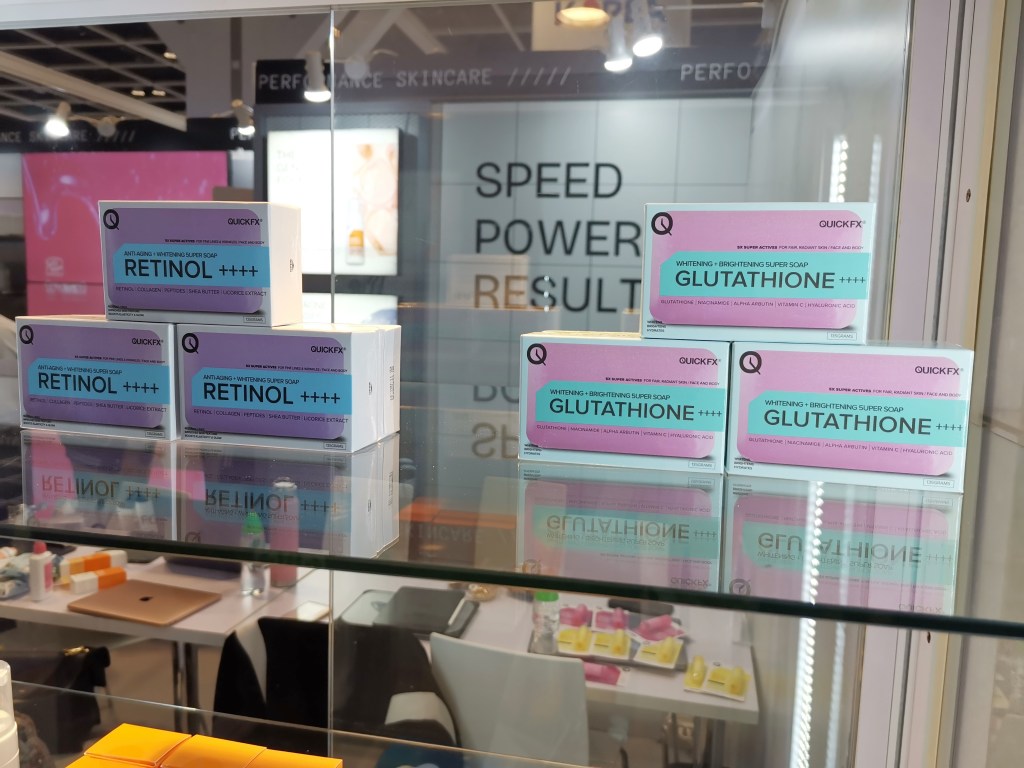

There were quite a few first-time exhibitors at this year’s Cosmoprof Asia, including this brand from the Philippines. QuickFX is by no means a newcomer, the brand was launched back in 2012 so they’ve been a mainstay on the Philippine drugstore beauty market for a while. And if you feel that the QuickFX products have a bit of a k-beauty vibe: The entire range is indeed manufactured in Korea.

Amongst the latest QuickFX launches was the Sen-C Bright range, a three-sku line formulated with brightening vitamin C for sensitive skin and a particularly interesting new range: Three actives-led solid face and body cleansing bars. Whitening & Brightening Super Soap Glutathione++++, Anti-Ageing & Whitening Super Soap Retinol++++ and Anti-Bacterial & Whitening Super Soap Charcoal. In addition to the highlighted star ingredients, the bars also contain other actives like niacinamide, liquorice extract, vitamins, peptides, shea butter and so forth.

I was told that solid body/skin cleansers are becoming very popular in QuickFX’s domestic market: The Philippine beauty market is very price-driven (like all South East Asian markets, with the possible exception of super-affluent Singapore) and local customers appreciate the price/value aspect of having to purchase only one product for multiple skin care purposes.

And of course we all know how active ingredients have been appearing in product categories far beyond facial care. At the trade shows I visited in 2023/2024 I’ve noticed this particularly in face cleansers, something which never made much sense to me – why add active ingredients to products that are often washed off directly after application?! Seems like a waste of money.

MINIMALIST (India)

Another interesting Cosmoprof Asia newcomer (and the first Indian skin care brand I’ve ever seen at an Asian trade fair, I think): Minimalist was launched in 2020 and offers gender-neutral actives-driven face care, hair care and body care. There are some 50-60 sku in the range, the packaging is clean and functional with a distinct apothecary-style vibe.

