Cosmobeauty Seoul 2025 was my 7th Cosmobeauty trade show and it’s kind of become my go-to Korean beauty trade fair. If you’re interested, here are my articles for Cosmobeauty Seoul 2016, Cosmobeauty Seoul 2017, Cosmobeauty Seoul 2018, Cosmobeauty Seoul 2019, Cosmobeauty Seoul 2023 and Cosmobeauty Seoul 2024. And as a bonus, the 2019 Getitbeautycon show which I rediscovered on my blog as I went through my previous Cosmobeauty coverage.

The April/May fair dates usually work well with Beautyworld Japan and/or Cosmoprof CBE Asean and although I once attended what is now K-Beauty Expo Korea (back then, in 2015, it was called International Beauty Expo Korea – here is my 2015 trade show article), I prefer Cosmobeauty.

Having said that I wasn’t the biggest fan of this year’s Cosmobeauty Seoul. Not because the quality of the exhibitors wasn’t stellar (it definitely was) but because I hated the additional crowds of consumers brought in by the organisers‘ decision to combine Cosmobeauty (a B2B show) with a consumer event, K-Beauty Festa.

This event extended throughout all three days of Cosmobeauty which, in my opinion, was a definite mistake. Other trade shows confine consumer attendees to the last day of the show giving the professional visitors, buyers, suppliers, distributors at least a couple of days to network/visit with exhibitors. After all, that’s why we attend trade fairs.

Instead, crowds of (mostly very young) consumers flooded the halls as soon as the doors opened, blocking aisles and exhibition booths whilst queueing up for give-away, games and other marketing events. For professional visitors like me, the extra crowds made my work much more difficult; often it was impossible to even get close to the products at the booth let alone chat with the sales staff – at some exhibition stands, the crowds of visitors were three-deep.

Some of the aisles in the centre of the halls were so clogged with visitors (mostly non-moving queues of people) that you couldn’t walk through and had to take detours. Really annoying. Sadly, the organisers have already announced that they’ll do the same event combo next year. I’ll attend the 2026 show, of course, because there isn’t another option but I’m not particularly looking forward to it.

COSMOBEAUTY SEOUL 2025: MAIN TRENDS

Anyway, aside from these annoyances it was a great show in terms of exhibitors, brands and launches. There was a strong focus on ingredients (of course!), with PDRN (polydeoxyribonucleotide) and glutathione (a tri-peptide consisting of the three amino acids glycine, cystein and glutamic acid) in particular taking a leading role. Soooo many PDRN/glutathione launches. It’s funny, Cosme Tokyo this January was all about exosomes, with the ingredient prominently highlighted across pretty much all new skin care launches. At Cosmobeauty there were exosomes as well but primarily as a supporting ingredient.

Also huge: Spicule beauty/microneedle beauty. In this kind of product, the active ingredients are manufactured into tiny spikes/spicules that are suspended in the product texture or, in the case of pimple and anti-wrinkle treatment patches, are part of the patch that you press onto the skin. When the product is massage into the skin the spikes lightly pierce the top layer of the skin which helps the actives penetrate more easily into the skin. The superficial skin injuries also boost the skin’s own repair mechanism, increasing circulation and improving collagen production. Sounds weird, but it works.

The standard spicule ingredient is usually hydrolyzed marine sponge but basically you can make most actives into spicules. The whole microneedle beauty trend started with Korean brand VT Cosmetics and its iconic ReedleShots. Since then, many other Korean (and Asian) brands have followed suit and launched their own spicule serums, creams and lotions.

Beauty tech/devices: So many launches! And a ton of innovation in this category, each iteration of face/scalp massagers/treatment devices is more comprehensive, elegant and easier to handle than the previous generation of beauty tools.

Organic: No longer a major concern for brands or consumers judging by the lack of organic/natural exhibitors at the show. I just went through my old Cosmobeauty reports and the 2017-2019 editions were all about sustainability and organic/natural ingredients and brand concepts. At Cosmobeauty 2025 there were a few natural beauty brands but nothing even close to the pre-pandemic exhibitor numbers.

What I also noticed: Many mainstream/mass market K-beauty brands that are already very well-known and distributed in Olive Young and online (brands like Make:Prem, Banobagi, Cremorlab) and very few international exhibitors. Almost all finished beauty exhibitors were Korean brands with a smattering of Chinese companies primarily in the packaging and OEM/ODM section. Very different from, for example, Cosmobeauty 2016, which had exhibitors from 13 countries including quite a few brands from Europe.

