The 2025 edition of Japan’s largest retail beauty trade show Cosme Tokyo took place from 15th to 17th January, as part of Cosme Week Tokyo which also included Cosme Tech (ingredients, packaging OEM/ODM), Esthec Japan (salon/professional beauty), Cosmetics Marketing Expo (services for the Japanese beauty industry), Hair Expo Tokyo (hair care) and Inner Beauty (functional foods/beverages/supplements).

According to the organisers, a total of 618 exhibitors and 38,266 visitors across all shows attended Cosme Week Tokyo 2025. In previous years, Cosme Week had also included a smaller Lifestyle and Wellness show but in 2025, this was spun off into the Lifestyle Week Tokyo 2025 fair. Lifestyle Week took place in the hall adjacent to Cosme Tech and you could enter with your Cosme Week badge, but it was very much treated as a separate show.

ALWAYS CHANGING: COSME WEEK TOKYO 2025

In fact, organisers RX Japan are continuing to reposition the Cosme Week format; I just went back to my older trade show reports – Cosme Tokyo 2014, Cosme Tokyo 2018, Cosme Tokyo 2019, Cosme Tokyo 2020, the digital editions Cosme Tokyo 2021 and Cosme Tokyo 2022, Cosme Tokyo 2023 and Cosme Tokyo 2024 – and a lot of changes have happened over the years.

Cosme Tech is getting bigger every year and in 2025, the number of its exhibitors far exceeded the combined might of Cosme Tokyo, Inner Beauty, Esthec, Hair Expo and Cosmetics Marketing Expo. Cosme Tech had its own separate halls this year (in previous years, Cosme Tech and Cosme Tokyo had shared the same halls. I wouldn’t be surprised if Cosme Tech was eventually turned into a separate trade show). In 2025, all exhibitors outside of Cosme Tech were grouped into Halls 7/8 which are located away from the other halls in that section of Tokyo Big Sight expo centre.

Initially I was sceptical since Halls 7/8 are in a separate building at the far end of the Eastern halls, you have to cross a small street. If you have to frequently go back and forth to the entry area it’s a hassle. However, it worked out really well. All of the exhibitors I chatted with were happy with the way the trade show progressed and the new layout did generate a lot of foot traffic.

RX Japan also increased the food and beverage options in Halls 7/8 compared to previous years, adding several food trucks and lots of seating options so you actually didn’t need to leave the location. They also introduced a First Gallery expo section for first-time exhibitors and indie brands. Great idea.

KEY TRENDS AT COSME TOKYO 2025

Like last year, the Korean brands dominated Cosme Tokyo, especially in the skin care and makeup categories. Micro-needle serums and spicule ingredients were everywhere at the fair, especially at the Korean booths (I saw spicules in face care but also in makeup, including cushion compacts and lip glosses) but also in plenty of Japanese launches. As were exosomes. Oh, so many exosome products! I am only going to mention a few of the more interesting exosome launches I saw at the fair.

Another key ingredient appearing at Cosme Tokyo 2025 were stem cells, of course. This is not a new trend by any means, human stem cells are a highly popular anti-ageing ingredient in Japan. Most Japanese brands prefer human umbilical cord blood/adipose tissue as a stem cell base since these are considered to be especially potent. However, there were also animal and plant-derived stem cells. In terms of texture trends I noticed a lot of carbonated/bubble launches amongst the Japanese brands in particular.

I came across iPS (induced pluripotent stem cells) for the first time at Cosme Tokyo 2025 and this cutting-edge medical technology fascinated me. It sounded like sci-fi: iPS can literally turn senescent (old/mature) cells into young cells. By inserting specific genes into “regular“ differentiated human somatic cells these cells can be reprogrammed into pluripotent cells. Which, in turn, can be differentiated into all sorts of cell types in the human body – cardiac cells, bone marrow cells, tissue cells, neural cells, blood cells. The potential applications of iPS for the diagnosis and treatment of diseases like diabetes, cancer and neurological diseases are staggering.

The iPS cell technology was first discovered by the Yamanaka research group at Kyoto University (Professor Yamanaka received a Nobel price for this discovery in 2012). The university has published an FAQ which really does a good job of explaining this complicated medical research in layperson’s terms.

