Cosmoprof CBE Asean 2025 – the fourth edition of this comparatively new B2B trade fair for the South East Asian beauty industry – was fantastic. A bigger show than last year, more retail brand exhibitors than Cosmoprof CBE Asean 2024 and Cosmoprof CBE Asean 2023 and really good energy all round.

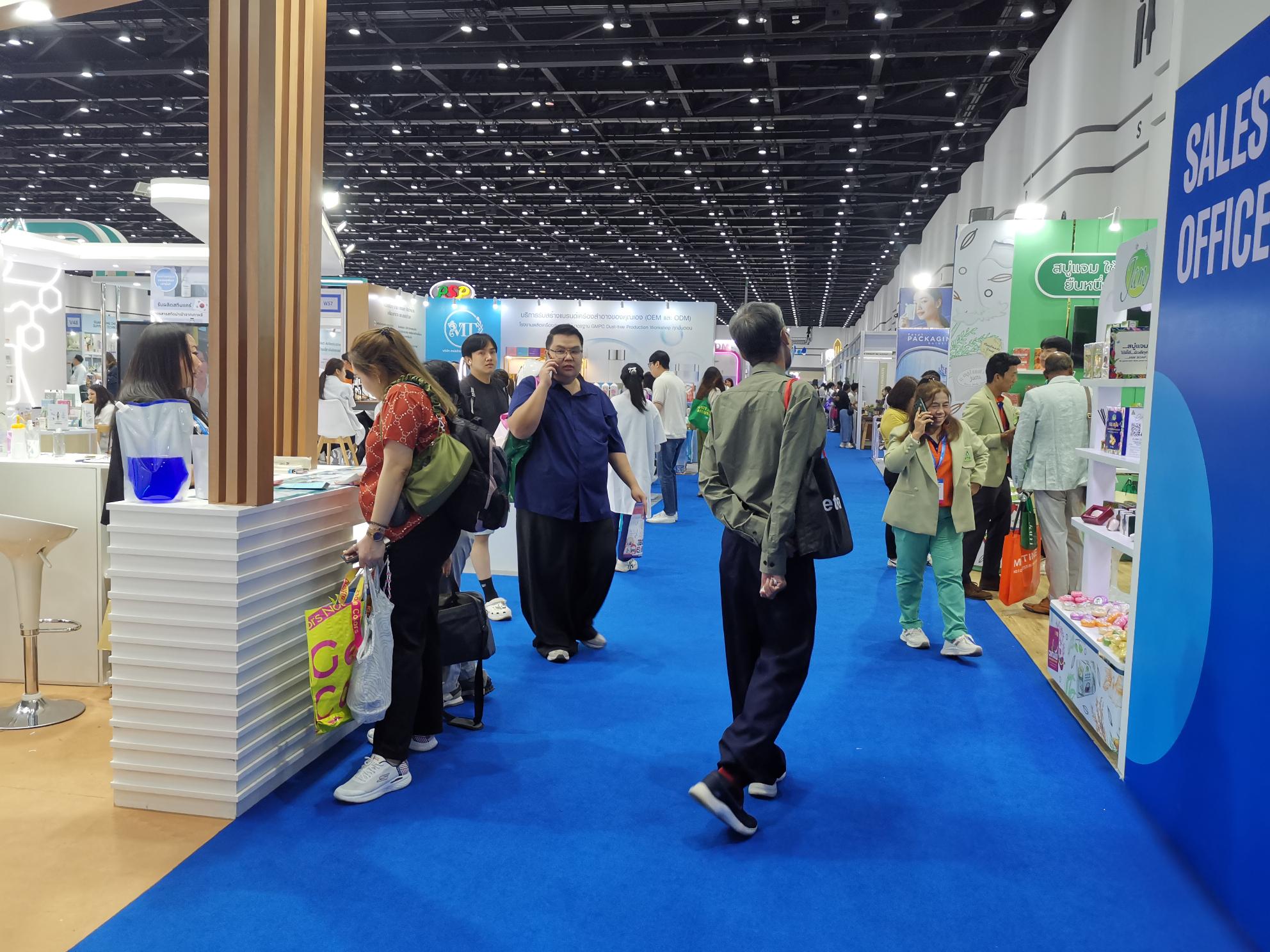

According to organisers BolognaFiere and China Beauty Expo (CBE), Cosmoprof CBE Asean 2025 brought together 650+ exhibitors (representing over 2,000 brands) from 21 countries across a total of 25,000 sq m of exhibition space.