But now let’s dive right into product innovation and a run-down of my favourite brand discoveries at this year’s Cosmobeauty. As usual, brands appear in random order but I’ve roughly divided the launches in three categories, face care, patch care and makeup. For extended coverage, check out my Instagram @annika_trendtraveller (my live Cosmobeauty Stories coverage is in a Highlight and/or check the Grid).

COSMOBEAUTY SEOUL 2025: SKIN CARE INNOVATION

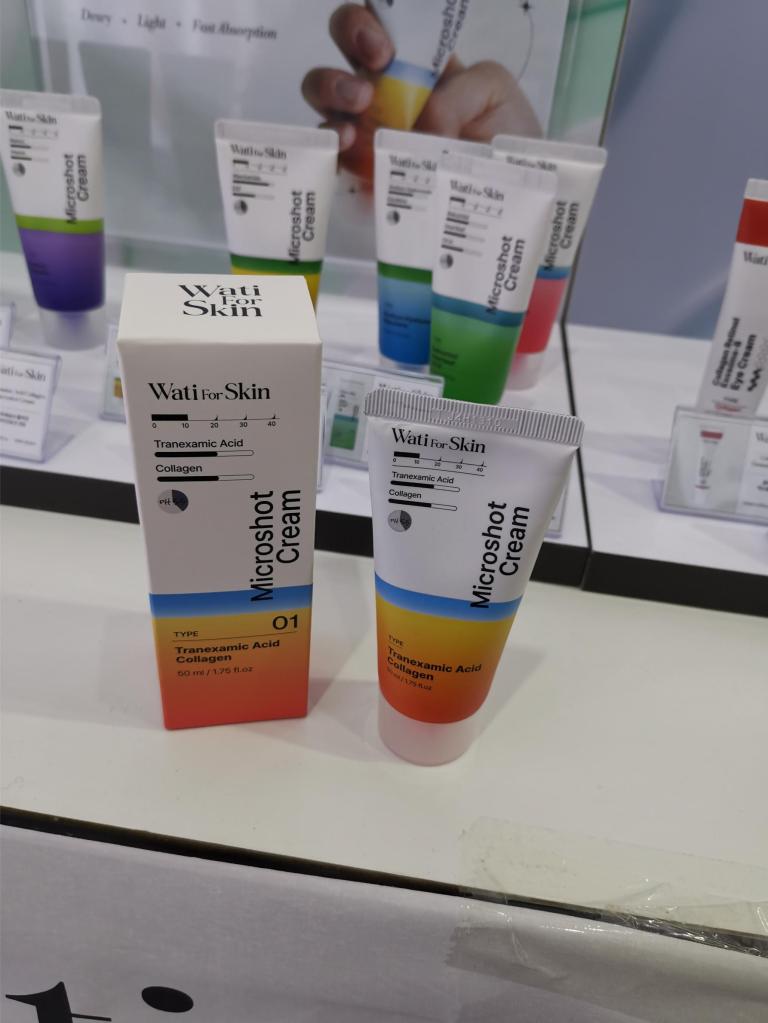

WATI FOR SKIN (Korea)

Newcomer brand Wati for Skin was definitely one of my favourite discoveries at the show. The functional beauty brand launched in 2024 and it encapsulates so many ingredients/brand trends in one product line-up.

First of all, there are some 50+ face care sku divided into highly segmented sub-ranges: 12 essences, 12 face creams, 12 eye creams, sheet masks and so on; each product focuses on 1-2 hero ingredients which are clearly highlighted on the packaging. The ingredient combinations extend across all sub-ranges so you can get your favourite actives, like PDRN or exosomes, as an ampoule, a face cream, eye cream and so on. Half the entire product line-up is spicule beauty – six of the eye creams include spicules, six of the facial moisturisers and, again, you can pick and choose your favourite ingredients combo.

Say you want PDRN, cica and spicules in one product – Wati for Skin will deliver. The retail price is 17-18 USD per product and the brand is primarily available online right now. However, Wati for Skin has also been doing pop-ups in Shinsegae department stores and the brand is planning to move into Lotte department store with its own permanent shop-in-shop. Oh, and their best-selling ingredient across all ranges is, tah-dah! PDRN.