FAVOURITE BRANDS AT COSME TOKYO 2025

REPLURI (Japan)

Let’s start with Cosme Tokyo’s iPS exhibitor. Japanese iPS cell manufacturer Rejuinc launched its first iPS-based beauty product in late 2024, Repluri Serum is an anti-ageing face care serum which has a great texture and even better ingredients – Google Translate gave a compact INCI list with human pluripotent cell culture medium listed in second place after water – and a lovely, light essential oil-based product scent which combines notes of lavender, bergamot and palmarosa.

The RRP of 33,000 JPY (200 Euro) reflects the expensive cutting-edge technology behind this serum (otherwise I would have bought a bottle). In a few month, Repluri will launch a matching scalp serum (see prototype in the picture above) which at 20,000 JPY is a tad cheaper.

DIGO FOR FUTURE (Japan)

I also liked this brand, and not just because newcomer hair care brand Digo for Future was launched specifically for mature hair and women aged 40+. It is so rare to meet a brand that was launched for older women! Digo offers a shampoo and treatment duo, both products are both with high-tech anti-ageing beauty ingredients – umbilical cord blood exosomes, human hair follicle stem cells, panthenol, hydrolysed keratin, peptides etc.

I received a shampoo sample and have been using it for the last week (without changing anything else in my daily hair care/styling routine) and what can I say, my (damaged and flat) hair really does look a lot better. This is not a claim I usually make but with this product it is absolutely true.

I noticed the increase in volume immediately and most intriguing was the fact that I don’t need to use an additional conditioner on my super dry ends. The shampoo leaves them smooth enough. I don’t understand enough about cosmetic formulations to pin-point exactly what it is that works on my hair, but it does. I’m hoarding the rest of my samples.

As Digo is still a new brand they mostly sell online for now (the products retail for around 12,000 JPY which is a prestige price tag) but the company is looking to move into offline distribution – probably through hair salons – as well. I’ll keep my fingers crossed for them.

MEECOLOR (Japan)

Another really cool product for older, greying hair was Mee Color – not a wash-out colour shampoo as I initially thought: This is an actual permanent colourant shampoo/conditioner which cleanses the scalp, conditions the hair and promises salon-quality colour results in just one product.

The formula is very low in sulfates to protect the hair structure (and it really doesn’t foam at all – I received a sample sachet and tried it out several times already). Nano-sized colour particles work on the hair shaft while charcoal pigments coat the outside of the hair strands. I did notice that my hair had a slightly darker sheen the first time I used it. The brand recommends that you use the shampoo for a week and then switch to your regular shampoo. The colour will grow out naturally.

SEINS MOUS (Japan)

I always enjoy visiting Japanese femcare brand Seins Mous’ exhibition booth, their products are so unapologetically and vibrantly feminine, with over-the-top marketing and eye-catching packaging. Really fun! At Cosme Tokyo 2025, Seins Mous introduced two new foam/bubble serums/moisturisers, Cracking W Exosome and Champagne Carbone.

Champagne Carbone has a thick, creamy foam texture which starts to prickle when you massage it into the skin, and yes, it did feel kind of carbonated! Ingredients include NMN (Nicotinamide mononucleotide) and human stem cells plus a lot of other functional face care ingredients. The product scent was much more natural and delicate than I expected (I thought Seins Mous would go for heavy, exotic florals or something) – instead the serum was scented with light notes of lavender.

Cracking W Exosomes – well, Google Translate gave me a host of information here! The formula includes 11 types of stem cells altogether, including exosomes from human adipose (fatty) tissue AND from bone marrow; I even saw something about horse exosomes? Plus seven different plant stem cells as well as a ton of other skin care ingredients (hyaluronic acid, ceramides, the usual). The thick bubble foam is scented with notes of rosemary.

DR. MEDION (Japan)

And speaking of carbonated beauty, Japanese salon brand Dr. Medion is kind of a trail-blazer here. The company has been offering an entire range of carbonated/carbon dioxide-based products for skin, body and hair for many years.