During the three days of the show (25th to 27th June 2025) some 23,000 visitors from 66 countries visited the fair in Queen Sirikit Convention Centre, an increase of 20% compared to last year’s visitor numbers.

As usual, I did a rough count of exhibitor countries in the digital database and double-checked with the colour-coded overview board near the entrance to the halls. With some 240 exhibitors China was the biggest exhibitor country at Cosmoprof CBE Asean 2025. As was to be expected: Mainland China dominates any trade show that has a significant packaging/supply chain section and at least 50% of Cosmoprof CBE Asean was dedicated to supply chain exhibitors. Thailand was the second-biggest country, I counted 175 exhibitors.

Then came Korea with around 112 exhibitors while Japan only had around a dozen companies at the show this year. Taiwan was represented with a dozen companies as well. Italy was the biggest non-Asian country pavillion with over 20 brands this year – unsurprisingy, considering that this is a Cosmoprof/BolognaFiere trade show.

This was my third Cosmoprof CBE Asean and I am really happy to see this trade fair grow every year. I compared the fair data for the last two shows and Cosmoprof CBE Asean 2023 registered 13,255 visitors and – well, there are no official figures for 2023 exhibitor numbers (I think there must have been some 350 exhibitors at the most, with the majority from the packaging and OEM/ODM sectors), just a mentioning of over 1,000 brands/exhibitors on 17,000 sq m of expo space.

Cosmoprof CBE Asean 2024 already had 1,500+ brands and companies (I counted around 500 exhibitors) and over 16,600 visitors and the 2025 edition – well, the figures speak for themselves. Very solid growth across all key trade show parameters. And I definitely noticed a lot more European/US visitors than during my first show in 2023.

This year, there were more large retail brands as well. I was particularly excited to see heritage brand Srichand1948 and its GenZ sister brand Sasi Beauty who were first time exhibitors at the show. In addition to MiZuMi, the Karmart brand stable, Cosluxe, Plantnery and, of course, Mistine you basically had at least a quarter of Thailand’s biggest drugstore beauty brands at the show. With booths! Seriously, I was so excited about this.

So, let’s dive straight into my favourite new brand launches from Cosmoprof CBE Asean 2025. I’m starting with the big mass market brands and then moving on to the indie exhibitors. Almost all brands that I am highlighting are Thai beauty brands.

CATHY DOLL/KARMART (Thailand)

Cathy Doll is one of Karmart’s flagship brands in Thailand and the entire South East Asian region. Launched in 2012, the brand’s portfolio comprises face care, body care, sun care and makeup with extensive product line-ups in each category. Fun, trend-driven products, colourful packaging and a very moderate price point.

Amongst the new Cathy Doll launches is the cleverly designed 2-in-1 Lash Curler Mascara – a mascara with a cap which can be flipped over to transform into a lash curler. Also new is the Sunday Lip Oil range which is, of course, formulated with SPF50 PA++++ sun filters – in a tropical country like Thailand, UV protection is essential and Thai beauty brands add sun filters to most face care, body care, hair care and colour cosmetics as a standard ingredient. I was told that Thai customers are becoming more conscious of the need to also protect the delicate lip skin against UV exposure and indeed, I’ve noticed a ton of new SPF lip care and colour products in-store here in Bangkok.

My favourite new Cathy Doll launch – and the one that I purchased – is a range of new jelly shimmer sticks. I bought one of these at trade show prices and have been using it for over a month now. I really really like it – the texture is cooling, the shimmer is visible but not over the top and it even looks good applied on top of powder.

BROWIT/KARMART (Thailand)

Browit by Nongchat is another Karmart hero brand. The brand was launched in 2018 in collaboration with Thai makeup artist Chatchai Peangapichart (the eponymous Nongchat) and originally, Browit focused exclusively on the brow and lash area.

Over the last few years, the brand has expanded into other eye makeup categories, including creamy and powder eyeshadows in pencil/pen and powder form (several new ranges here) and the two dual-ended undereye concealer creams. Smooth Up comes in pink-beige/green or yellow/purple; the texture is quite thick and the colour pigments were specifically selected to flatter the undertones of Thai skin colours.

HAIR IT/KARMART (Thailand)

Karmart brand Hair It was launched in cooperation with influencer Saypan – I seem to remember that they were still fairly new the first time I saw them at Cosmoprof CBE Asean 2023. And last year I bought one of the brand’s new scented scalp massage brushes (jasmine scent).