ISNTREE (Korea)

Isntree has been one of my favourite K-beauty brands since I first discovered this type of cosmetics. I used to stock up on their Hyaluronic Acid toner (still one of my favourite Isntree products) when I was visiting Seoul. Today, the brand is easily available in Germany and across Europe, both online and offline.

At Cosmobeauty Seoul 2025, Isntree presented a new SPF 50 PA+++ sun serum but I was more interested in the brand’s latest face care launch, the Plum Peptide range of hydrogel mask and spicule serum. The spicule serum (Plum Peptide Booster 2000) is available in two formats, by the way, as a bottled serum and individually packagd 2ml serum shots – a very popular pack size in Korea since VT Cosmetics first launched its original ReedleShots as 2ml packs.

I’m willing to bet that the Daiso-exclusive ReedleShot pack size of 6x 2ml (which sold out very quickly when they were first introduced) also played a role here: The 2ml format is the perfect size for a special treatment. Incidentally, I bought eight packs of Daiso ReedleShot pack sizes in the 300 version because they are so much cheaper per ml than the official ReedleShot bottled serum.

Anyway, Isntree’s new spicule serum is available in two pack sizes. I received a sample at the show and liked it; also enjoyed the hydrogel mask which is infused with petal fragments and made me feel very fancy. Active ingredients: plum blossom peptides and plum-derived spicules in the booster.

FROM ZERO (Korea)

A recently launched 3-sku face care brand which offers plant-based versions of trending actives. Another trend I noticed at the show, incidentally: organic might not be a selling claim any more but vegan still is. PDRN is traditionally manufactured from salmon sperm (the standard INCI name is “sodium DNA”) and with the on-going popularity of vegan beauty in Korea, companies are increasingly launching plant-based versions of PDRN, exosomes and so on.

From Zero is a good example: The three products in the EX-PDRN Glow range – a spray mist, serum and cream – are based on lotus flower water and contain broccoli PDRN, ginseng exosomes and three kinds of vegan collagen (chia seed, white jelly and hibiscus).

DEARDOT (Korea)

I enjoyed seeing Jeju-based indie brand Deardot again at Cosmobeauty 2025 (the brand also exhibited at the last two Cosmoprof Bologna shows); I just went through my old show reports and Deardot was launched in October 2022 and I first wrote about them at Cosmobeauty 2023.

I’ve linked to the 2023 trade show report which includes a detailed brand profile of Deardot. En bref, the brand’s using dangyuja extract in its products. The dangyuja citrus fruit is native to Jeju island, it’s a pomelo-citrus hybrid that contains three times as much vitamin C as lemons. However, the fruit doesn’t taste well so it‘s no longer commercially grown and now on the endangered plant list. With Deardot cultivating the dangyuja and turning it into a cosmetic active, the brand is actively preventing the plant from going extinct. The company has also donated dangyuja seeds to the Baekdudaegan Arboretum’s Seed Vault in Bongwha region.

All Deardot products contain dangjuya extract and at Cosmobeauty 2025, the brand presented its new Dangyuja VitaGlow Mask with PDRN generated from fermented dangyuja extract, sea buckthorn extract, cica and dangyuja extract. I tried the sheet mask which was super moisturising. Also, it was absolutely saturated in serum and there was enough left over in the mask sachet for the next morning.

BREEJEI (Korea)

Breejei is a cute essential oil face care brand from Jeju which launched in May 2025. The brand’s founder Gahee Lee offers four plant oil-based face oils that are blended with various essential oils depending on the skin type.

Most of the essential oils that Lee uses in her products are sourced from Jeju and so are the carrier oils: The base oils are usually a blend of camellia seed oil and sunflower oil so the texture is light and absorbs easily into the skin.

I also liked the fragrance testers at the Breejei booth: You stick your nose into the funnel-shaped bit and squeeze the bulb which releases a puff of fragrance through the funnel without the fragrance molecules spraying all over the place.

AMAHOLIC (Korea)

Amaholic is a new skin and hair care brand within the Kocostar group of brands, with flaxseed oil/extract as signature ingredients. Packaging is stylishly minimalistic and there are eight sku: Cleansing oil, cleansing gel, essence, moisturising lotion, face oil, sheet mask, hair conditioner and hair cream mist.

All products contains flaxseed oil, fermented flaxseed extract, linseed oil or a combination thereof, with other skin care actives such as niacinamide, hyaluronic acid, panthenol, ceramides and so on.