At the trade show, Dr. Medion presented its recently relaunched Spaoxy Dualgel VC+ Mask which is such a fun product. The aerosol can contains two product phases which are squeezed out simultaneously when you press the dispenser button. The yellow phase contains the vitamin C derivative APPS; you mix both phases together in the palm of your hand so carbon dioxide is generated and the product turns into a fluffy, thick foam mask which can then be applied to the face.

Carbonic acid is claimed to help the skin absorb the active ingredients better and it’s a popular product type in Japan. I haven’t really seen that many carbonated beauty brands in Europe though – at Cosmoprof Bologna a couple of years ago there was an Italian exhibitor offering this type of beauty technology but other than that I can’t think of any other brands right now.

SPA TREATMENT (Japan)

Wave Corporation is one of the biggest Japanese salon manufacturers and the company exhibits at each Cosme Tokyo and Beautyworld Japan so I see their brands at the trade shows every year. I enjoy visiting the Wave Corp booth because there are always a lot of product innovations to write about – for example, the company regularly updates its high-tech Spa Treatment products with the latest anti-aging/cosmetic beauty tech so their launch pace is high.

At Cosme Tokyo 2025, Spa Treatment presented a new exosome serum, the ExoBio Moist Essence which is a light, liquid gel-type serum formulated with exosomes, human adipose stem cells, niacinamide, retinol and several vitamin C derivatives. Another new launch which is reflecting current beauty trends is the Re:Ti Micro Patch, under-eye micro-needle patches formulated with dissolving hyaluronic acid needles, retinol and Syn-Ake complex.

You press the patches onto the undereye area until the needles prick the skin. After 40 minutes, the hyaluronic acid needles will have dissolved into the skin, the brand says. Each patch contains 150 ingredient micro-needles with a projection size of 230±20㎛.Basically they’re invisible to the naked eye.

FRACTIONAL CC (Japan)

Another interesting micro-needle brand was Fractional CC which had its booth at the First Gallery (Cosme Tokyo’s exhibition section for newcomer brands). The brand presented it’s new-ish 4-sku Needle Serums, a range of micro-needle serums where the main ingredient is manufactured into ingredient spicules (tiny spikes, essentially) and suspended in the serum texture. The brand’s signature spicule ingredient is hydrolyed marine sponge extract (which, incidentally, I saw in several other spicule launches at the show) and in each of the four serums, the spicules are combined with other key actives.

The brand’s newest launch was the AZ Serum (azelaic acid) but there was also a Retinol & Exosome Needle Serum and two Vitamin C serums in different concentrations: 15,000 (I assume it’s ppm), the regular concentration in the serum range, and a 60,000 ppm version for consumers who want a stronger effect. I tried all four serums on my hand and even the 60,000 version was so much less abrasive than the Korean needle serum brands I’ve tried over the last few years. And indeed, the booth lady confirmed that their customers preferred gentler formulas which I can absolutely understand. The price range for the Needle Serums is from 2,500-3,500 JPY (15-20 Euro) which is an average price for Japanese masstige beauty.

Soon Fractional CC will launch a PDRN (Polydeoxyribonucleotide, another popular Japanese anti-ageing ingredient) range of serums. The brand is sold online, of course, but they also have a very strong offline distribution structure in their domestic market – amongst others, Fractional CC is sold in Tokyu Hands, Ainz & Tulpe and various other Japanese drugstore chains. The company also has an international presence: Products are exported to Singapore, Canada and the US, I was told, and the serums are even available in Matsukiyo stores in Hong Kong.