In 2025, Hair It’s major launch was the Heat & Sun Protection Shiny Spray, an SPF50 PA++++ spray that shields hair from both UV exposure and styling tool-induced heat damage. It can be used on damp or dry hair. I really like these Asian hair SPF sprays and do wish that the European manufacturers offered more options that are NOT hair sprays with a bit of SPF added.

SKYNLAB/KARMART (Thailand)

Karmart’s Skynlab brand offers some really innovative products, such as last year’s optical brightening tooth serum – it is tinted a light purple and in addition to cleaning the teeth, adding fluoride etc during the brushing process, the colour pigments help to neutralise any yellow-ish tones of the tooth enamel.

At this year’s Cosmoprof CBE Asean, Skynlab presented several new mouth wash products, including four super-stylish twist-up mouth sprays – my favourites were the Apple Camomile and Lemon & Sea Salt flavours. Very tasty, quite literally.

ACCA BY DR. DSP/KARMART (Thailand)

Acca by Dr. DSP is one of Karmart’s newest brands. Developed in collaboration with medical doctor Dissapong Panithaporn, Acca has a strong dermo/cosmeceutical slant and offers microbiome-focused face care for sensitive and irritated skin as well as acne care.

Amongst the brand’s most interesting products is the Sensitive Sun Serum SPF50 PA++++, a sun care/face care hybrid with a liquid-watery texture. It is applied like a face serum; other sun care products can then be layered on top.

BABY BRIGHT/KARMART (Thailand)

Baby Bright is another Karmart best-seller in South East Asia. I think the brand was launched a few years after Cathy Doll but they’ve definitely been around for more than a decade. Baby Bright offers face, body and hair care, makeup and sun care – essentially the full personal care line-up – and there were a lot of new launches to explore.

The face care collection was extended with several new hydrogel masks – the pink-packaged mask, Picopore, is formulated with salicylic acid and lactic acid for an exfoliating effect. I don’t think I’ve ever seen an exfoliating hydrogel mask, these type of masks usually tend to focus on hydration.

Several new sun care launches, including an SPF50 PA++++ sun stick in the Melabright range and the Vegan Glow Sun Spray, an all-over moisturising sun protection spray equipped with SPF50 PA++++ as well as hydrating coconut, argan, jojoba and sunflower oils.

The RejuLight range was extended with various serums and ampoules featuring all the actives currently trending in Asia (PDRN, exosomes etc.) and in the ExoWhite line, I was intrigued by one new launch, the dermo-inspired Milk Exosome treatment. This is a set of a five ampoules to be used as a special intensive skin care treatment.

Seeing this kind of salon-type treatment product in a cheap and cheerful GenZ mass market brand like Baby Bright was surprising but I was told that these kind of ampoule treatments are becoming very popular with younger Thai consumers – the global K-beauty trend in action.

PLANTNERY (Thailand)

I’ve seen Plantnery at Watsons and other mass market beauty retailers around Bangkok and was curious about this personal care brand. And here they were at the trade show! I used the opportunity to check out the brand’s portfolio in more detail and ask a ton of questions of the booth people.

Plantnery was launched in 2019 at the height of the international natural beauty boom, starting with face and body care products. Over the past five years the company has expanded into other beauty categories and colour cosmetics is one of their newest ventures. The first Plantnery makeup range was launched in early 2025. I like the sleek pack design of the (vegan) lip glosses. The line-up also includes cushion compacts and a 6-sku range of matte lip creams.

I was particularly interested in brand’s highly segmented range of setting sprays. European brands usually offer one type of finishing makeup spray as a kind of one-size-fits-all deal; Plantnery, on the other hand, has three different formulas for different skin types and different finishing effects – mattifying, semi-mattifying and dewy. In a challenging climate like Thailand’s tropical humidity it makes sense that customers are much more discerning about what they require from their beauty brands.

SASI BEAUTY (Thailand)

Srichand1948 and its sister brand Sasi Beauty were first-time exhibitors at Cosmoprof CBE Asean showing the growing importance of the fair as a showcase for domestic beauty brands. I was particularly excited to see Sasi – just the previous week I’d bought a shimmer stick and a quattro powder shimmer palette from the brand and really like both products.