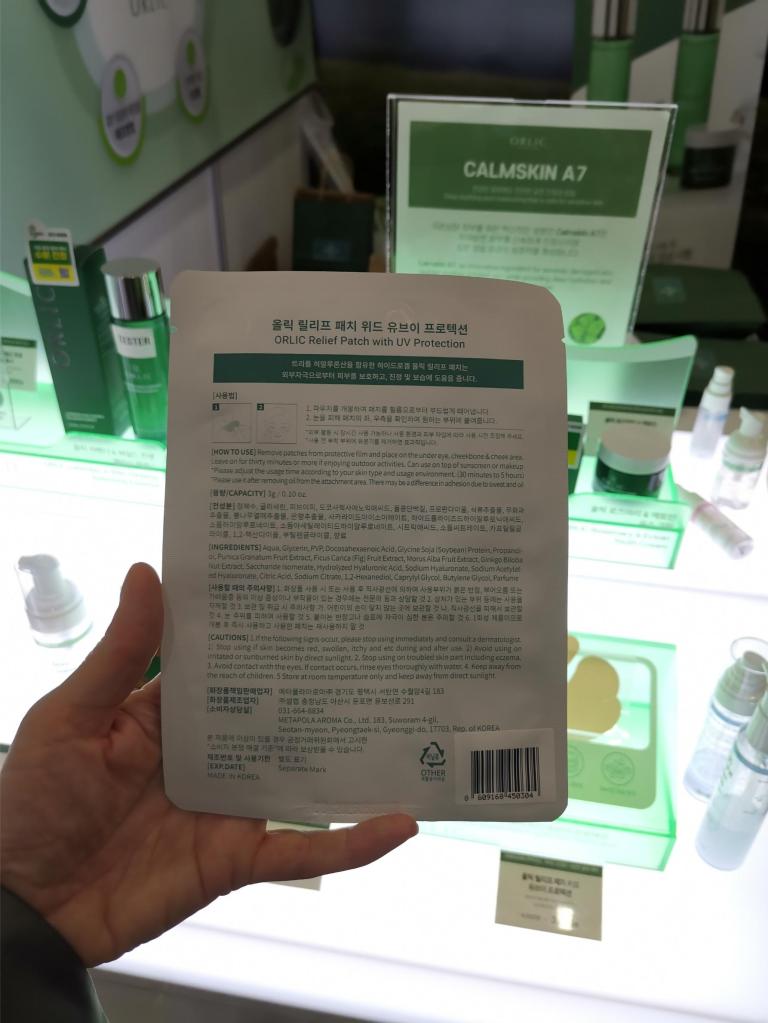

ORLIC (Korea)

I first met natural beauty brand Orlic at Cosme Tokyo this January – I’ve linked to my show report which includes a more detailed brand profile. I particularly liked the SPF50 cream which I received at the Tokyo show; I tested it out in April/May when temperatures in Germany finally turned summery and was so taken with the product that I bought a back-up at Cosmobeauty 2025. The sun cream works really well on my skin.

At Cosmobeauty 2025, Orlic presented a new sun protection product and it’s such a typically Korean format: A moisturising protective cheek patch specifically for when you are expecting prolonged sun exposure. You apply the patches to the face on top of your usual skin care; apply sun protection on top if you like and then wear the whole thing outside. The cheek patch offer physical sun protection in addition to the hydrating and cooling benefits.

The brand also had a few new modelling masks at the booth. The mask base is a gel (not the usual powder) which you mix with water and then it works just like your average powder modelling mask. Nice.

COSMOBEAUTY SEOUL 2025: PATCH COSMETICS

This section is mostly about patches and stickers, and I’ll be starting with two of the big manufacturers of medicated AC (Acne Care) patch products.

A brief intro to the Korean acne/pimple patch market: These are medicated sticker patches that you apply on top of pimples to help them shrink/heal more quickly. Pimple patches recently started to become popular in Europe as well, even the German drugstores now carry a small selection of pimple patch products, both in the medicinal plain version and as decorative, colourful patches.

However, the original product innovation is, of course, Korean; and the Korean market still offers one of the largest selection of different pimple patch types. The plain ones are designed to look as invisible as possible on the skin, brands manufacture them in different sizes and different thicknesses even; some are designed so you can apply makeup on top of them. Then there are decorative patches in cute, colourful designs, turning your AC care product into a highly visible fashion statement. Both very cool approaches.