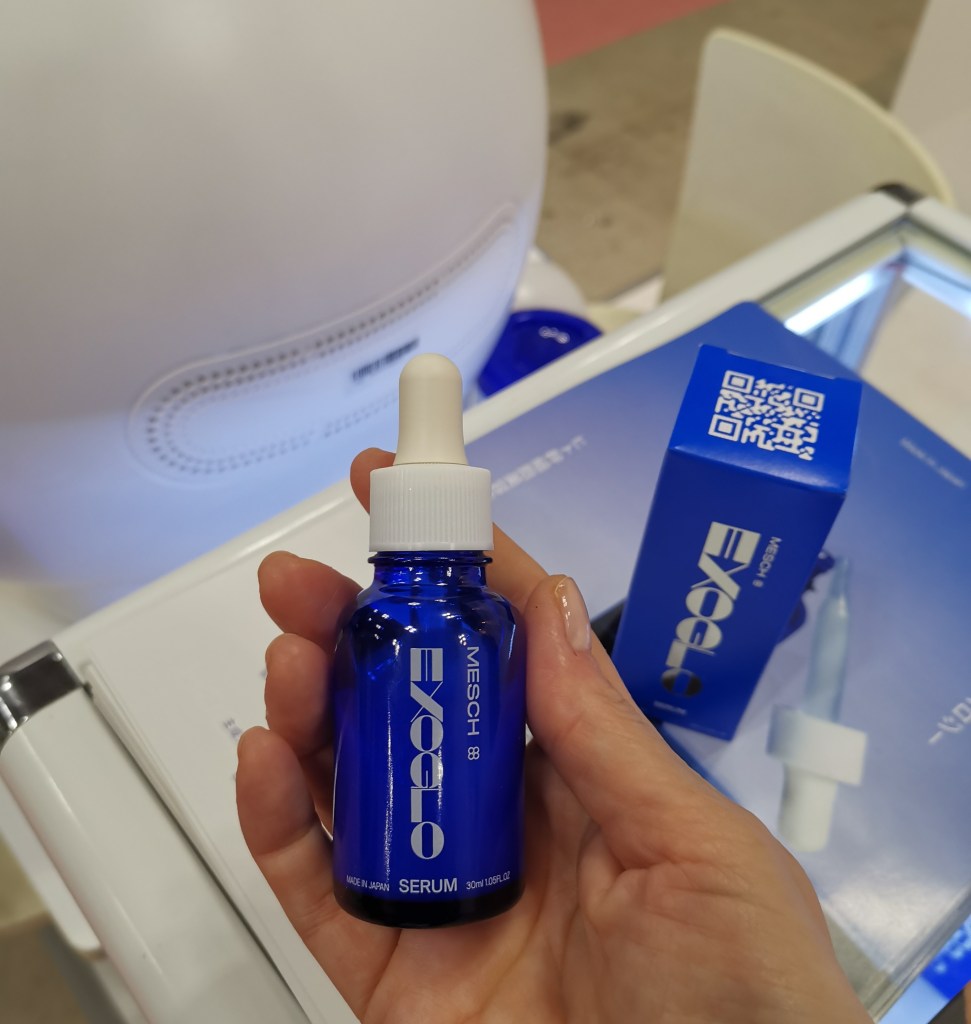

EXOGLO (Japan)