In its home market, Minimalist is sold both online and offline, especially in pharmacies, drugstores and beauty stores. It’s a classic Millennials/GenZ brand so a large part of turnover comes from online retail but as the brand expanded they increasingly moved into offline distribution as well.

Minimalist is also active in around 25 international markets including Asia, the US and Canada, its European markets are primarily in Eastern Europe (Romania, Poland) but I was very interested to learn that the brand is slated to expand into the German market soon – and they will not just sell online on Amazon and the like but also in offline Douglas and Zalando Beauty stores.

I imagine this will only be in selected Douglas stores, big city locations and so on but hey, Douglas is still the leading perfumery chain in Germany and the Douglas online store is by far the biggest online beauty retail platform in the country.

SKY RESOURCES (Malaysia)

I’ve seen Malaysian beauty brand Sky Resources at the South East Asian trade shows I visited this and last year – at Cosmoprof CBE Asean 2023 and Cosmoprof CBE Asean 2024 and, of course, at Beauty Expo Malaysia 2023 (no blog article, check my Instagram feed @annika_trendtraveller).

At Cosmoprof Asia 2024, Sky Resources presented its completely revamped SRG Care face and body care range – new packaging, new product formulas, a TON of trending product launches; I wish I could link to a brand website but the only SRG Care links I found online are on Shopee and Shopee requires you to be logged into the website before you can access the brands listed by the online retailer.

Anyway, the new SRG Care launches include aromatherapy/wellness-inspired moisturising hair mists, shimmering makeup fixing sprays in different scent variants, gold-encapsulated vitamin C face care, brightening skin serums with peptides that offer targeted anti-pigmentation benefits, barrier care/biome-boosting face care products.

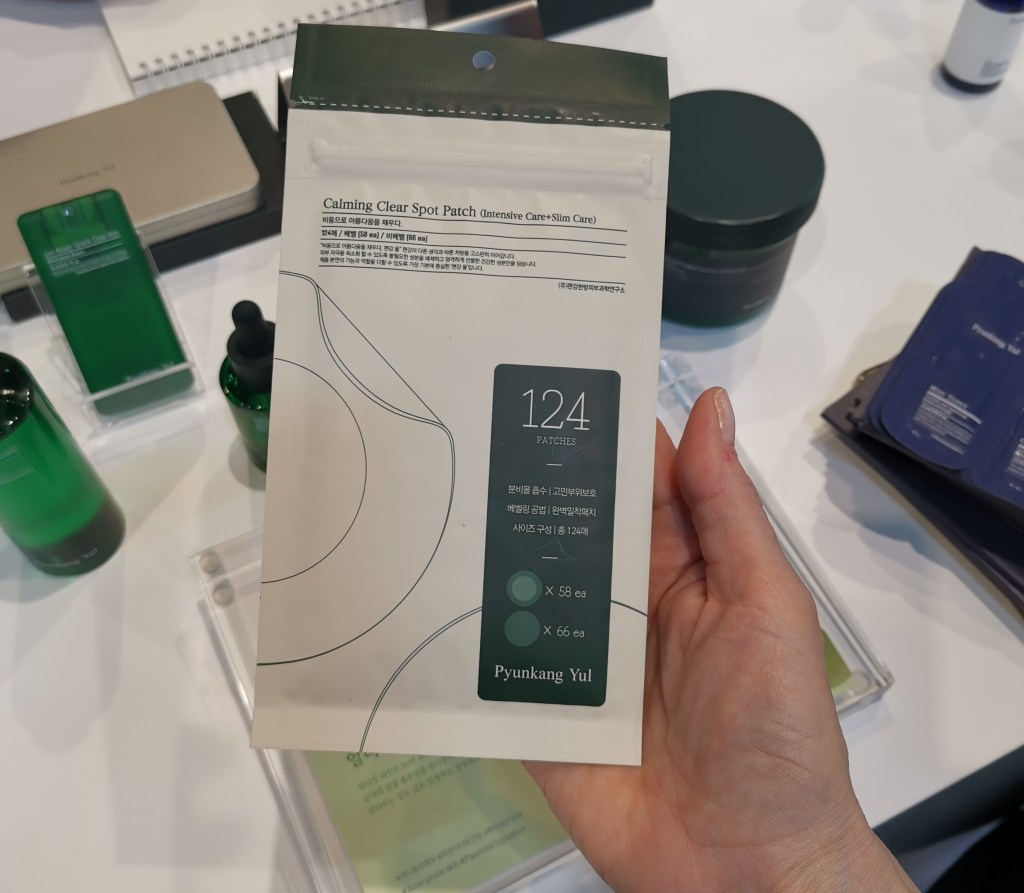

PYUNGKANG YUL (Korea)