Many pimple patch companies offer microneedle patches which are usually equipped with magnesium-based microneedle/spicules (magnesium helps skin to heal more quickly) as part of the patch. These patches can be used with additional anti-pimple serums but frequently, they are already saturated with a treatment serum or essence. The microneedles can be self-dissolving or not: Essentially, you apply the patch to your pimple and press it into the skin so the spikes pierce the pimple/skin and the serum can do its thing.

SNOW2PLUS (Korea)

I’ve been writing about Korean magnesium patch manufacturer LabnPeople‘s Snow2Plus brand at every Cosmobeauty, it feels like, and at Cosme Tokyo shows as well – the company was an exhibitor there this year and last year.

Snow2Plus always has the coolest patch innovations; they specialise in magnesium microneedle patches which are combined with other skin care technology, such as LED lights/batteries or iontophoresis (weak micro-currents) to help the ingredients to be absorbed into the skin more efficiently. At last year’s Cosmobeauty Seoul, I highlighted Snow2Plus‘ LED Pimple Patch kit – and this year, the company presented three exciting up-coming launches.

The apple-shaped patches are mangnesium microneedle patches which already contain the anti-pimple serum, you grab the apple stem and pull it downwards which releases a drop of the serum; then you apply the sticker to the pimple.

The heart-shaped patches work with micro-currents, take the patch out of the packaging, apply a drop of your favourite serum and press the patch on the pimple. And the square patches contain a tiny LED battery, you add the serum and then apply the patch to the skin.

CATCH ME PATCH (Korea)

Catch me Patch also offers a number of magnesium-based microneedle patches although the brand seems to focus more on medicated decorative pimple patches. Their product range offers so many fun designs and I remember that at last year’s show, the brand presented a set of patches/stickers that were designed in collaboration with a Korean artist. Also a really cool idea.

This year, Catch me Patch showed a duo of pimple patches created to target skin healing during different stages of pimple development. The Early Stage Blemish Care set contains individually packaged self-dissolving microneedle stickers saturated with hydrating and soothing tea tree and centella asiatica extracts as well as hyaluronic acid to help speed the initial healing process.

The follow-up product, Post-Blemish & Dark Spot Care, was created to help tackle the skin discolourations that are often left behind by healed pimples: The key actives in these self-dissolving microneedle patches are skin-brightening niacinamide, adenosine and ectoin.