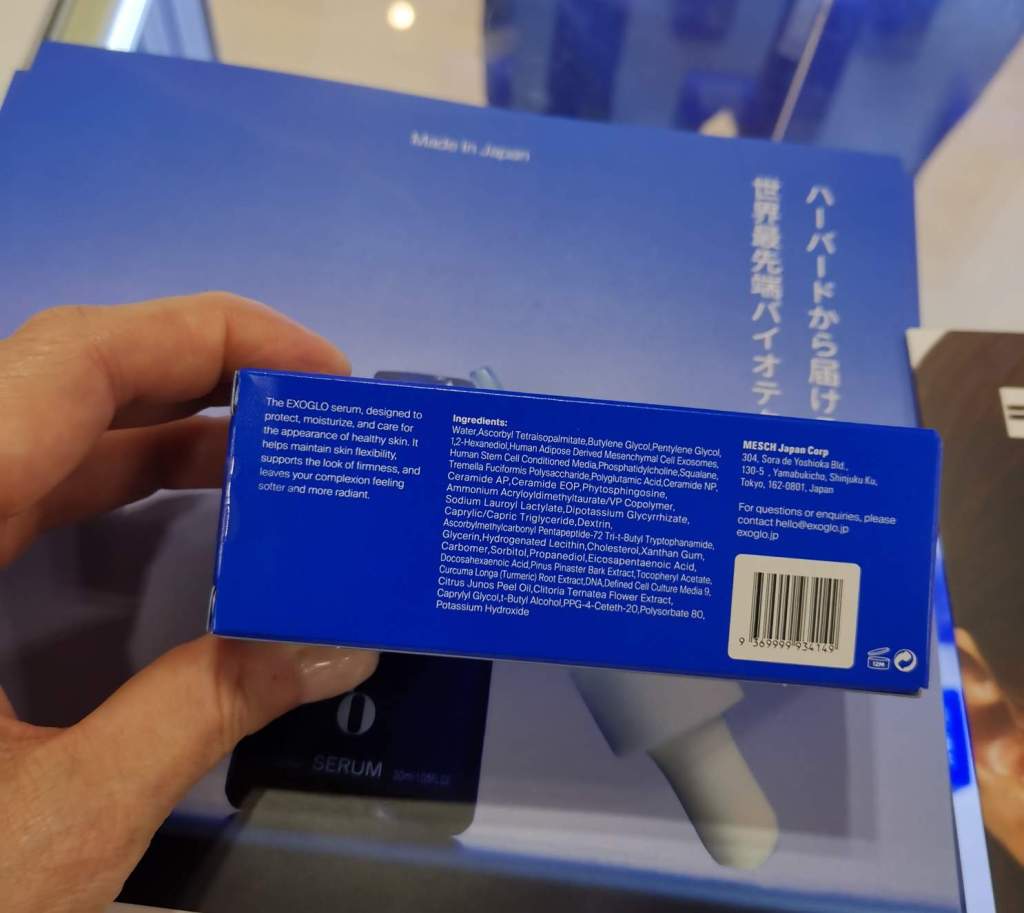

Amongst the dedicated exosome brands at the show I particularly liked Mesch Haus‘ ExoGlo serum – great ingredients which include human adipose tissue-based exosomes, human stem cells, vitamin C derivatives, ceramides, peptides, squalane and various herbal extracts combined with a lovely yuzu fragrance (essential oil-based). With a wonderful texture, of course.

ExoGlo was launched in November 2024 and is currently selling online only. However, the company is looking to move into offline retail soon, starting with a series of pop-ups in department stores. Beauty salons and clinics are another potential retail channel for his brand, the founder told me. At a price point of 22,000 JPY the serum isn’t cheap at all but I’ll keep my fingers crossed for ExoGlo! And I look forward to trying out my sample once I’m back in Berlin.

YESIC (Japan)

Most makeup brands I saw at Cosme Tokyo 2025 were Korean so when I first saw the eye-catching YesIC booth at the show I immediately thought this was a K-beauty brand.

But no, it’s actually a Japanese brand which will be launched in June/July 2025! The brand concept’s solid: There is a compact range of cube-shaped cosmetics including twist-up cream blusher sticks, highlighting powders and setting powders as well as two kinds of lip creams (matte and glossy). I really like the pack design which strikes a good balance between cute and stylish.

There are also clever little key-chain thingies that you can use to attach the beauty cubes to your handbag or phone. Priced at a very reasonable 900 JPY to 1,500 JPY (6-9 Euro) which is a low price tag for the Japanese beauty mass market, YesIC will be sold at the trendiest Japanese beauty retailers, including Donki (Don Quijote), Loft and Plaza stores – not in any drugstores, the booth guy was very specific about that. YesIC will be positioned as a trending GenA/GenZ brand, not a mainstream label.

10TO11 (Japan)

10to11 was another newcomer brand in the First Gallery. Launching in June 2025, 10to11 is a sauna beauty brand – not onsen/hot spring beauty, we’re talking about classic European-style saunas here (in Japan, this type of sauna is usually called “Finnish sauna”). During the pandemic, Finnish saunas became very popular in Japan, I remember someone telling me about that at Cosme Tokyo 2023. And the 10to11 brand founder confirmed this fact.

Her product range is compact, there are three sku: A Hair & Scalp Pack to protect the hair from the intense heat, a refreshing and hydrating facial mist which has a wonderful woodsy fragrance (Japanese cypress/hinoki or sandalwood, I think) and an all-over body cream that you apply after the sauna. The packaging looks great and pricing is on-point as well: 2,500-3,500 JPY which is an average price tag in Japanese mass market beauty.