It’s been years since I last saw Korean clean beauty brand Pyungkang Yul at a trade show. While the brand is widely available in Germany it sells almost exclusively online so I had fun exploring all the new products that I‘ve missed over the years.

The brand’s most recent launch is the Ultimate Calming range which was launched in early 2024: Five unscented face care products including Toner Pads, Spot Patches which are available in two different thicknesses so you can wear them underneath makeup, and the Get Ready Quick Clear Mist which is packaged in a flat rectangular container (and which was a finalist in this year’s Cosmoprof Asia Awards).

SANDAWHA / NOSTE (Korea)

Sandawha is one of my favourite organic beauty brands from Korea. The Jeju-based beauty brand is one of the pioneers in its domestic market: Certified organic beauty brand Sandawha was launched in 2004, six years before Whamisa which for many years was one of the most highly recognised organic Korean brands internationally.

Anyone remember the Whamisa hype when the brand was picked up in the US by – I can’t remember which online retailer it was? My 2014 Whamisa article (which I posted just before Whamisa became popular in the US) was the first detailed English-language brand profile at that time and it remains one of the most frequently accessed blog articles on trend-traveller.com. Since then I‘ve kind of lost track of Whamisa – too many re-brandings and price hikes for my taste.

Anyway, I’ve bought Sandawha products every time I visited Seoul before the pandemic. Since C*vid, Sandawha’s domestic retail has moved pretty much exclusively online (like most Korean indie brands) so I rarely see them in-store anymore. Luckily Skincure returned to Cosmobeauty Seoul in 2023 and 2024 and they also were at Cosmoprof Asia this year so I was able to stock up on my favourite products (including the classic green-packaged liposome lotion and the 2-phase pink-packaged face serum) at trade show prices.

Sandawha also presented some really cool new launches at the fair: The brand has moved into the colour cosmetics category with an Illumination Cushion Compact – formulated, of course, with camellia seed oil and camellia flower water – and two tinted lip balms packaged in stylish, heavy containers with a magnetised click-on cap. I bought one of the Lip Balms to try and like it very much; good colour pay-off and super moisturising.

The brand’s owner Skincure Global also has a few other beauty brands under its belt and one of these is a dermo brand Noste. Noste’s most recent launch is a needle/microneedling shot – if you’re unfamiliar with this: These are clear serums with the active ingredients manufactured into tiny needles. These needles prick the skin during application and help the active ingredients to penetrate into the top most skin layer.

Since Korean brand VT Cosmetics came out with its iconic Reedle Shot a couple of years ago, needle shots have become one of the most hyped product types in Korea and internationally. VT offers its Reedle Shots in different concentrations – the lowest is 100 and then it goes up in increments, 300, 500, 700; with the highest concentrations at 1000 and above (and those must REALLY peel off your skin!).

Noste’s Zaldrm Needle Shots are at the 100 concentration; I received several sample packs to try out. On my damaged skin barrier the Needle Shot prickled quite a bit when I massaged the serum into the skin but I did feel that the effects of the sheet mask I applied on top of the serum were more pronounced. However, I can only imagine how abrasive the higher concentrations must be. Shudder.

BEAUTÉ DE PIVOINE (Japan)

Beauté de Pivoine is a cute little clean beauty range which was launched this November. Just two products, an intentionally minimalistic range: A gentle face cleansing gel and an all-in-one moisturising serum/lotion.

Both products are formulated with peony extract (as indicated by the brand name), the textures are delightful and the formulas are unscented. Halal-certified and vegan. I like the grey-scale pack design.

Price tag: 6,000-7,000 JPY which places this brand into the lower luxury category. The Yen is still very weak right now so the Japanese RRP works out as 37-45 Euro but on the domestic market, this is definitely more of a luxury brand than masstige.