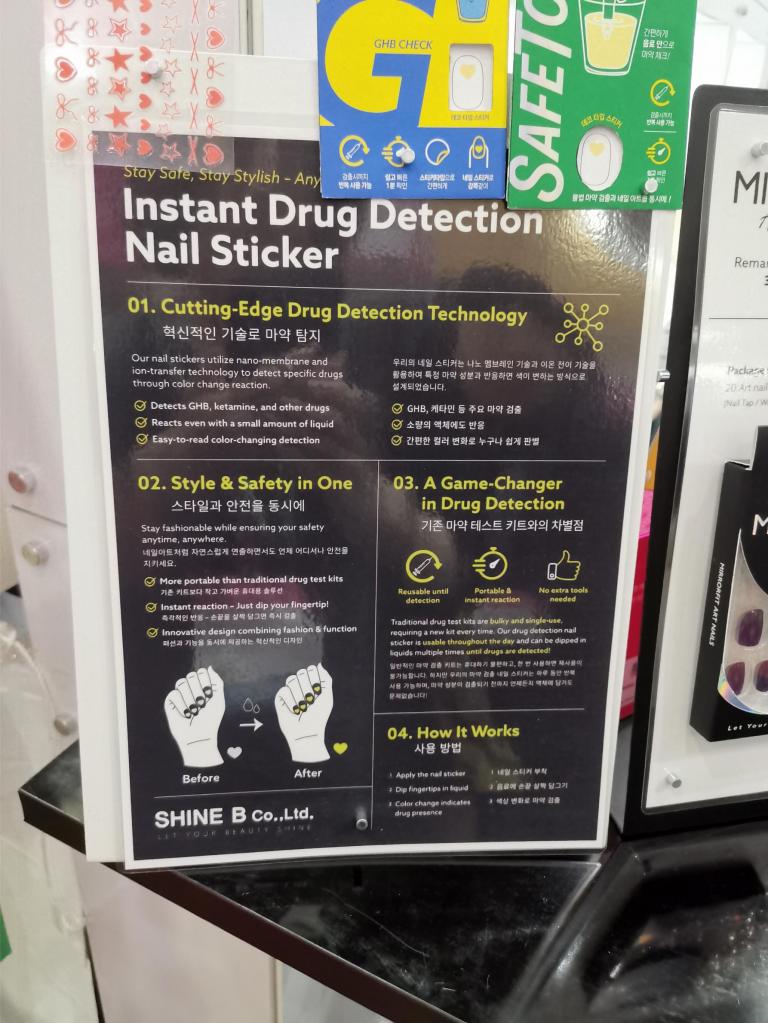

SHINEB BEAUTY (Korea)

I feel like there were more nail care/nail sticker exhibitors at Cosmobeauty Seoul 2025 than during previous editions but maybe I never paid much attention to this product category? I do tend to hyperfocus on skin care. Anyway, in the exhibition hall there was an aisle with nail beauty product exhibitors, especially press-on nails and nail stickers/nail wraps which have become very popular with Korean consumers. Especially the nail art-inspired sticker designs.

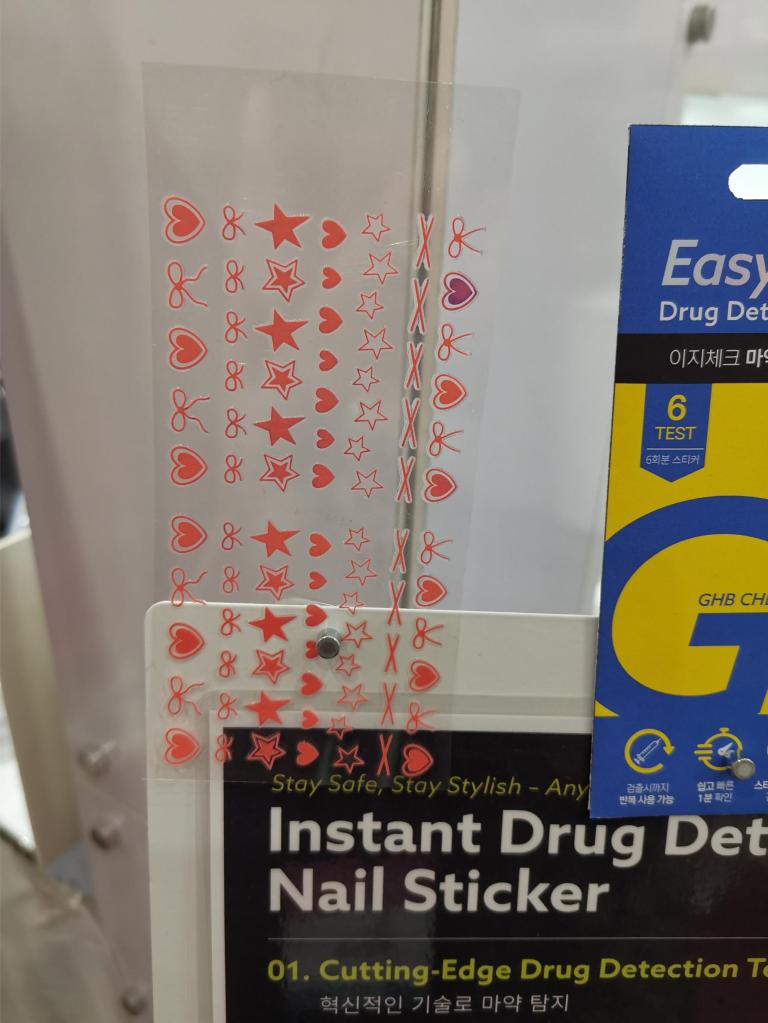

I admired the sticker products of several Korean brands, including Bandi Beauty and ShineB – and ShineB presented a fascinating launch. Leveraging nail sticker technology to improve personal safety for women – I’ve never come across a product like this, at least not at the trade shows that I usually visit.