The brand will initially sell only only but the company is also looking to move into offline retail, especially through Japanese (public) bath houses which you’ll find in every city and town.

ORLIC (Korea)

Orlic was a very nice-looking brand and a first-time exhibitor at Cosme Tokyo 2025. I was particularly interested in their sustainable sheet mask concept: The active ingredients of Tablet Dive Ectoin Mask are in a compressed dry tablet in the bottom of the sachet (which is made from recycled paper), together with the folded dry mask sheet.

You tear open the sachet and fill it with bottled water (or I guess you can add a splash of floral waters/toners for extra hydration) to the filling line, wait a few minutes until the tablet has dissolved and the sheet mask is saturated. Then you take out the mask, unfold it and apply it to the face. Because the mask essence is freshly prepared it does away with the need to add preservatives.

The Orlic range was launched last year. In addition to the Tablet mask there are also two toners formulated with ginseng water (Lavender & Wild Ginseng and Rosemary & Wild Ginseng), a serum (Rosemary & Ectoin), a matching water cream (Rosemary & Ectoin) and an SPF cream. The INCI look pretty organic to me, the SPF cream contains both mineral and chemical filters but it’s certified reef-friendly. The entire range is vegan as well. Price point: 22-25 USD.

The brand also offers its customers the option to buy empty containers they can use to blend Orlic Toners with bottled water to adjust the ingredients and intensity depending on personal preference. I also saw a foaming face wash is tablet form, simply add water to the pump dispenser bottle and shake.

While these kind of tablet cosmetics are now fairly common in Germany – although it’s still a niche format, dominated by maybe a half dozen brands that I can think of right now – the products are comparatively easy to find in organic supermarkets and drugstores. In Asia, however, this kind of format is still fairly novel, I think. And definitely not mainstream.

COCOHEALI (Korea)

This was the cutest Korean children’s beauty brand; I was particularly charmed by Cocoheali’s stackable cubes of body wash which come equipped with soap bubble blowing applicators so you can blow bubbles while you’re sitting in the bath tub. I would have loved this as a child. I imagine it’s also a great product to have if your kid doesn’t like taking baths.

The Cocoheali range also offers sun pacts (SPF sun creams in cushion compacts format), peel-off nail polishes, body moisturisers (also packaged as compacts with sponges and everything for maximum playfulness!), lip balms and kid-sized sheet masks. The brand was launched in 2018 and on their website I saw that the company also offers children’s furniture in the prettiest pastel shades. So cute.

MUEZ (Korea)

Muez is Korean newcomer beauty brand with some interesting beauty products, such as the Melashine UV Shield Patch. Such a Korean product! This is an ultra-thin physical sun protection patch (0.013mm thickness, the booth attendant wore one and you could barely see it on the skin). You apply it to the cheeks (which are usually especially prone to sun damage) and it will protect the skin from sun exposure in addition to whatever SPF creams and lotions you use on your face. The Melashine patch also comes with a moisturising serum formulated with niacinamide, glutathione and madecassoide to apply on top of the patch for extra skin hydration.