Sasi was launched in 2017 as a more GenZ targeted makeup range – trending colours and textures, sleek and stylish pack design, very unlike heritage brand Srichand1948 which has a much more sophisticated brand vibe. At the trade fair, Sasi presented its latest launches, including the Perfect Personal Color collection of lip glosses, powder blushes and quattro powder eyeshadows divided into four different colour families (spring, summer, autumn and winter). The autumn quad palette was particularly pretty (Sasi powder shadows are super blendable).

Also new: The Tomato Tone-Up Powder, a pink-toned face powder formulated with lycopene. I do enjoy seeing bottled face powders, it seems to be such a specifically Thai product. The first time I saw these bottles, on one of my first Bangkok trips, I was confused since in Europe bottled powders are either baby products or deodorising body powders. But young Thai women (and probably men as well) like the convenience of simply shaking powder into their hands and patting it onto the face rather than messing about with compacts, powder puffs and so on.

GENTLE COLORS (Thailand)

Thai personal care brand MiZuMi (one of the leading skin and sun care brands in Thailand) was a returning exhibitor at Cosmoprof CBE Asean. The company recently expanded into the colour cosmetics category with a new makeup brand. Gentle Colors offers stylishly packaged makeup items for GenZ and GenA consumers – cushion compacts, lip makeup etc.

I particularly liked one of the most recent Gentle Colors launches, the limited edition Pride Blush, a blue-coloured heart-shaped pH-reactive cream blush that changes colours according to the individual skin pH value. I do love colour-changing makeup and own at least five different pH-reactive lip balms.

Pride Month (June) is celebrated enthusiastically all over Thailand but especially in the country‘s capital city, Bangkok. During the month of June there are loads of Pride-related events and promotions in the big shopping malls across the city. The Siam mall group is especially active: All of the Siam shopping centres in Bangkok – there are at least five including Icon Siam, Siam Square and Siam Discovery – are widely decorated with rainbow-coloured carpets, flags and special installations/exhibits. Major personal care and food brands are introducing limited editions and special offers, cafés and restaurants launch colourful Pride-inspired beverages and sweets. Because the rainbow flag/colours is so very visible in central Bangkok, these Pride marketing events seem a lot less performative than what beauty brands are doing here in Germany during Pride month (very little: A couple of special rainbow-packaged products or a rainbow flag-decorated display and that’s usually it).

ITHAI (Thailand)

Spa brand Ithai was launched in 2015, starting out with home spa aromatherapy products and then branching out into herbal and medicinal products. I remember seeing them at one of my first Cosmoprof Asia shows (they were exhibiting at the communal Thai brand pavillion) so it was great to see Ithai again. In 2021, the company started launching its first medicinal products – traditional Thai herbal remedies and ingredients re-interpreted as modern cosmetic formulas.

I liked the brand’s 3-sku range of rescue balms – each of the balms has a different texture; from the lighter-textured Soothe for dry and sensitive skin to the more emollient Smooth. Another interesting product is Ithai’s Aroma Gel, a modern version of the classic warming/cooling tiger balm-type lotions. Created specifically for the neck region, the gel-type lotion cools slightly but not too much (the traditional tiger balm products contain a lot of menthol and are usually a bit too much for my skin).

One of the upcoming launches is a range of four aroma roll-ons to match Ithai’s best-selling range of aroma sprays. Like the Aroma Gel, the roll-ons are specifically formulated for use in a hot and humid climate: Instead of the more common oil base, the Ithai roll-ons are based on a fresh milky serum – refreshing and not too sticky; perfect for the tropical Thai climate.

MCJABRIAL (Thailand)

I first met silk beauty brand McJabrial at my very first Cosmoprof CBE Asean and it’s been a pleasure seeing the brand at each subsequent show. Silk beauty (cosmetics formulated with sericin, a protein derived from the fibres of silk cocoons) is very popular in Thailand – not surprising, considering that sericulture (silk production) is a traditional Thai industry and Thai silks are globally famous. Sericin has many interesting skin care benefits: It’s hydrating, helps to increase skin elasticity and promotes collagen production. As a by-product of silk production it is also a classic upcycling ingredient.

In fact, many of the Asian silk beauty brands that I’ve seen at trade shows over the past decade, including brands from Japan (Japanese sericulture has declined in recent years but historically, it is a traditional industry), Korea (ditto – Korea also has a well-established sericulture sector) or, indeed, Thailand are actually silk fabric manufacturing companies that launched beauty products as a supplementary category.