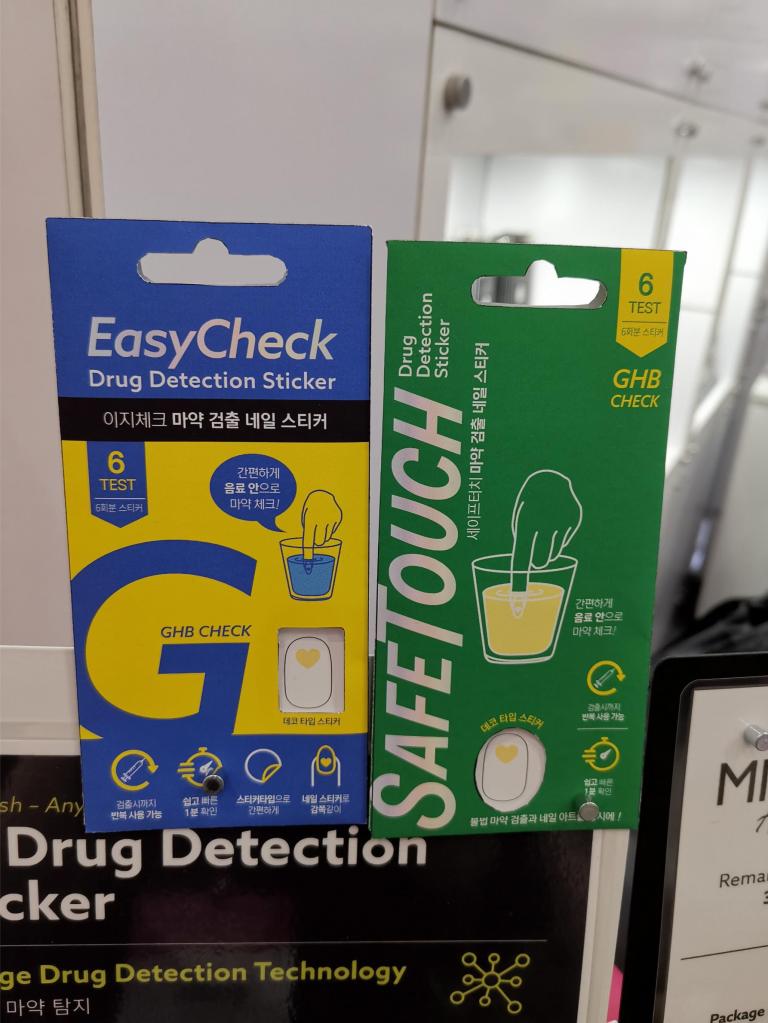

Essentially, ShineB has developed stylish and discrete drug detection nail stickers. And while these stickers can be used across a variety of drug detection scenarios, such as law enforcement and border control, the primary purpose behind the development of these stickers was to keep women safe(r). From men. Because, let’s face it, women very VERY rarely use date r@pe drugs like GHB on other women. Fact. It’s always (or at least 99.9999999999%) men who are the perpetrators).

The nail stickers are applied to the finger nails, you can stick them on top of your usual manicure. If you want to test your beverage for drugs, you simply dip the nail into the liquid. If the sticker changes colour it indicates the presence of GHB (or whichever substance), i.e. someone tampered with your drink. According to packaging and marketing visuals, th drug detection stickers at the ShineB booth were designed to react to GHB, but the technology can easily be leveraged to encompass other type of drugs as well.

COSMOBEAUTY SEOUL 2025: MAKEUP BRANDS

PINKY COSMETICS (Korea)

Pinky Cosmetics is not exactly a makeup brand but they do have the cutest kids nail stickers so they kind of fit into the nail sticker/makeup category. Kids beauty brand Pinky was launched in 2015 and I liked them because they place the product focus on playful beauty rather than makeup for pre-teens. Children’s makeup brands – which are usually aimed at little girls – always leave me slightly uneasy.

However, Pinky Cosmetics doesn’t have colour cosmetics except for some lip crayons and the afore-mentioned nail stickers. Which are the sweetest thing ever. I don’t recall ever having seen children’s nail-sized nail stickers in the European market before although children, especially girls, love playing around with nail polishes. And stickers are so much more easy to apply and remove than polishes. Anyway, Pinky offers some 20+ sticker designs for kids. The line-up also includes some bath and body care, child-sized sheet masks (two different sizes, extra small and small), face lotions, a hair wax stick and some cute accessories like hair ties. Products are mostly sold online but are also available in selected offline retailers such as Lottemart.