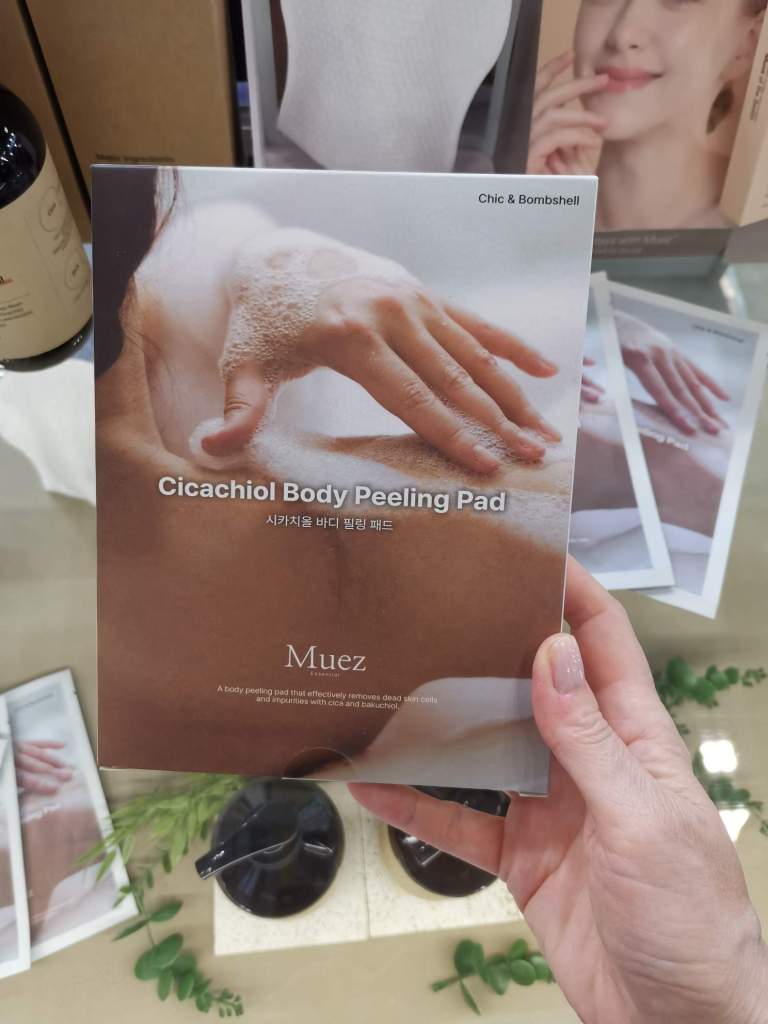

The brand’s Cicachiol Body Peeling Pad is a ready-to-use moisturising glove saturated in cleansing and exfoliating ingredient including salicylic acid, willowbark extract and sugarcane extract) – you can use it on wet or dry skin. It’s available in three scents and there are three matching liquid body cleansers in the line as well.

SNOW2PLUS (Korea)

I met this brand at Cosmobeauty Seoul last June and really REALLY liked their magnesium micro-needle patch products. They have the coolest little LED/micro-needle devices – check out my Cosmobeauty Seoul 2025 show report for more info on the brand. At Cosme Tokyo, Snow2Plus presented two new micro-needle kits for skin and scalp.

The Boostok Eco Hair and Boostok Eco Skin sets each contain a small rectangular micro-needle stamping device and a bottle of treatment serum but essentially you can use the micro-needle device with any kind of liquid scalp or face treatment, I think. You squeeze a bit of the serum onto the micro-needle cap applicator and then “stamp” the device across the skin or along the scalp. Each set also contains two replacement micro-needle caps and the cutest little pair of tweezers to make changing the applicators easier. There are also several new and super cute magnesium micro-needle patches for impurities and pimples.

JOOCYEE/UHUE (China)

I met Japanese distributor Mimi Japan for the first-time at last year’s Cosme Tokyo – you can read more about the company in my 2024 trade show report – and had a really interesting chat with the guy at the booth. I knew Chinese makeup brand Judydoll but was unfamiliar with Joocyee (pronounced “juicy”). Since the pandemic, Korean beauty brands have relentlessly pushed their way into Japanese beauty retail; you can find K-beauty in Japanese convenience stores, in drugstores, beauty speciality retailers and perfumeries, trend-driven retail chains such as Loft, Plaza or Donki (Don Quijote) – Korean brands are everywhere, they’ve become very much part of the mainstream.

There are many reasons for this development: K-beauty tends to be more affordable than a lot of the Japanese masstige brands, the products are fun to use, with stylish and colourful packaging and eye-catching beauty innovations. The influence of K-pop, K-drama and Korean lifestyle/culture/food on Japanese GenA, GenZ and Millennials is also playing a major role, of course.

Loft was one of the first retailers to jump on the K-beauty bandwagon and at the trade show last year, the guy from Mimi Japan told me that Loft was also the first Japanese retail chain to list Chinese beauty brands, in this case Judydoll and Joocyee. The two brands have been doing very well in Japan so far and at this year’s Cosme Tokyo, Mimi Japan introduced a third Chinese makeup brand that will be rolled out soon: Uhue. I spent a lot of time at the Joocyee and Uhue displays just admiring the packaging and playing around with the products.