McJabrial also offers several silk beauty ranges but at Cosmoprof CBE Asean 2025 the company presented Smile Mai, a new range of beauty accessories made with silk cocoon fibres. The Smile Mai products include biodegradable and reusable cleansing and exfoliating wipes and sheet masks with different shapes to suit different parts of the face.

You can use these as cleansing cloths or as DIY hydrating masks: Simply saturate the mask sheets with hydrosol (or even plain water) to release the sericin and place them on the face like a regular sheet mask. Afterwards you rinse the masks in hot water and let them dry. They can be reused multiple times.

LAMAII (Thailand)

When I first walked past the Lamaii booth I thought I’d mis-read the hero ingredient featured in the Thai newcomer brand Lamaii’s six face and body care products – but no, it actually WAS fruit fly larva oil (my brain kind of skipped over the larva part; I thought it was a fruit-based extract).

Apparently fruit fly (bactrocera dorsalis) larva oil is rich in omega 7 fatty acids so it has a lot of interesting skin care properties, nourishing and rejuvenating the skin. Who knew! That’s why I love attending trade fairs, I always learn something new.

Lamaii was launched in early 2025, their stylishly packaged and moderately priced products (400-500 BHT, approximately 10-13 Euro) are sold primarily online, with Lazada, Shoppee and TikTok as the most important retail platforms.

SCENT & SENSE (Thailand)

Visiting the booth of Thai fragrance design company Scent & Sense is always one of my personal highlights at Cosmoprof CBE Asean. Scent & Sense was launched in 2014 and they create fragrances for corporate clients –restaurants and cafés, hotels, retailers and showrooms and so on – but they also do a lot of projects for retail beauty and lifestyle brands.

Scent & Sense sources most of its raw fragrance materials from local Thai farms in order to support flagging agricultural communities in the rural areas of Thailand. The company also operates their own farms in Northern Thailand – around 20-30 of the essential oils used in Scent & Sense products are cultivated and distilled there.

Check out the pictures below for some of Scent & Sense fragrance creations – as the names indicate, the fragrances usually feature highly abstract and mind-bendingly complex scent pyramids.

You can also refer to my Cosmoprof CBE Asean reports for the 2023 and 2024 shows for more examples – in the past, Scent & Sense has created a fried chicken-inspired scent for fast food chain KFC’s Chinese New Year’s celebrations, a set of fragrances inspired by the dynamics between the characters of a popular Thai TV drama show (each scent was based on a specific episode) or a scent based on a sequence of traditional Thai music. At last year’s trade show the company presented a showcase of fragrances inspired by negative emotions (anger, loneliness, depression, pride, insecurity, anger, arrogance or solitude).

And occasionally, Scent & Sense co-founder and fragrance director Rujira Trakulyingcharoen gets even more unusual fragrance design requests – like the one in the picture above: One client requested a scent reminiscent of male body odour.

I also liked one of Scent & Sense’s most recent retail brand design projects: Two room sprays created for Thai pet care brand Hommeow. These two sprays are for cat owners whose cats are stand-offish or skittish and don’t like to get close to their owners. The scent blends contain catnip as well as several other herbal fragrance compounds (carefully selected so they are not toxic for cats). I test-sprayed both products and the scents are so pleasant. I would absolutely use them as regular room sprays (and I don’t even have any pets).

OAO (Taiwan)

With a regionally specific show like Cosmoprof CBE Asean I usually focus on the domestic brands but Taiwanese beauty brand OAO’s key botanical intrigued me so much that I need to include it in my coverage of Cosmoprof CBE 2025.

So, OAO is manufactured by Taiwanese company Vitafoss International and the key ingredient in the two luxe face care products is the rare and very expensive oil of the Taiwanese moon orchid (phalaenopsis amabilis). In the two-phase Orchid Repair Activating Oil the orchid oil is combined with other light plant oils such as olive and grapeseed oils in a rose water base. Orchid Youth Compact Milk Complex is a more milky two-phase facial spray.

Since the main ingredient is so expensive to manufacture the price of both skin care products is correspondingly high, around 200 USD. Despite the luxury price tag, OAO sells very well in Taiwan (both online and offline – the company has a brand store in Taipei’s Da’an neighbourhood) and in mainland China (through upmarket salons and spas).

I’ll leave you with a few more pictures from the show. The next Cosmoprof CBE Asean show will take place from 24th to 26th June 2026 at the usual location in QSCCC. Thanks for reading.