TFIT (Korea)

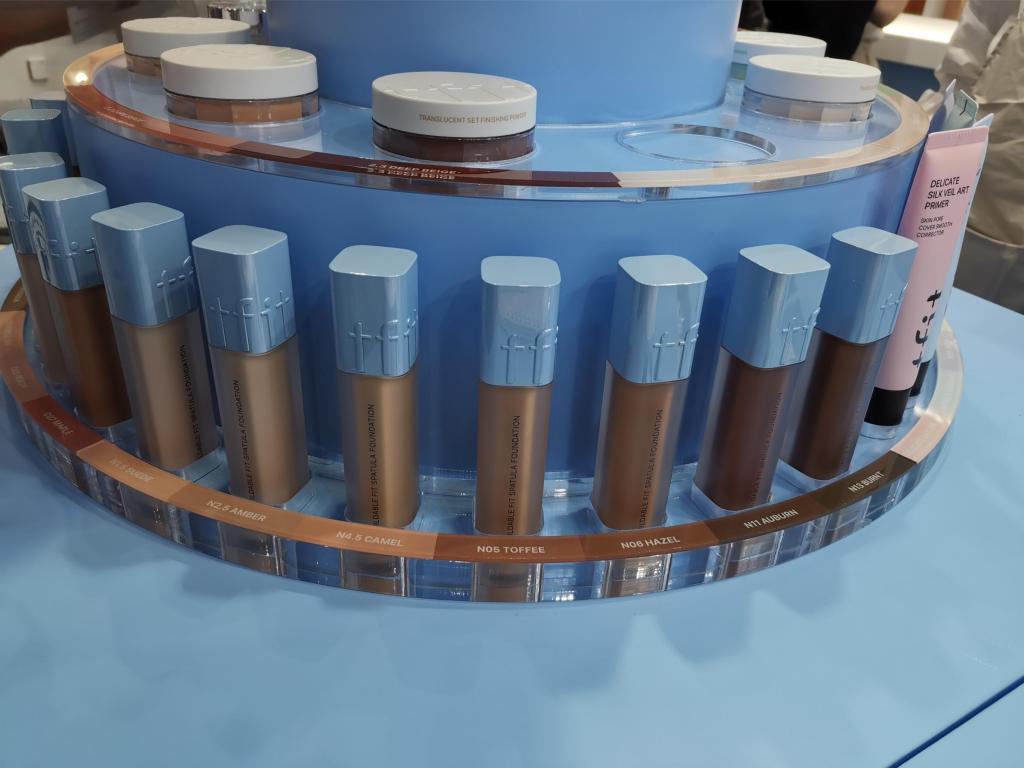

In contrast, Tfit is all about serius makeup. I’ve seen the Korean foundation brand at a few trade shows but Cosmobeauty Seoul 2025 was the first time that I looked at the products in more detail. Colour diversity in face makeup is still very much a niche category in Korea (as in other East Asian markets), with foundation shades usually confined to a narrow colour spectrum that extends from extra light to medium and a focus on yellow and pink undertones.

Tfit, however, offers a very wide range of colours; the brand’s Radiance Serum Foundation (which I recall seeing at Cosme Tokyo last year) is now available in 20 shades quite a few of which are on the darker side of the colour spectrum. And Tfit’s new Spatula Foundation – which is their most recent launch – offers buildable colour in 30 (!) colours, including darker browns and even a couple of brownish black shades. These foundations have a fairly high pigmentation (unlike the Radiance Serum Foundation which offers sheerer colours) so they ought to be truly suitable for darker skin tones.

At Cosmobeauty, Tfit only showed its foundation range and I do wish I had had the opportunity to try out their other product ranges, especially the trio cover creams and the contouring creams. Will definitely do this next time I’m in Seoul.

MOOLDA (Korea)

A playful, vegan makeup brand focusing on lip colours and blushes. Launched in 2022, Moolda’s most recent introduction is the Moisture Veil Multi Use Blush range of fluffy-creamy multipurpose blushes in reds, oranges, purples, browns and even a dark brown/black shade that can also be used for face contouring, highlighting, as eye or lip makeup or to contour the hairline. Each blush comes with a tiny makeup egg sponge applicator.

The other lip colour ranges feature all the classic K-beauty textures you’d expect from a GenZ makeup brand – lip oils, lip tattoos (lip stains), water tints (super glossy finish). Nice-looking packaging and a moderate price tag. Moolda is sold primarily online but also offline at selected Olive Young stores.

I’ll leave you with some more images from the show. Next year’s Cosmobeauty Seoul will take place from 27th to 19th May 2026. Thanks for reading.