Check out the pics for an overview of what the brands look like. Incidentally, Mimi Japan has just signed another international beauty brand for distribution in Japan: Mistine from Thailand! I’m really curious to see how this will play out, Thai beauty is not particularly strongly represented in markets outside of South East Asia. I can absolutely see Mistine in Plaza or Loft though.

CHANDO HIMALAYA (China)

A bit of dèja vu going on here: This brand (the sheet mask packs in particular) seemed so familiar to me but I couldn’t remember where I’d last seen Chando Himalaya. Then it struck me: It was at China Beauty Expo 2019! Feels like eons ago. Back then, the Chinese beauty brand was just called Chando, they’ve since rebranded themselves as Chando Himalaya (this might be just for the international markets though, to increase the storytelling factor?).

Cosme Tokyo 2025 was Chando Himalaya’s first-ever trade fair outside of mainland China, I was told, and now I’m really curious to find out where (i.e. in which retail/distribution channels) the brand will end up. Department store shop-in-shops maybe? I feel like the brand is not trendy enough for Tokyu Hands / Loft / Plaza and I can’t really see the products in drugstores either.

Anyway, at the trade show, Chando Himalaya – which already has a strong distribution especially in South East Asia but also in the US – presented some of its best-selling Asian beauty ranges as well as a new makeup-line and some recently launched body and hair care ranges.

PURA VIDA (Taiwan)

A very nice dermo-inspired face care brand from Taiwan with stylish packaging and well-formulated functional beauty products. Pura Vida will be launched soon in Japan; as this is a still a new brand they are starting with online retail but eventually, the products will also be sold through offline stores, especially beauty clinics and salons.

Which makes sense considering the rather premium price point of 10,000-12,000 JPY (60-70 Euro); remember that the Japanese Yen is very weak right now when you’re coming from the USD or Euro currency. For a local income, 10,000 JPY is a lot. Five years ago it’d have been around 100 Euro (yes, I can still remember the time when 1,000 Yen equalled 10 Euro).

However, the products might be expensive but they are also really good, with compact and straight-forward INCIs. There are several product ranges for different skin concerns: Liposome Hydration, Vitamin Brightening, Acne Clarifying and so on; at the booth the brand only presented a few products from each series: Two serums (Liposome Hydration Serum and Vitamin C Serum), a Liposome Hydration Lotion (this is a liquid toner), an anti-ageing ampoule and undereye micro-needle patches. I received samples of the Liposome Lotion and the Vitamin C serum and liked both products, especially the Lotion. Really hydrating. An interesting brand, I look forward to seeing them in-store in future.

FACIALBEAU (Taiwan)

Another beauty brand from Taiwan and here we’re circling back to the exosome trend: Facialbeau presented two new beauty ranges/brands which are formulated with plant-based exosomes. Had a really nice chat with one of the booth ladies and she told me that in Taiwan, the only exosomes allowed in cosmetic products are plant-based. There are no animal-derived exosomes in Taiwanese cosmetics.

The Orchid Exorigin collection of anti-ageing face care was developed for skin aged 40+ and contains a proprietary complex of highly concentrated orchid exosomes (Facialbeau uses a local white orchid varietal for its star ingredient). There are seven sku in the range – toner, serum, sheet mask, eye cream, ampoule etc and as you might expect, the price range is in the prestige category (2,000-3,000 NTD (60-90 Euro).

The second range shown at the booth is for younger skin, with grapefruit exosomes as the signature ingredient. The Aquamax Exorigns collection offers three serums – brightening, hydrating and skin-softening – which are priced at a much more affordable 1,000 NTD (approx. 30 Euro). Textures are great, products are unscented and distribution is primarily online right now although I was told that there will be a Facialbeau brand store in Taipei 101 (the most famous building in Taiwan and essentially tourist central) in spring 2025.

And this is it from Cosme Tokyo 2025. I’ll leave you with some more images of the show. The next Cosme Week Tokyo will take place from 14th to 16th January 2026.

Pingback: Cosmobeauty Seoul 2025: [Show Report] | TRENDS. TRAVELS. AND BERLIN