I asked about the brand’s distribution channels but since they are still so new on the market, retail is exclusively online at the moment. However, the company is intending to expand into offline distribution as well.

MEDITHERAPY (Korea)

New from Korean beauty brand Meditherapy: The anti-ageing Shumage range, five high-tech face care products (hydrogel mask, face cream, micro-needle dermo patches, ampoule and face cream) plus a rather cute little EMS skin massage device designed to be used in conjunction with the face cream.

The device looks like a little stamp, it fits on top of the cream jar for easier storage and offers red light and yellow light treatments. It works as you might expect: Apply the product first, then switch on the device and lightly “stamp” (massage) it across the face.

Meditherapy recommends that you use the anti-inflammatory red light first and then switch to the yellow light setting to boost product absorption.

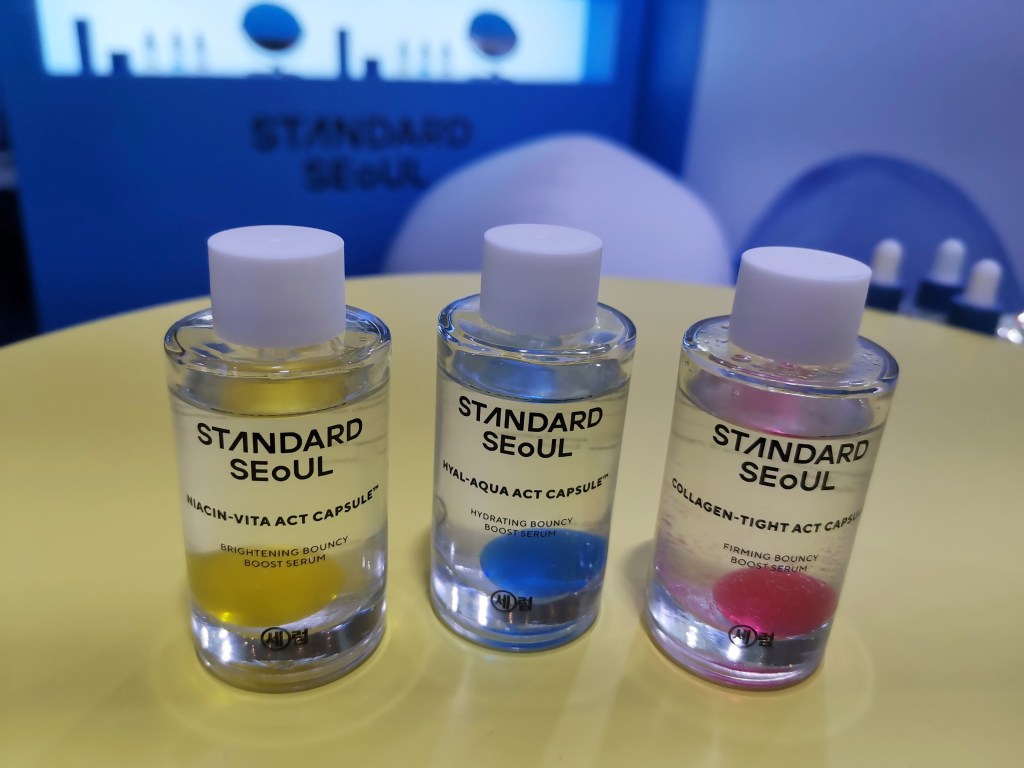

STANDARD SEOUL (Korea)

And a final Korean brand to finish off this trade show report! I feel that clean beauty brand Standard Seoul kind of embodies why Korean beauty has become globally famous over the past decade (in Germany, K-beauty is currently on its second wave of popularity) – the product textures are delightful and fun to use, the packaging is stylish and the line-up is compact and gender-free.

Standard Seoul is the latest addition to Korean manufacturer Grafen Official’s brand portfolio. The product range offers three 2-phase serums (the colourful oil phases look so pretty inside the glass flacons), the clear gel cream PantheCera Wrapping Glow (as the name suggests, the active ingredients in this product include panthenol and ceramides) and a fun bubble peeling gel which can be used as a cleanser or mask.

The products retail for around 25 USD and in Korea, Standard Seoul will soon be rolled out into offline Olive Young stores.

And that’s it for me from Cosmoprof Asia 2024. I’ll leave you with some more images from the show. Next year’s trade fair will take place from 12th to 14th November 2025. Thanks for reading!